Get the free Donor Retention after Giving Tuesday, Sample Thank You ...In-Kind Gifts: How to Ackn...

Show details

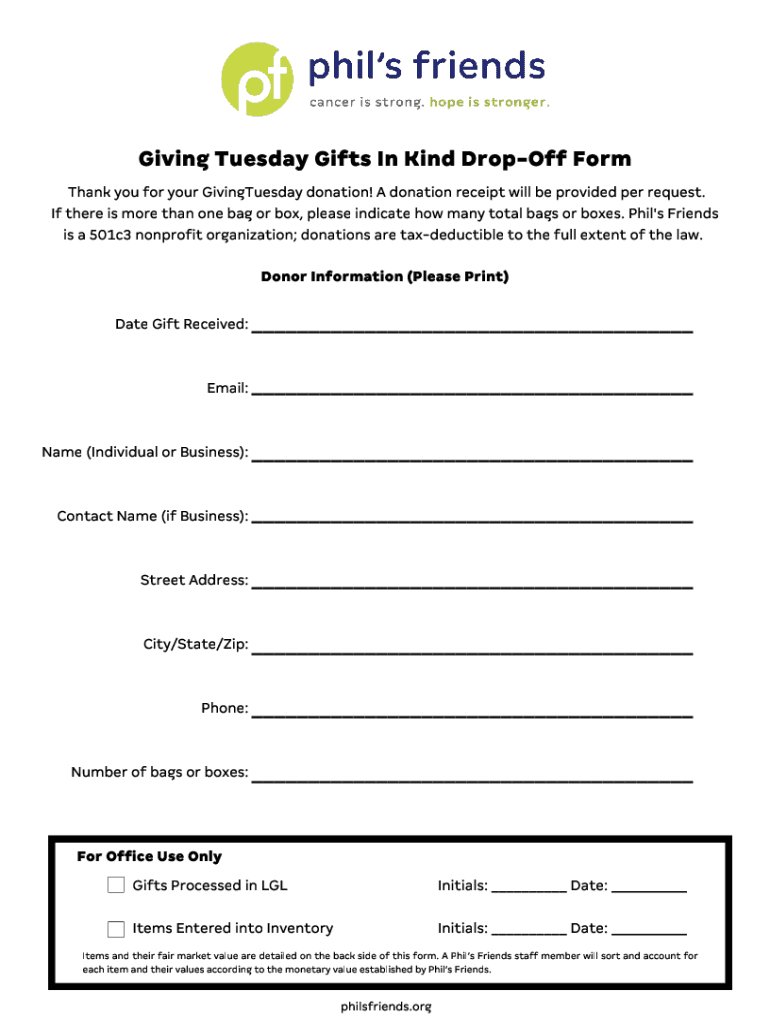

Giving Tuesday Gifts In Kind Drop-off Form Thank you for your Giving Tuesday donation! A donation receipt will be provided per request. If there is more than one bag or box, please indicate how many

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor retention after giving

Edit your donor retention after giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor retention after giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donor retention after giving online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit donor retention after giving. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor retention after giving

How to fill out donor retention after giving

01

Collect all necessary information about the donor, such as their name, contact details, and donation amount.

02

Determine the appropriate time frame for sending the donor retention after giving, typically within one week or two of receiving the donation.

03

Craft a personalized thank-you message that expresses gratitude for their donation and highlights the impact it will make.

04

Include specific details about how the donation will be used and any upcoming events or projects that may interest the donor.

05

Address the donor by name and be sincere in your appreciation.

06

If possible, add a personal touch by mentioning a previous interaction or connection with the donor.

07

Provide options for the donor to stay connected, such as subscribing to newsletters or following social media accounts.

08

Double-check the accuracy of all the information before sending the donor retention after giving.

09

Send the donor retention via email, mail, or both, depending on the donor's preferences.

10

Follow up with the donor periodically to maintain the relationship and provide updates on the impact of their donation.

Who needs donor retention after giving?

01

Non-profit organizations and charities that rely on donations

02

Fundraising campaigns and initiatives

03

Community service organizations

04

Donation-based businesses or projects

05

Any entity that seeks to cultivate long-term relationships with donors

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get donor retention after giving?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific donor retention after giving and other forms. Find the template you want and tweak it with powerful editing tools.

How can I fill out donor retention after giving on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your donor retention after giving. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete donor retention after giving on an Android device?

On Android, use the pdfFiller mobile app to finish your donor retention after giving. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is donor retention after giving?

Donor retention after giving refers to the process of keeping track of donors who have made contributions to an organization and retaining them for future donations.

Who is required to file donor retention after giving?

Nonprofit organizations and charities are typically required to file donor retention after giving.

How to fill out donor retention after giving?

Donor retention after giving is usually filled out by recording donor information, donation amounts, and dates of contributions in a database or spreadsheet.

What is the purpose of donor retention after giving?

The purpose of donor retention after giving is to track donor interactions, maintain communication with donors, and ultimately increase donor retention rates.

What information must be reported on donor retention after giving?

Information that must be reported on donor retention after giving includes donor names, contact information, donation amounts, and dates of contributions.

Fill out your donor retention after giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor Retention After Giving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.