Get the free W-8BEN-E for Canadian eCommerce Sellers: FAQs & Sample ...W-8BEN-E for Canadian ...

Show details

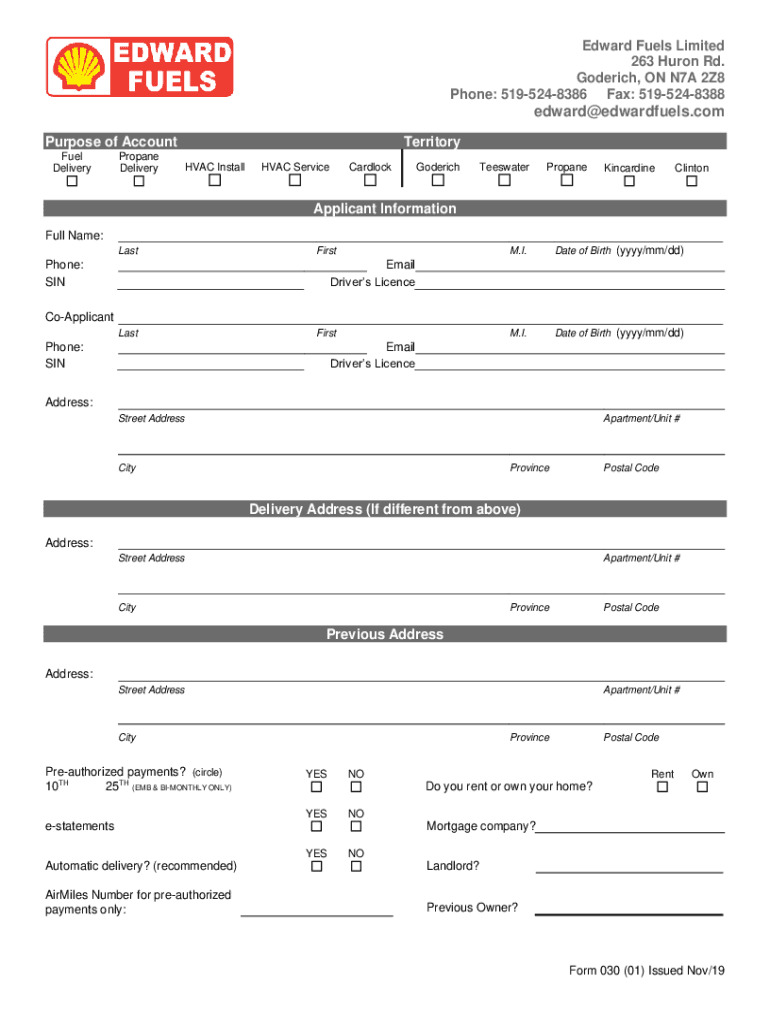

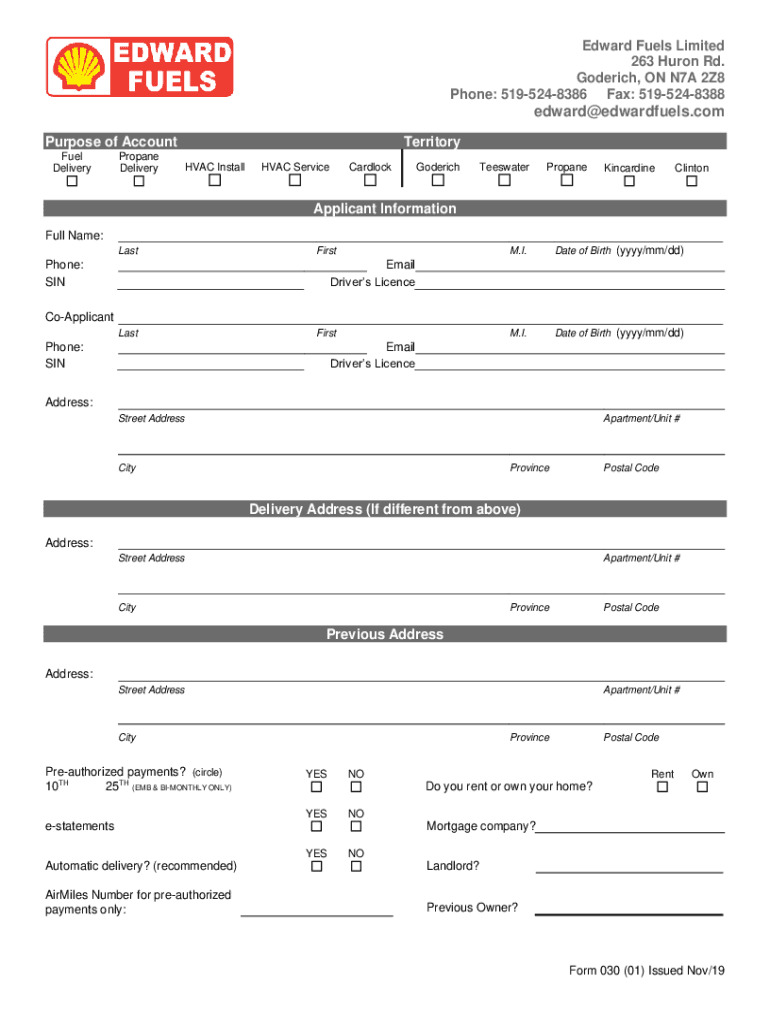

Edward Fuels Limited

263 Huron Rd.

Roderick, ON N7A 2Z8

Phone: 5195248386 Fax: 5195248388edward@edwardfuels.com

Purpose of Account

Fuel

DeliveryPropane

DeliveryTerritory

HVAC InstallHVAC ServiceCardlockGoderichTeeswaterPropaneKincardineClintonApplicant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w-8ben-e for canadian ecommerce

Edit your w-8ben-e for canadian ecommerce form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-8ben-e for canadian ecommerce form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w-8ben-e for canadian ecommerce online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit w-8ben-e for canadian ecommerce. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w-8ben-e for canadian ecommerce

How to fill out w-8ben-e for canadian ecommerce

01

Start by downloading the W-8BEN-E form from the Internal Revenue Service (IRS) website.

02

Fill out the first part of the form, which includes providing your name, country of residence, and tax identification number.

03

Indicate the type of beneficial owner you are, such as an individual, corporation, or partnership.

04

Complete the certification section by stating that the information provided is accurate and that you are not a U.S. person.

05

Provide your permanent address and, if applicable, your mailing address.

06

Specify the article of the U.S. tax treaty that may reduce or eliminate the tax withholding on certain types of income.

07

Include any additional documentation required, such as a copy of your tax identification number certificate or any supporting documents related to claiming treaty benefits.

08

Review the completed form for accuracy and sign it.

09

Submit the W-8BEN-E form to the appropriate party or authority as instructed, such as your trading platform or tax authority.

10

Keep a copy of the filled-out form for your records.

Who needs w-8ben-e for canadian ecommerce?

01

Any Canadian ecommerce entity that is receiving income or making transactions subject to U.S. taxation may need to fill out a W-8BEN-E form.

02

This includes Canadian businesses selling products or services to U.S. customers, receiving income from U.S. sources, or engaging in U.S. investment activities.

03

It is important to consult with a tax professional or advisor to determine if the W-8BEN-E form is required for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in w-8ben-e for canadian ecommerce without leaving Chrome?

w-8ben-e for canadian ecommerce can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out w-8ben-e for canadian ecommerce using my mobile device?

Use the pdfFiller mobile app to complete and sign w-8ben-e for canadian ecommerce on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit w-8ben-e for canadian ecommerce on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute w-8ben-e for canadian ecommerce from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is w-8ben-e for canadian ecommerce?

The W-8BEN-E is a form used by foreign entities, including Canadian businesses engaged in eCommerce, to certify their foreign status and claim tax treaty benefits for income received from U.S. sources.

Who is required to file w-8ben-e for canadian ecommerce?

Canadian entities that receive certain types of income from U.S. sources, such as dividends, interest, royalties, or other payments, are required to file the W-8BEN-E form.

How to fill out w-8ben-e for canadian ecommerce?

To fill out the W-8BEN-E, Canadian entities must provide their legal name, country of incorporation, address, tax identification number, and other relevant information, indicating the type of income and claiming any applicable tax treaty benefits.

What is the purpose of w-8ben-e for canadian ecommerce?

The purpose of the W-8BEN-E is to establish a foreign entity's eligibility for reduced withholding tax rates on U.S. source income, thus preventing excess taxes from being withheld.

What information must be reported on w-8ben-e for canadian ecommerce?

The W-8BEN-E requires information such as the entity's name, address, U.S. tax identification number (if applicable), foreign tax identification number, and details about the type of income being received and any applicable tax treaty benefits.

Fill out your w-8ben-e for canadian ecommerce online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W-8ben-E For Canadian Ecommerce is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.