Get the free Last 3 or 4 numbers on back of card

Show details

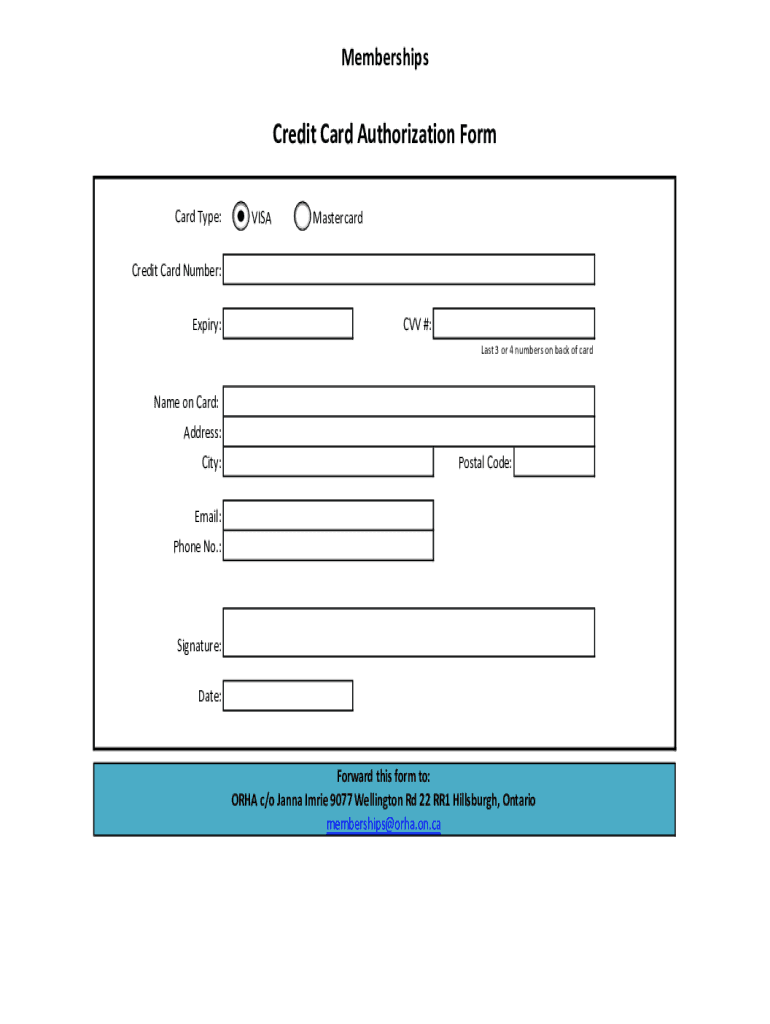

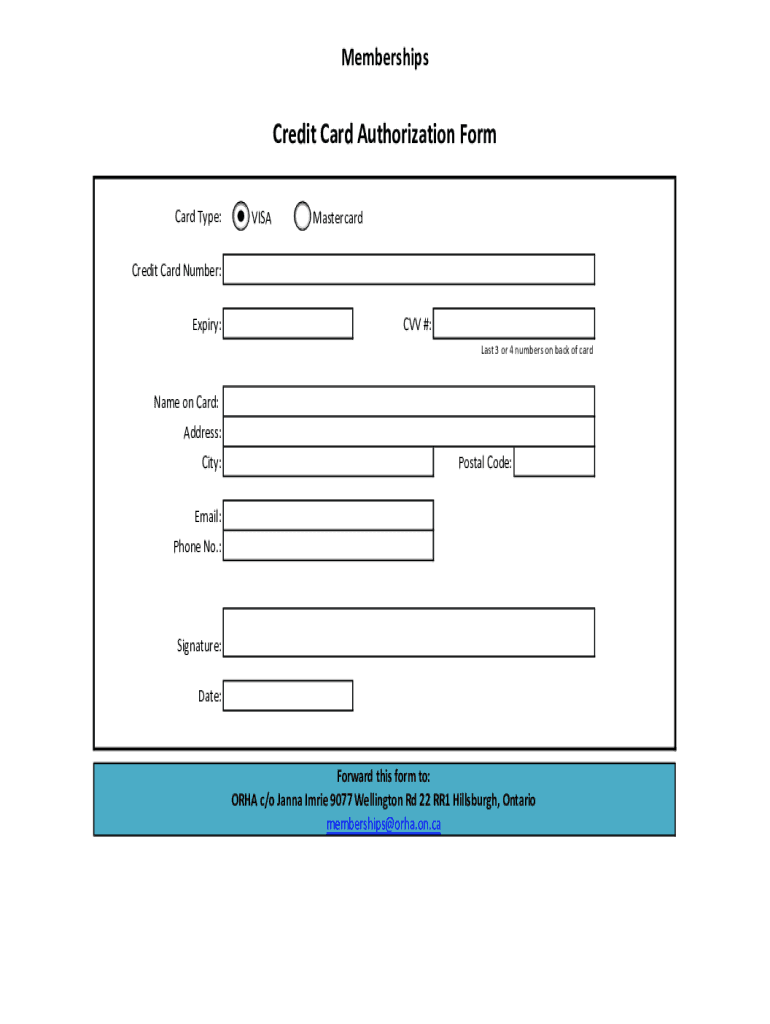

MembershipsCredit Card Authorization Form

Card Type: VISAMastercardCredit Card Number:

Expiry:CVV #:

Last 3 or 4 numbers on back of carnage on Card:

Address:

City:Postal Code:Email:

Phone No.:Signature:

Date:Forward

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign last 3 or 4

Edit your last 3 or 4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your last 3 or 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit last 3 or 4 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit last 3 or 4. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out last 3 or 4

How to fill out last 3 or 4

01

Start by gathering all the necessary information such as personal details, employment history, and education qualifications.

02

Begin with the most recent information and work backwards. Fill out the latest three or four positions or educational experiences in chronological order.

03

Provide accurate and descriptive information for each entry, including job titles, dates of employment, company names, and job responsibilities.

04

Include any relevant achievements, certifications, or awards received during each position or educational experience.

05

Use clear and concise language, avoiding any unnecessary jargon or complicated terms.

06

Double-check all the provided information for accuracy and completeness before submitting the last 3 or 4.

07

If there are any gaps in employment or education, briefly explain the reasons for the gaps.

08

Format the last 3 or 4 entries in a consistent and organized manner, making it easy for the reader to navigate and understand.

09

Proofread the entire document to ensure it is free from any spelling or grammatical errors.

10

Finally, save the completed form as a PDF or Word document and submit it as required.

Who needs last 3 or 4?

01

The last 3 or 4 are usually required by employers or educational institutions when they want to evaluate a candidate's recent work experience or educational background.

02

Job applicants who have relevant experience or qualifications within the last 3 or 4 positions usually need to provide this information.

03

Students applying for higher education or scholarships may also be asked to provide the last 3 or 4 educational experiences.

04

This information is valuable for employers, educational institutions, or scholarship committees to assess an individual's current skills, knowledge, and suitability for a specific position or program.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my last 3 or 4 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your last 3 or 4 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit last 3 or 4 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit last 3 or 4.

How do I fill out last 3 or 4 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign last 3 or 4. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is last 3 or 4?

The 'last 3 or 4' typically refers to the last three or four years of tax returns that individuals or businesses need to file with the IRS or other tax authorities.

Who is required to file last 3 or 4?

Individuals or businesses that have not filed their tax returns for the last three or four years are required to file them to remain compliant with tax laws.

How to fill out last 3 or 4?

To fill out the last three or four years of tax returns, gather all necessary financial documents, complete the appropriate tax forms for each year, and ensure that all income, deductions, and credits are accurately reported.

What is the purpose of last 3 or 4?

The purpose of filing the last three or four years of tax returns is to rectify any past non-filing issues, comply with tax laws, and potentially qualify for tax benefits, loans, or other financial assistance.

What information must be reported on last 3 or 4?

The information that must be reported includes income earned, deductions claimed, credits applied, and any other relevant financial data for each tax year being filed.

Fill out your last 3 or 4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Last 3 Or 4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.