Get the Tax Free Savings Account for Individuals - ClucasGray

Show details

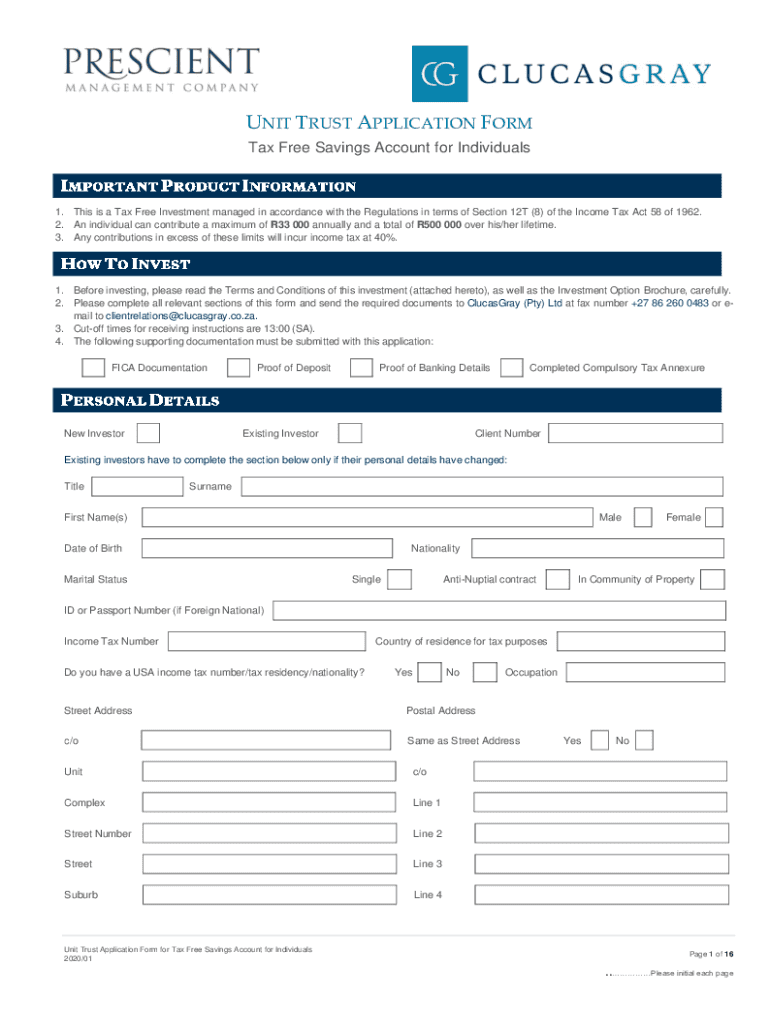

UNIT TRUST APPLICATION FORM

Tax Free Savings Account for Individuals1. This is a Tax Free Investment managed in accordance with the Regulations in terms of Section 12T (8) of the Income Tax Act 58

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax savings account for

Edit your tax savings account for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax savings account for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax savings account for online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax savings account for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax savings account for

How to fill out tax savings account for

01

To fill out a tax savings account, follow these steps:

02

Determine your eligibility: Check the guidelines provided by your country's tax authorities to see if you are eligible for a tax savings account.

03

Gather necessary documents: Collect all the required documents such as your identification proof, proof of income, and any other supporting documents specified by the tax authorities.

04

Choose a tax savings account provider: Research and select a reputable financial institution or bank that offers tax savings account services.

05

Open an account: Visit the chosen financial institution and complete the necessary paperwork to open a tax savings account.

06

Provide relevant information: Fill out the required information, such as your personal details, contact information, and tax identification number.

07

Understand contribution limits: Familiarize yourself with the maximum contribution limits allowed by the tax authorities for a tax savings account.

08

Make contributions: Start making regular contributions to your tax savings account as per your financial capability.

09

Keep track of contributions: Maintain a record of all the contributions made to your tax savings account for future reference and tax reporting.

10

Review and update annually: Review your tax savings account annually to ensure it aligns with any changes in tax regulations or personal circumstances.

11

Seek professional advice if needed: Consult a tax advisor or financial expert if you require assistance or have any questions related to tax savings account.

12

Who needs tax savings account for?

01

Tax savings accounts can be beneficial for the following individuals:

02

- Self-employed individuals: Those who work as independent contractors or freelancers can utilize tax savings accounts to save for taxes they need to pay in the future.

03

- Small business owners: Business owners can set up tax savings accounts to save a portion of their earnings for tax obligations while earning potential tax benefits.

04

- Individuals with irregular income: If your income fluctuates throughout the year, having a tax savings account can help you manage your tax payments more efficiently.

05

- High earners: Individuals with high incomes may benefit from tax savings accounts as they can use them to lower their taxable income and potentially reduce their tax liability.

06

- Individuals in higher tax brackets: People in higher tax brackets might find tax savings accounts advantageous as they can maximize their tax savings by contributing to these accounts.

07

- Anyone looking for tax planning: Those who want to manage their taxes effectively and save money on taxes can consider utilizing tax savings accounts.

08

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax savings account for from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tax savings account for. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in tax savings account for without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing tax savings account for and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit tax savings account for on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign tax savings account for. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is tax savings account for?

Tax savings account is used for individuals to save money on taxes by contributing and investing in tax-advantaged accounts such as 401(k) or IRA.

Who is required to file tax savings account for?

Individuals who want to save money on taxes and meet the eligibility requirements for tax-advantaged accounts like 401(k) or IRA are required to file tax savings account for.

How to fill out tax savings account for?

To fill out tax savings account, individuals need to provide information on their contributions, investments, and withdrawals from tax-advantaged accounts such as 401(k) or IRA.

What is the purpose of tax savings account for?

The purpose of tax savings account is to help individuals save money on taxes and build wealth for retirement by taking advantage of tax-advantaged accounts like 401(k) or IRA.

What information must be reported on tax savings account for?

Information such as contributions, investments, and withdrawals from tax-advantaged accounts like 401(k) or IRA must be reported on tax savings account form.

Fill out your tax savings account for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Savings Account For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.