Get the free Tax Court of Canada Rules of Procedure Respecting the Excise ...

Show details

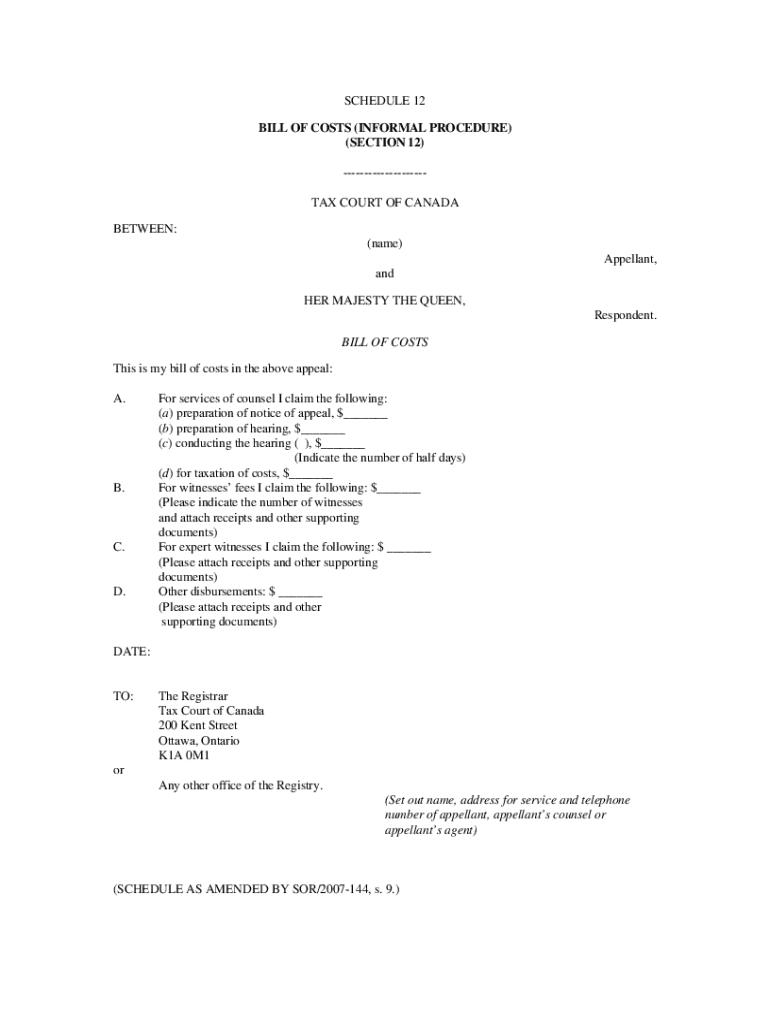

SCHEDULE 12 BILL OF COSTS (INFORMAL PROCEDURE) (SECTION 12) TAX COURT OF CANADA BETWEEN: (name) Appellant, and HER MAJESTY THE QUEEN, Respondent. BILL OF COSTS This is my bill of costs in the above

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax court of canada

Edit your tax court of canada form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax court of canada form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax court of canada online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax court of canada. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax court of canada

How to fill out tax court of canada

01

To fill out the tax court of Canada, follow these steps:

02

Start by downloading the appropriate forms from the official website of the tax court of Canada.

03

Gather all the necessary documents, such as tax statements, receipts, and any supporting evidence.

04

Carefully read the instructions provided with the forms to understand the requirements and procedures.

05

Fill out the forms accurately, ensuring that all the required information is provided and all calculations are correct.

06

Attach any supporting documents as needed, making sure to keep copies for your records.

07

Double-check all the information you have entered to avoid any mistakes or omissions.

08

Review the completed forms and make any necessary corrections before submitting.

09

Submit the filled-out forms, along with any required fees, to the tax court of Canada by mail or electronically.

10

Keep a copy of the submitted forms and supporting documents for future reference.

11

Await further correspondence from the tax court of Canada regarding your case.

Who needs tax court of canada?

01

The tax court of Canada is needed by individuals and organizations who wish to challenge decisions made by the Canada Revenue Agency (CRA) regarding their taxes or other financial matters.

02

Typically, those who may need the tax court of Canada include:

03

- Taxpayers who believe they have been treated unfairly by the CRA and want to dispute their tax assessments or penalties.

04

- Businesses or corporations facing tax-related issues, such as disputed deductions, tax credits, or other financial matters.

05

- Individuals or organizations disputing GST/HST assessments or other indirect taxes.

06

- Individuals or organizations appealing the denial of tax refunds or benefits.

07

- Tax professionals or accountants representing clients in tax-related disputes.

08

It is important to note that not all tax matters can be brought to the tax court of Canada. The court has jurisdiction over specific types of cases as defined by Canadian tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax court of canada for eSignature?

Once you are ready to share your tax court of canada, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit tax court of canada online?

With pdfFiller, it's easy to make changes. Open your tax court of canada in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete tax court of canada on an Android device?

On an Android device, use the pdfFiller mobile app to finish your tax court of canada. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is tax court of canada?

The Tax Court of Canada is a federal court that has exclusive jurisdiction over tax matters in Canada.

Who is required to file tax court of canada?

Individuals, corporations, and other entities who disagree with a decision made by the Canada Revenue Agency (CRA) regarding their taxes may file a case with the Tax Court of Canada.

How to fill out tax court of canada?

To file a case with the Tax Court of Canada, individuals must complete the required forms and submit them to the court along with any supporting documentation.

What is the purpose of tax court of canada?

The purpose of the Tax Court of Canada is to provide an independent and impartial forum for resolving disputes between taxpayers and the CRA.

What information must be reported on tax court of canada?

Taxpayers must provide details of the dispute, including relevant facts and legal arguments, when filing a case with the Tax Court of Canada.

Fill out your tax court of canada online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Court Of Canada is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.