Get the free Open Ended Debt/Liquid Schemes

Show details

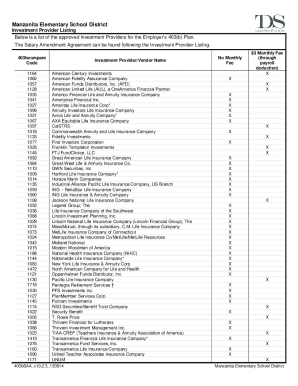

Investment Manager: LIC Mutual Fund Asset Management Ltd.KEY INFORMATION MEMORANDUM & COMMON APPLICATION FORM Continuous Offer of Units at Applicable Naveen Ended Debt/Liquid Schemes LIC MF Banking

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign open ended debtliquid schemes

Edit your open ended debtliquid schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your open ended debtliquid schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit open ended debtliquid schemes online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit open ended debtliquid schemes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out open ended debtliquid schemes

How to fill out open ended debtliquid schemes

01

Start by gathering all necessary documents such as identification proof, address proof, and income proof.

02

Research different open ended debtliquid schemes offered by various financial institutions and compare their benefits, risks, and terms.

03

Choose the scheme that best suits your financial goals and risk appetite.

04

Fill out the application form provided by the financial institution offering the scheme.

05

Provide accurate and complete information in the application form, ensuring that all sections are filled correctly.

06

Attach the necessary documents as mentioned in step 1 to support your application.

07

Double-check all the information filled in the application form for any errors or mistakes.

08

Submit the completed application form along with the supporting documents to the respective financial institution.

09

Pay any required application fees or charges as specified by the institution.

10

Wait for the financial institution to review your application and provide a decision on whether it has been approved or not.

11

If approved, carefully read and understand the terms and conditions of the scheme before investing any funds.

12

Make the necessary investments as per the guidelines provided by the financial institution.

13

Monitor your investments regularly and stay updated with any changes or updates regarding the scheme.

14

Seek professional financial advice if needed to ensure your investments align with your long-term financial goals.

Who needs open ended debtliquid schemes?

01

Individuals who want to invest their money in a low-risk financial product.

02

Individuals who are looking for a liquid investment option that allows them to easily withdraw their funds when needed.

03

Individuals who prefer a professionally managed investment scheme.

04

Individuals who want to diversify their investment portfolio by including debt instruments.

05

Individuals who have surplus funds and are willing to earn a steady income with a moderate return on investment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the open ended debtliquid schemes in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your open ended debtliquid schemes in seconds.

Can I create an eSignature for the open ended debtliquid schemes in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your open ended debtliquid schemes right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete open ended debtliquid schemes on an Android device?

Use the pdfFiller mobile app to complete your open ended debtliquid schemes on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is open ended debtliquid schemes?

Open ended debtliquid schemes refer to mutual fund schemes that do not have a fixed maturity date and allow investors to enter or exit at any time.

Who is required to file open ended debtliquid schemes?

Asset management companies are required to file open ended debtliquid schemes with the regulatory authorities.

How to fill out open ended debtliquid schemes?

To fill out open ended debtliquid schemes, asset management companies need to provide detailed information about the fund's investment portfolio, performance, and risk factors.

What is the purpose of open ended debtliquid schemes?

The purpose of open ended debtliquid schemes is to provide investors with a liquid investment option that offers capital preservation and regular income.

What information must be reported on open ended debtliquid schemes?

Asset allocation, credit quality of securities, duration of portfolio, maturity profile, and expense ratio are some of the key information that must be reported on open ended debtliquid schemes.

Fill out your open ended debtliquid schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Open Ended Debtliquid Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.