Get the free Mutual Funds Investment Planning - Mutual Funds Online Axis MF

Show details

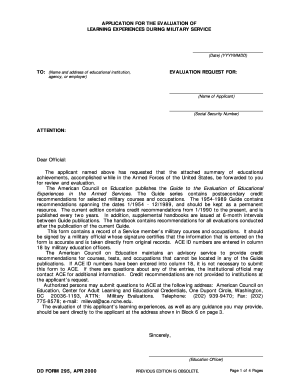

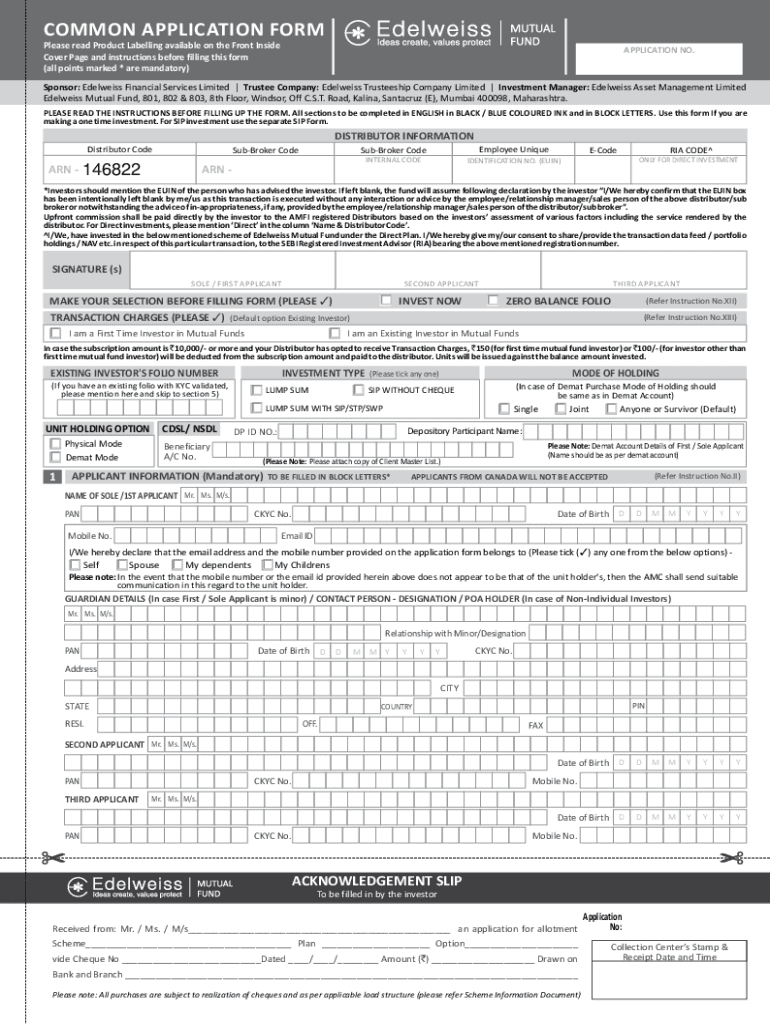

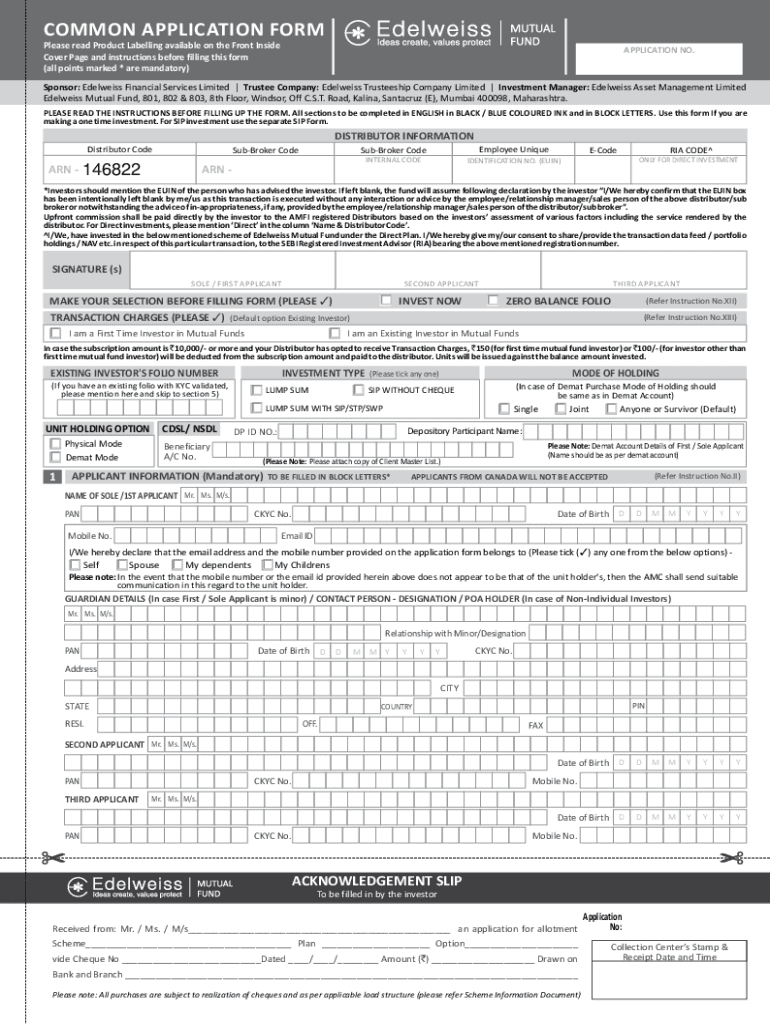

MUTUAL FUND Key Information Memorandum (KIM) and Common Application Form Continuous Offer of Units of R 10 per Unit at NAV based prices, subject to applicable Loads except for Edelweiss Liquid Fund

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual funds investment planning

Edit your mutual funds investment planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual funds investment planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual funds investment planning online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mutual funds investment planning. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual funds investment planning

How to fill out mutual funds investment planning

01

Determine your investment goals: Before filling out mutual funds investment planning, you need to determine your investment goals such as saving for retirement, education, or buying a house.

02

Research different mutual funds: Research and compare different mutual funds to find the ones that align with your investment goals and risk tolerance.

03

Consider your risk tolerance: Assess how much risk you are willing to take with your investments. This will help you choose the right mix of mutual funds.

04

Decide on the investment amount: Determine how much you are willing to invest in mutual funds and establish a budget.

05

Fill out the necessary paperwork: Contact the mutual fund company or your financial advisor to get the required paperwork for opening an investment account.

06

Provide the required information: Fill out the paperwork accurately and provide the necessary personal and financial information, including your name, address, social security number, and investment preferences.

07

Choose the mutual funds: Indicate your investment preferences by selecting the specific mutual funds you want to invest in.

08

Read and understand the prospectus: Carefully read the prospectus provided by the mutual fund company. It contains detailed information about the fund's investment objectives, risks, fees, and expenses.

09

Submit the paperwork: Once you have completed the necessary paperwork and reviewed it for accuracy, submit it to the mutual fund company or your financial advisor.

10

Monitor and review your investments: Regularly monitor the performance of your mutual funds and review your investment strategy to ensure it aligns with your goals and risk tolerance.

11

Seek professional advice if needed: If you are unsure about any aspect of filling out mutual funds investment planning, consult with a financial advisor for guidance and recommendations.

Who needs mutual funds investment planning?

01

Individuals planning for retirement: Mutual funds investment planning can be beneficial for individuals who are saving for their retirement and looking for long-term investment options.

02

Parents saving for their children's education: Mutual funds investment planning can help parents save and grow their money to fund their children's education expenses in the future.

03

Individuals with specific financial goals: Anyone with specific financial goals such as buying a house, starting a business, or saving for a major expense can benefit from mutual funds investment planning.

04

Individuals looking for diversification: Mutual funds offer diversification by investing in a variety of assets, making them suitable for individuals who want to spread their risk.

05

Investors seeking professional management: Mutual funds are managed by experienced professionals who make investment decisions on behalf of investors, which can be advantageous for individuals without the time or expertise to manage their investments.

06

Beginners in investing: Mutual funds provide a relatively simple way to start investing for beginners who may not have extensive knowledge or experience in the financial markets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mutual funds investment planning for eSignature?

When you're ready to share your mutual funds investment planning, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the mutual funds investment planning form on my smartphone?

Use the pdfFiller mobile app to complete and sign mutual funds investment planning on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit mutual funds investment planning on an Android device?

You can make any changes to PDF files, like mutual funds investment planning, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is mutual funds investment planning?

Mutual funds investment planning is a strategy for investing in a diversified portfolio of securities through a mutual fund.

Who is required to file mutual funds investment planning?

Individuals or entities who invest in mutual funds are required to file mutual funds investment planning.

How to fill out mutual funds investment planning?

Mutual funds investment planning can be filled out by consulting with a financial advisor or using online tools provided by mutual fund companies.

What is the purpose of mutual funds investment planning?

The purpose of mutual funds investment planning is to help investors achieve their financial goals by investing in a diversified portfolio of securities.

What information must be reported on mutual funds investment planning?

Mutual funds investment planning must include details of the investments made, the value of the investments, and any income or gains received.

Fill out your mutual funds investment planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Funds Investment Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.