Get the free PRIVATE RETIREMENT SCHEME (PRS) ACCOUNT OPENING FORM

Show details

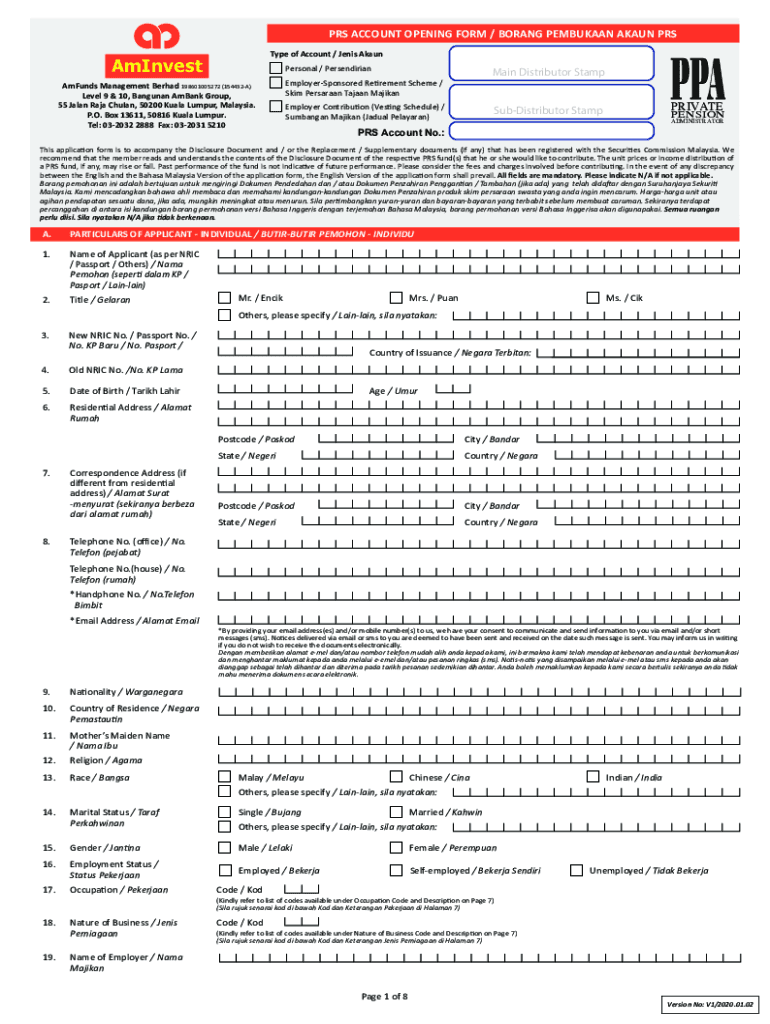

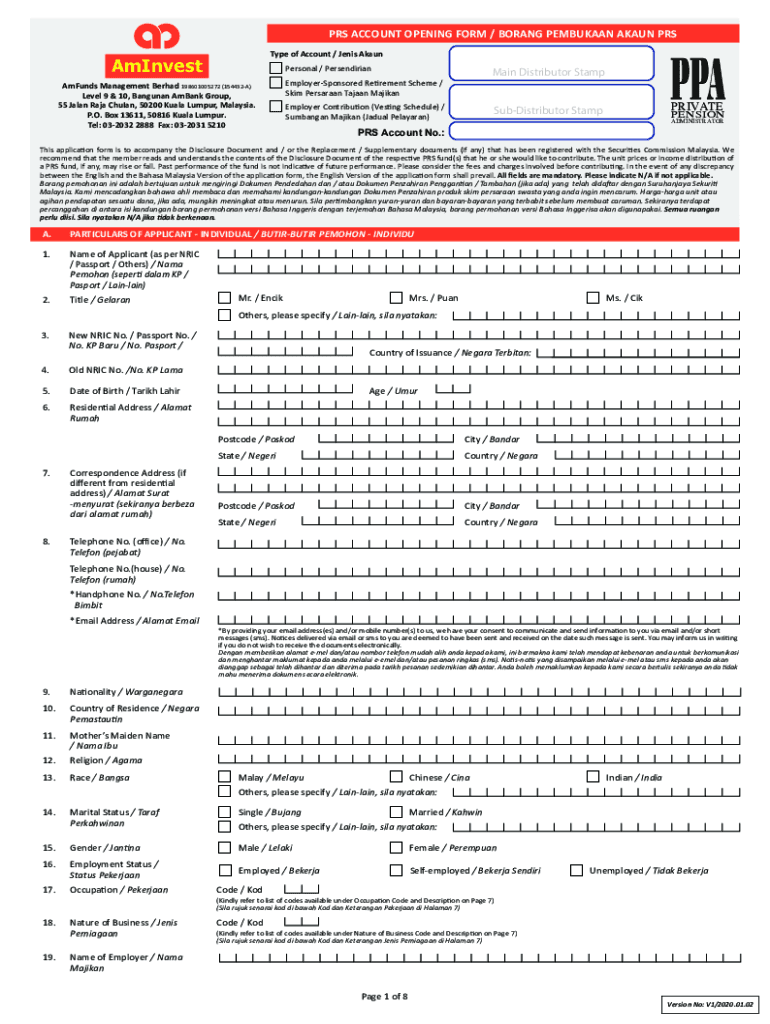

PRS ACCOUNT OPENING FORM / BORING PEMBUKAAN AK AUN PRS Type of Account / Denis AkaunAmInvest Funds Management Broad 198601005272 (154432A) Level 9 & 10, Angular Embank Group, 55 Japan Raja Chuan,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private retirement scheme prs

Edit your private retirement scheme prs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private retirement scheme prs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private retirement scheme prs online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit private retirement scheme prs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private retirement scheme prs

How to fill out private retirement scheme prs

01

Step 1: Gather all necessary information and documents such as identification card, proof of income, and bank account details.

02

Step 2: Research and compare different private retirement scheme (PRS) providers to find the one that suits your needs.

03

Step 3: Choose the type of PRS fund you want to invest in, such as equity fund, bond fund, or balanced fund.

04

Step 4: Contact the chosen PRS provider and fill out the application form with accurate and complete information.

05

Step 5: Submit the application form along with the required documents to the PRS provider.

06

Step 6: Make the initial contribution or investment as required by the PRS provider.

07

Step 7: Monitor the performance of your PRS fund regularly and adjust your investment strategy if needed.

08

Step 8: Keep track of any updates, notifications, or changes provided by the PRS provider.

09

Step 9: Continue to contribute to your PRS fund as per your financial capacity and retirement goals.

10

Step 10: When you reach the eligible age for withdrawal, follow the instructions provided by the PRS provider to access your retirement savings.

Who needs private retirement scheme prs?

01

Private retirement scheme (PRS) is suitable for individuals who want to save for their retirement and have additional funds aside from their Employees Provident Fund (EPF) savings.

02

Those who do not have a pension or sufficient retirement savings may also consider PRS to supplement their income during retirement.

03

Young professionals who want to start planning and investing for retirement early can benefit from PRS as it provides long-term investment opportunities.

04

Self-employed individuals or those without an employee retirement scheme can use PRS to save for their retirement.

05

Individuals who want to diversify their retirement savings and have control over their investment choices may opt for PRS.

06

PRS can also be suitable for those who are willing to take on some investment risks in exchange for potential higher returns in the long run.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get private retirement scheme prs?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific private retirement scheme prs and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the private retirement scheme prs in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your private retirement scheme prs in seconds.

How do I fill out private retirement scheme prs on an Android device?

Use the pdfFiller mobile app to complete your private retirement scheme prs on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is private retirement scheme prs?

Private Retirement Scheme (PRS) is a voluntary long-term savings and investment scheme designed to help individuals accumulate savings for retirement.

Who is required to file private retirement scheme prs?

Individuals who wish to save for retirement and take advantage of tax benefits can voluntarily participate in a Private Retirement Scheme (PRS).

How to fill out private retirement scheme prs?

You can fill out a Private Retirement Scheme (PRS) form provided by the PRS provider or fill out an online application on the PRS provider's website.

What is the purpose of private retirement scheme prs?

The purpose of a Private Retirement Scheme (PRS) is to encourage individuals to save for retirement and provide them with a long-term savings and investment option.

What information must be reported on private retirement scheme prs?

Information such as personal details, investment preferences, contribution amounts, and beneficiary details must be reported on a Private Retirement Scheme (PRS) form.

Fill out your private retirement scheme prs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Retirement Scheme Prs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.