Get the free Non-QM Non-Warrantable Condo Project Review

Show details

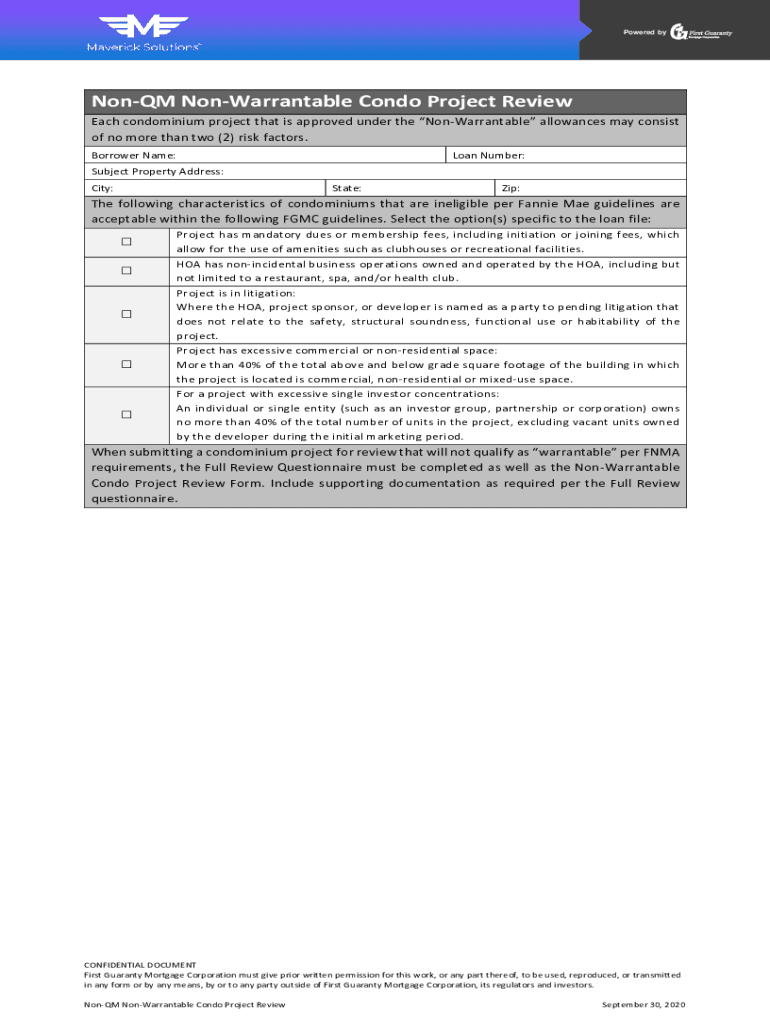

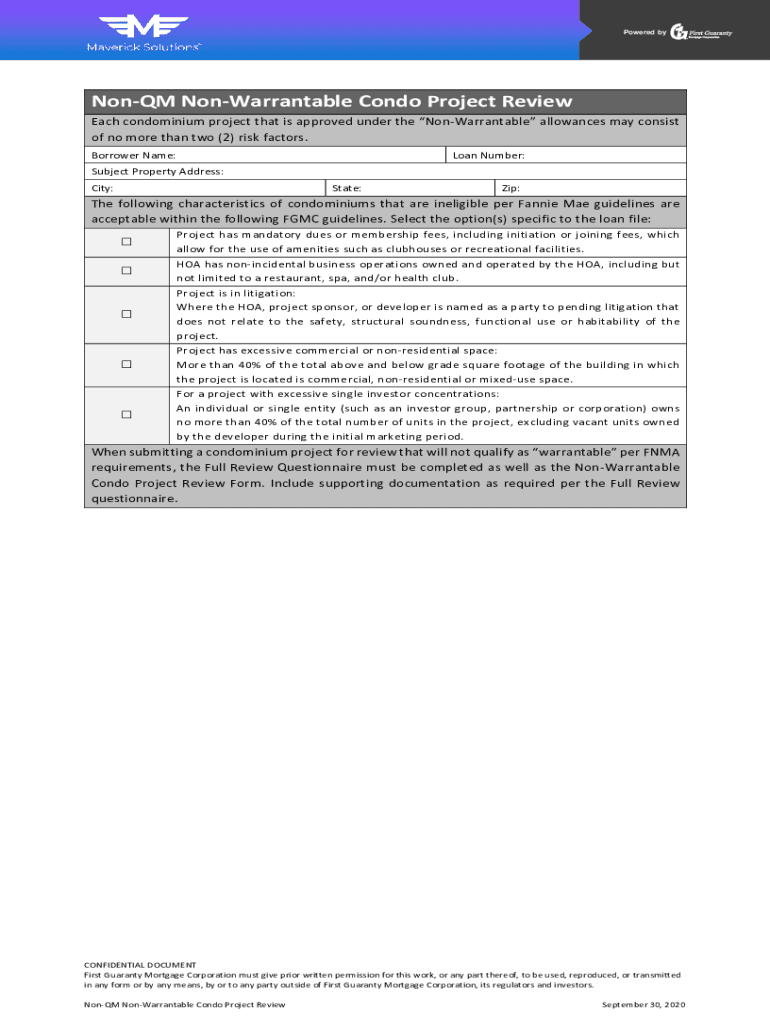

Powered synonym Unwarrantable Condo Project Review Each condominium project that is approved under the Unwarrantable allowances may consist of no more than two (2) risk factors. Borrower Name:Loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-qm non-warrantable condo project

Edit your non-qm non-warrantable condo project form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-qm non-warrantable condo project form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-qm non-warrantable condo project online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-qm non-warrantable condo project. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-qm non-warrantable condo project

How to fill out non-qm non-warrantable condo project

01

To fill out a non-qm non-warrantable condo project, follow these steps:

02

Gather all the necessary paperwork and documentation related to the condo project.

03

Start by providing general information about the project, including its name, address, and contact details.

04

Specify the type of non-qm non-warrantable condo project, such as whether it's a new construction or an existing development.

05

Clearly describe the project's characteristics, amenities, and features to give a comprehensive understanding.

06

Provide financial information, including the project's budget, funding sources, and any ongoing expenses.

07

Outline the project's governance and management structure, including homeowner association rules and regulations.

08

Include any legal documents related to the condo project, such as the declaration of covenants, conditions, and restrictions.

09

Submit the filled-out non-qm non-warrantable condo project form to the appropriate authority for review and approval.

10

Ensure to comply with any additional requirements or guidelines provided by the regulatory bodies overseeing condo projects.

11

Keep copies of all the submitted documents for future reference and follow-up.

Who needs non-qm non-warrantable condo project?

01

Non-qm non-warrantable condo projects are typically designed for individuals who do not meet the strict qualification criteria of traditional mortgage lenders.

02

Who needs a non-qm non-warrantable condo project include:

03

- Self-employed individuals with non-traditional income sources

04

- Borrowers with high debt-to-income ratios

05

- Foreign nationals or investors without a U.S. credit history

06

- Those looking to finance condo projects that do not meet Fannie Mae or Freddie Mac guidelines

07

Non-qm non-warrantable condo projects provide alternative financing options for those who may not be eligible for conventional loans.

08

These projects cater to individuals who require more flexible underwriting standards and are willing to accept higher interest rates or larger down payments.

09

It is advisable to consult with a mortgage professional or lender specializing in non-qm loans for further guidance and assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-qm non-warrantable condo project directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your non-qm non-warrantable condo project and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for signing my non-qm non-warrantable condo project in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your non-qm non-warrantable condo project and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out non-qm non-warrantable condo project on an Android device?

Use the pdfFiller app for Android to finish your non-qm non-warrantable condo project. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is non-qm non-warrantable condo project?

A non-QM (Qualified Mortgage) non-warrantable condo project refers to a condominium that does not meet specific criteria set by Fannie Mae or Freddie Mac for loans to be considered qualified. It may include properties that have certain financial or structural issues, potentially making them riskier for lending.

Who is required to file non-qm non-warrantable condo project?

Lenders and mortgage professionals involved in providing financing for non-QM non-warrantable condo projects are typically required to file the necessary documents to ensure compliance with regulatory guidelines.

How to fill out non-qm non-warrantable condo project?

Filling out a non-QM non-warrantable condo project usually involves providing detailed information about the property, including buy-in amounts, ownership structures, financial documentation, and other pertinent details. It is essential to follow the instructions provided by the relevant regulatory body or lender.

What is the purpose of non-qm non-warrantable condo project?

The purpose of a non-QM non-warrantable condo project is to provide financing options for buyers of condos that do not meet conventional lending criteria, helping them secure mortgages while managing the associated risks.

What information must be reported on non-qm non-warrantable condo project?

Information that must be reported typically includes property details, ownership structure, financial assessments, tenant occupancy rates, and any relevant disclosures regarding the project's compliance with loan criteria.

Fill out your non-qm non-warrantable condo project online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Qm Non-Warrantable Condo Project is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.