Get the free Share repurchases on 12

Show details

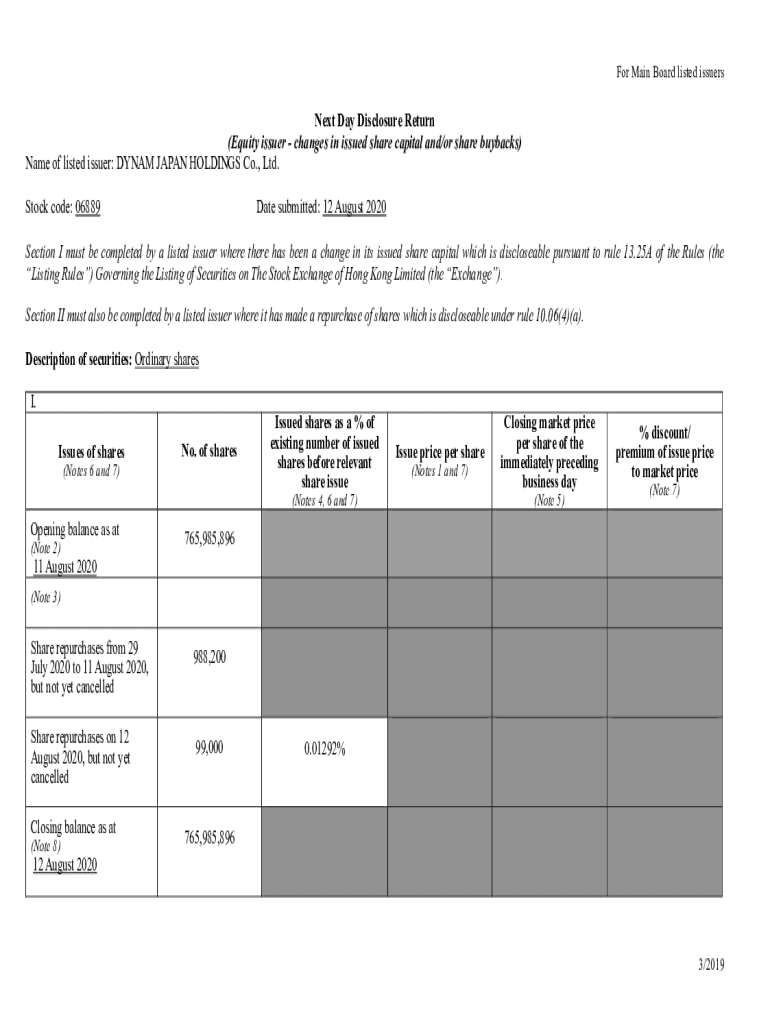

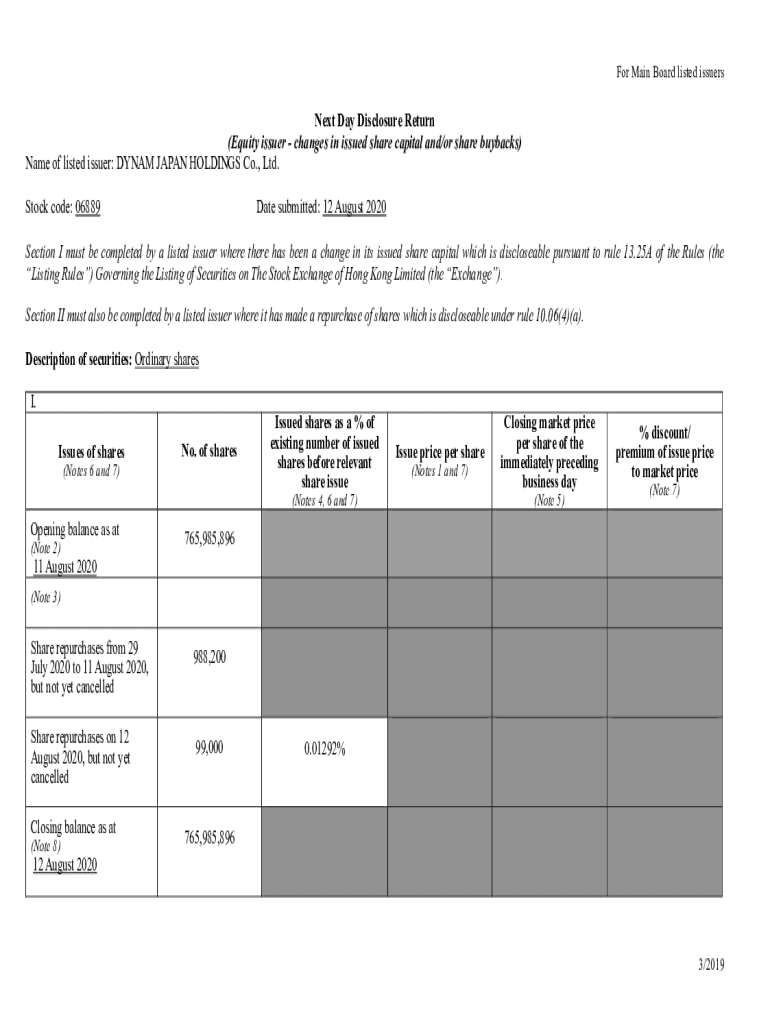

For Main Board listed issuersNext Day Disclosure Return (Equity issuer changes in issued share capital and/or share buybacks) Name of listed issuer: DYNAMO JAPAN HOLDINGS Co., Ltd. Stock code: 06889Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign share repurchases on 12

Edit your share repurchases on 12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your share repurchases on 12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing share repurchases on 12 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit share repurchases on 12. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out share repurchases on 12

How to fill out share repurchases on 12

01

Obtain the necessary documents for share repurchases on 12, including the repurchase agreement and any legal forms required by the jurisdiction.

02

Determine the number of shares to be repurchased and calculate the total cost.

03

Notify the shareholders about the intention of share repurchases on 12 through a formal announcement or communication.

04

Set a timeline for the repurchases, considering factors such as market conditions and available funds.

05

Execute the repurchases as per the agreement, which may involve buying back shares from existing shareholders.

06

Keep detailed records of the repurchases, including the date, number of shares repurchased, and the price paid.

07

Comply with any legal and regulatory requirements related to share repurchases, such as filing necessary disclosures or notifications.

08

Update the company's records and financial statements to reflect the repurchases.

09

Communicate the completion of share repurchases on 12 to the shareholders and provide relevant information about the impact on the company's capital structure.

10

Consider consulting with legal and financial advisors to ensure compliance and proper execution of the share repurchases.

Who needs share repurchases on 12?

01

Companies or corporations that want to reduce the number of outstanding shares in the market may consider share repurchases on 12.

02

Shareholders who are willing to sell their shares may also be interested in participating in share repurchases on 12.

03

Investors or financial institutions looking to improve the company's capital structure or to increase their ownership percentage may find share repurchases on 12 beneficial.

04

Companies facing excess cash or seeking to return value to their shareholders may utilize share repurchases on 12 as a strategy.

05

In general, any entity involved in the ownership or trading of shares and aims to manage their capital structure or enhance shareholder value can consider share repurchases on 12.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my share repurchases on 12 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your share repurchases on 12 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit share repurchases on 12 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your share repurchases on 12 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit share repurchases on 12 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your share repurchases on 12 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is share repurchases on 12?

Share repurchases on 12 refer to the buying back of company shares by a corporation on the 12th day of a certain month.

Who is required to file share repurchases on 12?

Corporations or companies engaging in share repurchases on the 12th day of a month are required to file the transaction details.

How to fill out share repurchases on 12?

To fill out share repurchases on 12, companies need to provide details such as the number of shares repurchased, the price paid per share, the total value of the transaction, and the reason for the repurchase.

What is the purpose of share repurchases on 12?

The purpose of share repurchases on 12 can vary, but common reasons include returning cash to shareholders, increasing earnings per share, and signaling that the company believes its stock is undervalued.

What information must be reported on share repurchases on 12?

Companies must report details such as the number of shares repurchased, the price paid per share, the total value of the transaction, and any associated costs.

Fill out your share repurchases on 12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Share Repurchases On 12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.