Get the free Request for Penalty Cancellation - Covid 19 Impact

Show details

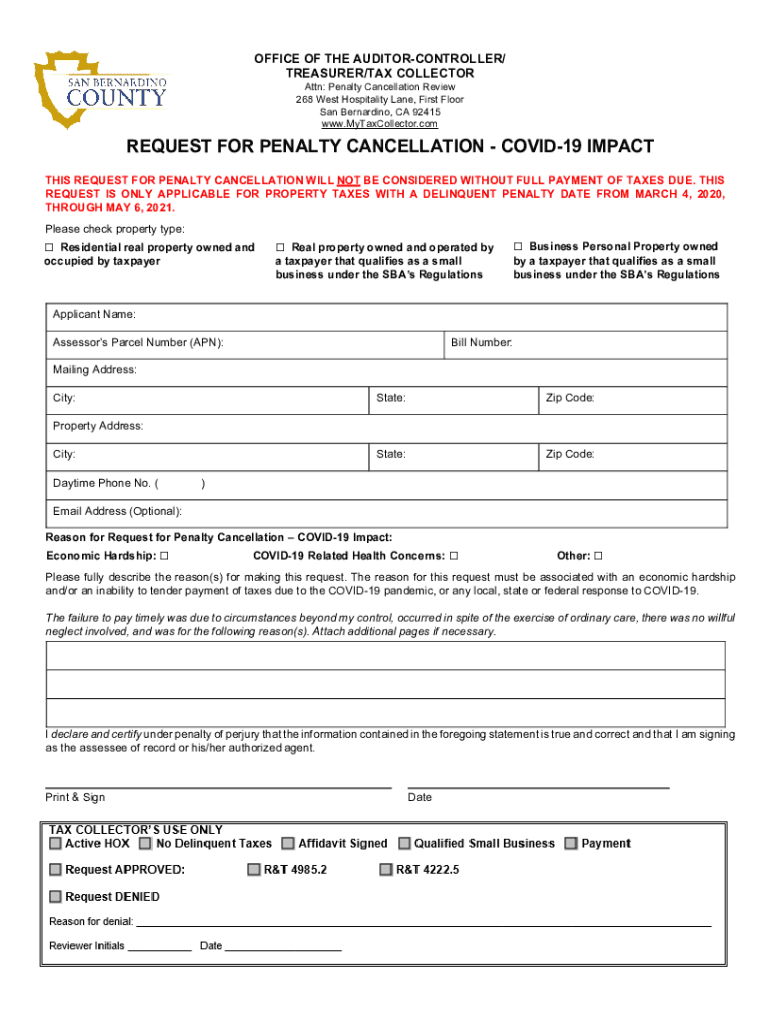

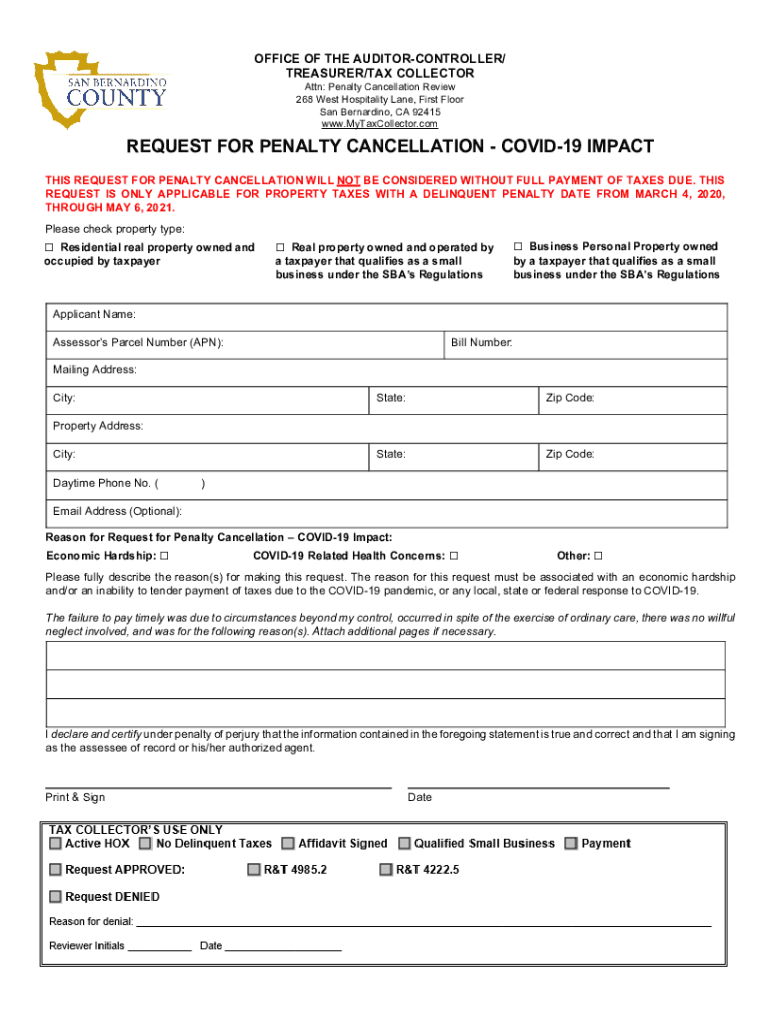

OFFICE OF THE AUDITORCONTROLLER/ TREASURER/TAX COLLECTOR Attn: Penalty Cancellation Review 268 West Hospitality Lane, First Floor San Bernardino, CA 92415 www.MyTaxCollector.comREQUEST FOR PENALTY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for penalty cancellation

Edit your request for penalty cancellation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for penalty cancellation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit request for penalty cancellation online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit request for penalty cancellation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for penalty cancellation

How to fill out request for penalty cancellation

01

Start by gathering all necessary documents related to the penalty that you want to cancel, such as penalty notice, supporting evidence, and any relevant correspondence.

02

Carefully review the penalty notice and understand the grounds on which you can request cancellation. This could include demonstrating that the penalty was issued in error, proving exceptional circumstances, or showing that you have taken corrective action.

03

Draft a formal request letter addressing the relevant authority or department responsible for processing penalty cancellations. Be sure to include your personal and contact details, penalty reference number, and a clear explanation of your reasons for seeking cancellation.

04

Attach copies of all supporting documents to strengthen your case. This may include photographs, receipts, witness statements, or any other evidence that supports your argument.

05

Submit the request letter and supporting documents via the prescribed method specified by the authority. This could be through email, mail, or an online portal. Make sure to keep copies for your records.

06

Follow up with the authority if you do not receive a response within a reasonable timeframe. Politely inquire about the status of your request and provide any additional information or clarification if requested.

07

If your request for penalty cancellation is approved, ensure that you comply with any instructions provided by the authority, such as paying outstanding fines, attending any required meetings, or completing any necessary paperwork.

08

If your request is denied, evaluate the reasons provided by the authority and consider whether you have grounds for an appeal. Seek legal advice if necessary and proceed with the appropriate appeal process.

Who needs request for penalty cancellation?

01

Anyone who has received a penalty and believes they have valid grounds to request cancellation can benefit from submitting a request for penalty cancellation. This includes individuals who have been wrongly penalized, have experienced exceptional circumstances beyond their control, or have taken appropriate corrective action to address the issue. It is important to review the specific criteria and guidelines provided by the relevant authority to determine if you meet the requirements for requesting penalty cancellation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify request for penalty cancellation without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including request for penalty cancellation, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit request for penalty cancellation in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing request for penalty cancellation and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the request for penalty cancellation in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your request for penalty cancellation in minutes.

What is request for penalty cancellation?

A request for penalty cancellation is a formal application made to tax authorities to waive or reduce penalties imposed for late filing, late payment, or other compliance failures.

Who is required to file request for penalty cancellation?

Taxpayers who have incurred penalties due to non-compliance, such as late filing or payment, are required to file a request for penalty cancellation.

How to fill out request for penalty cancellation?

To fill out the request, taxpayers should provide their identifying information, details of the penalties incurred, and a clear explanation of the circumstances that led to the non-compliance.

What is the purpose of request for penalty cancellation?

The purpose is to seek relief from financial penalties by explaining the reasons for the non-compliance and demonstrating that it was due to reasonable causes.

What information must be reported on request for penalty cancellation?

The request must report the taxpayer's identification, the specific penalties being contested, the reason for the request, and any supporting documentation.

Fill out your request for penalty cancellation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Penalty Cancellation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.