Get the free following conditions income-expenditure accounting Please note

Show details

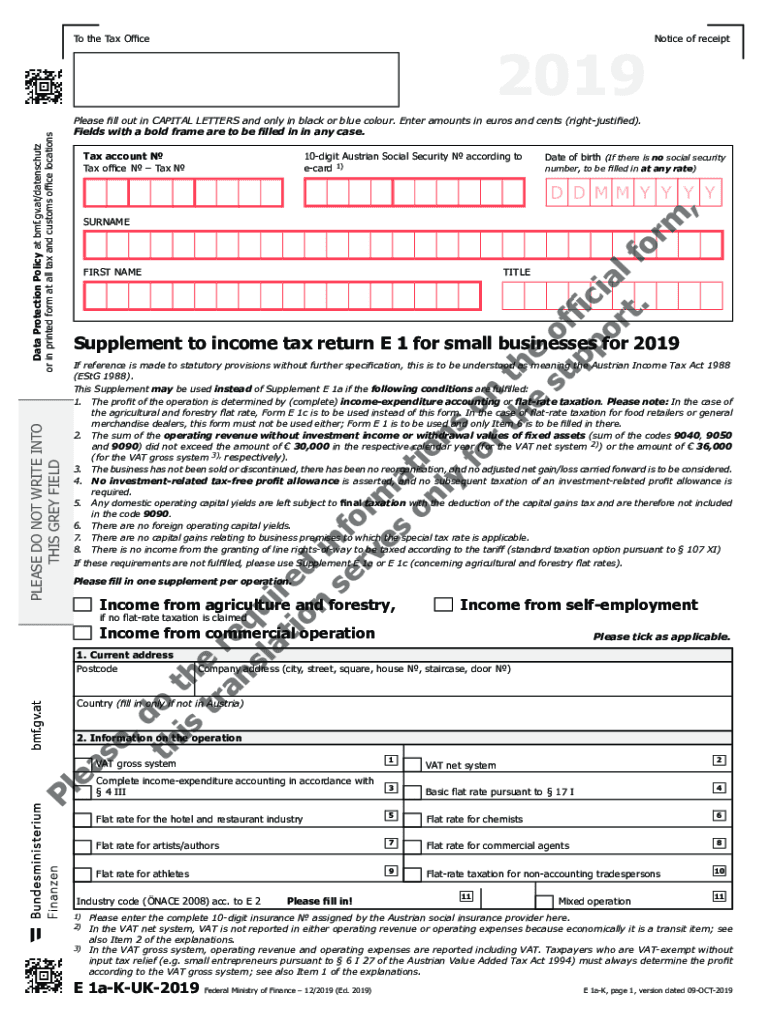

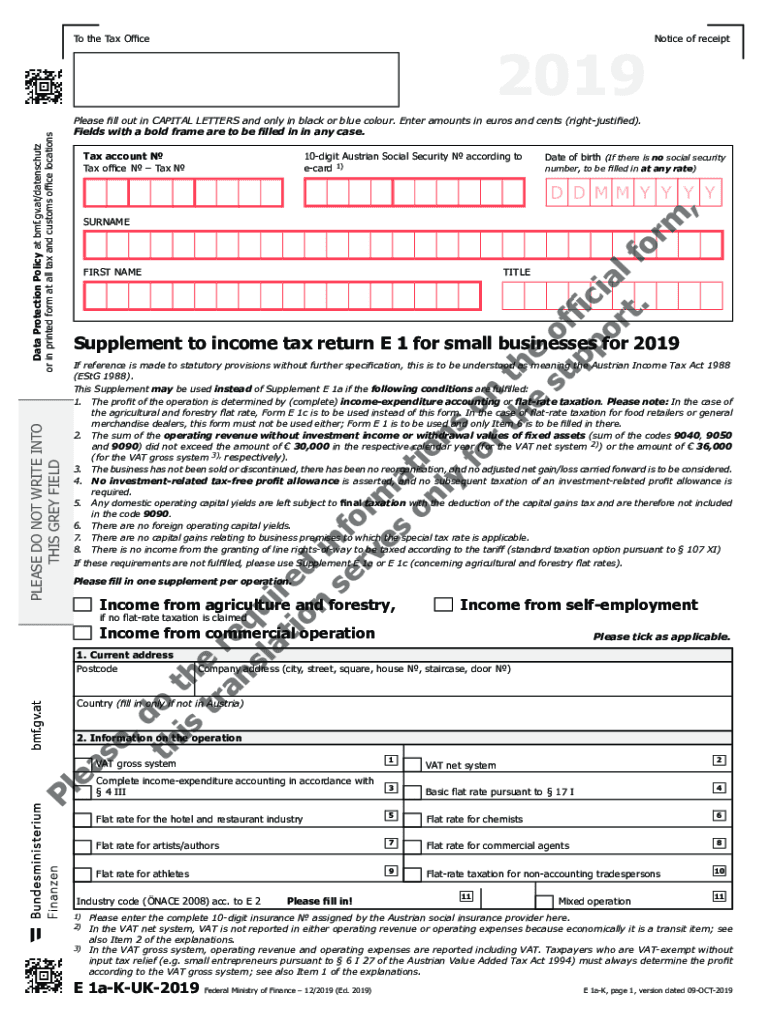

2019Please fill out in CAPITAL LETTERS and only in black or blue color. Enter amounts in euros and cents (right justified). Fields with a bold frame are to be filled in any case. Tax account Tax office

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign following conditions income-expenditure accounting

Edit your following conditions income-expenditure accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your following conditions income-expenditure accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing following conditions income-expenditure accounting online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit following conditions income-expenditure accounting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out following conditions income-expenditure accounting

How to fill out following conditions income-expenditure accounting

01

Start by gathering all relevant financial documentation, such as income statements, expense reports, receipts, and invoices.

02

Categorize your income and expenditures into different accounts or categories, such as revenue, operating expenses, cost of goods sold, etc.

03

Ensure that all income and expenses are recorded accurately and consistently using a standardized accounting system or software.

04

Calculate the net income or loss by subtracting total expenses from total income.

05

Prepare financial statements, such as the income statement and balance sheet, to provide a clear summary of the income and expenditure trends.

06

Regularly review and analyze the income-expenditure accounting records to identify areas of improvement or potential cost-saving opportunities.

07

Use the income-expenditure accounting information to make informed financial decisions, monitor profitability, and comply with legal reporting requirements.

Who needs following conditions income-expenditure accounting?

01

Income-expenditure accounting is needed by businesses of all sizes and industries to effectively track and manage their financial transactions.

02

Individuals and households can also benefit from income-expenditure accounting to keep track of their income sources, expenses, and savings.

03

Accountants, financial analysts, and financial managers rely on income-expenditure accounting to analyze financial performance, prepare financial reports, and make financial projections.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my following conditions income-expenditure accounting in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your following conditions income-expenditure accounting and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I sign the following conditions income-expenditure accounting electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your following conditions income-expenditure accounting and you'll be done in minutes.

How do I complete following conditions income-expenditure accounting on an Android device?

Use the pdfFiller Android app to finish your following conditions income-expenditure accounting and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is following conditions income-expenditure accounting?

Following conditions income-expenditure accounting is a method of accounting where income and expenses are recorded as they are received or paid, regardless of when they are earned or incurred.

Who is required to file following conditions income-expenditure accounting?

Nonprofit organizations and small businesses with annual gross receipts of less than $250,000 are required to file following conditions income-expenditure accounting.

How to fill out following conditions income-expenditure accounting?

To fill out following conditions income-expenditure accounting, one must record all income and expenses as they occur throughout the year and include a statement of assets and liabilities.

What is the purpose of following conditions income-expenditure accounting?

The purpose of following conditions income-expenditure accounting is to provide a simple and straightforward way for small organizations and businesses to track their financial transactions.

What information must be reported on following conditions income-expenditure accounting?

On following conditions income-expenditure accounting, one must report all income received, expenses paid, assets, and liabilities.

Fill out your following conditions income-expenditure accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Following Conditions Income-Expenditure Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.