Get the free Tax Exemptions - Marylandtaxes.gov

Show details

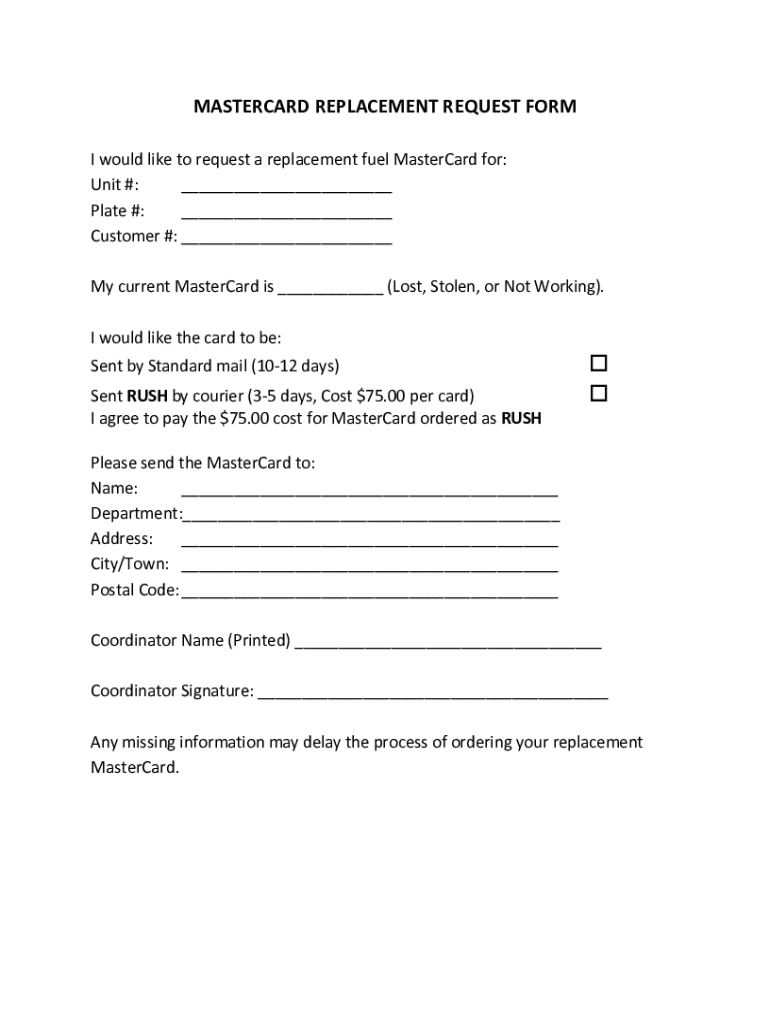

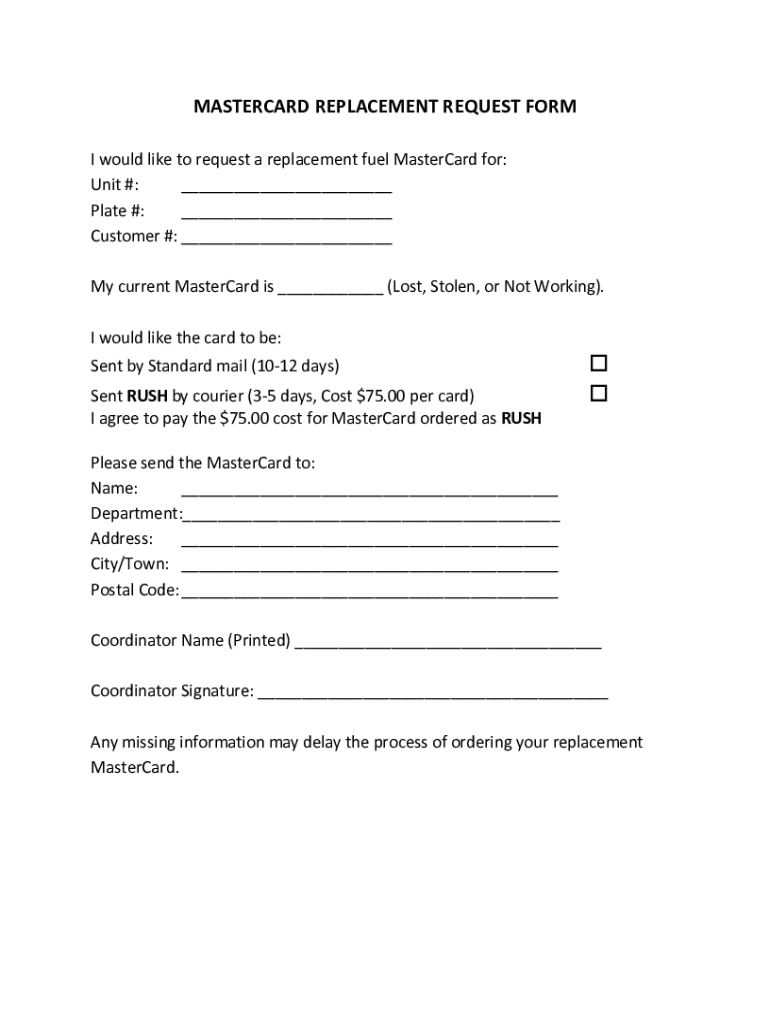

MASTERCARD REPLACEMENT REQUEST FORM I would like to request a replacement fuel MasterCard for: Unit #: Plate #: Customer #: My current MasterCard is (Lost, Stolen, or Not Working). I would like the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exemptions - marylandtaxesgov

Edit your tax exemptions - marylandtaxesgov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exemptions - marylandtaxesgov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax exemptions - marylandtaxesgov online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax exemptions - marylandtaxesgov. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exemptions - marylandtaxesgov

How to fill out tax exemptions - marylandtaxesgov

01

To fill out tax exemptions in Maryland, follow these steps:

02

Gather all the necessary documents related to your tax situation, such as your W-4 form, proof of dependents, and any relevant income or deduction records.

03

Determine which tax exemptions you are eligible for. Exemptions can vary based on factors such as your filing status, income level, and specific circumstances. Refer to the official website of the Maryland State Comptroller for a comprehensive list of available exemptions.

04

Carefully review the instructions provided on the tax exemption forms. These instructions will guide you on how to properly complete each section.

05

Fill out the necessary information on the tax exemption forms, making sure to provide accurate and up-to-date details. Double-check all the information before submitting.

06

Attach any supporting documents required for each exemption you're claiming. These documents may include proof of income, proof of residency, or documentation of qualifying expenses.

07

Submit the completed tax exemption forms along with your other tax documents. You can typically submit them electronically through the Maryland taxes website or mail them to the appropriate address provided on the forms.

08

Keep copies of all the forms and supporting documents for your records. It's essential to have documentation in case of any future inquiries or audits.

09

Monitor the status of your tax exemption claim. You can check the progress online or contact the Maryland State Comptroller's Office for any updates or inquiries.

10

If your tax exemption is approved, you should see the corresponding deductions or benefits reflected in your tax return or upcoming tax payments. If there are any discrepancies or issues, contact the relevant authorities for assistance.

Who needs tax exemptions - marylandtaxesgov?

01

Tax exemptions in Maryland may be beneficial for various individuals or entities, including:

02

- Individuals with dependents: Parents or guardians who financially support dependents, such as children or elderly family members, may be eligible for tax exemptions related to dependent care or support.

03

- Students: Students attending eligible educational institutions may qualify for educational tax exemptions or credits.

04

- Low-income individuals: Certain exemptions are available for individuals or families with low income levels, helping to reduce their tax burden.

05

- Senior citizens: Maryland offers specific tax exemptions and credits for senior citizens, providing financial relief for those in retirement.

06

- Disabled individuals: Individuals with disabilities may be eligible for various tax exemptions or deductions aimed at easing their financial obligations.

07

- Non-profit organizations: Registered non-profit organizations can often claim exemptions from certain taxes, allowing them to allocate more resources towards their charitable work.

08

It is advisable to consult with a tax professional or refer to the official documentation on the Maryland State Comptroller's website to determine the specific eligibility criteria and requirements for different tax exemptions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax exemptions - marylandtaxesgov online?

pdfFiller has made filling out and eSigning tax exemptions - marylandtaxesgov easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the tax exemptions - marylandtaxesgov in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your tax exemptions - marylandtaxesgov and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete tax exemptions - marylandtaxesgov on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your tax exemptions - marylandtaxesgov. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is tax exemptions - marylandtaxesgov?

Tax exemptions on marylandtaxesgov refer to certain deductions or credits that reduce the amount of taxable income for individuals or businesses in the state of Maryland.

Who is required to file tax exemptions - marylandtaxesgov?

Individuals or businesses who meet certain criteria set by the Maryland tax authorities are required to file for tax exemptions on marylandtaxesgov.

How to fill out tax exemptions - marylandtaxesgov?

To fill out tax exemptions on marylandtaxesgov, individuals or businesses need to complete the necessary forms provided by the Maryland tax authorities and submit them online or by mail.

What is the purpose of tax exemptions - marylandtaxesgov?

The purpose of tax exemptions on marylandtaxesgov is to help individuals or businesses reduce their tax liabilities and promote specific economic activities or behaviors in the state of Maryland.

What information must be reported on tax exemptions - marylandtaxesgov?

The information that must be reported on tax exemptions on marylandtaxesgov includes details about income, deductions, credits, and any supporting documentation required by the Maryland tax authorities.

Fill out your tax exemptions - marylandtaxesgov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exemptions - Marylandtaxesgov is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.