Get the free ENDOWMENT TRUST

Show details

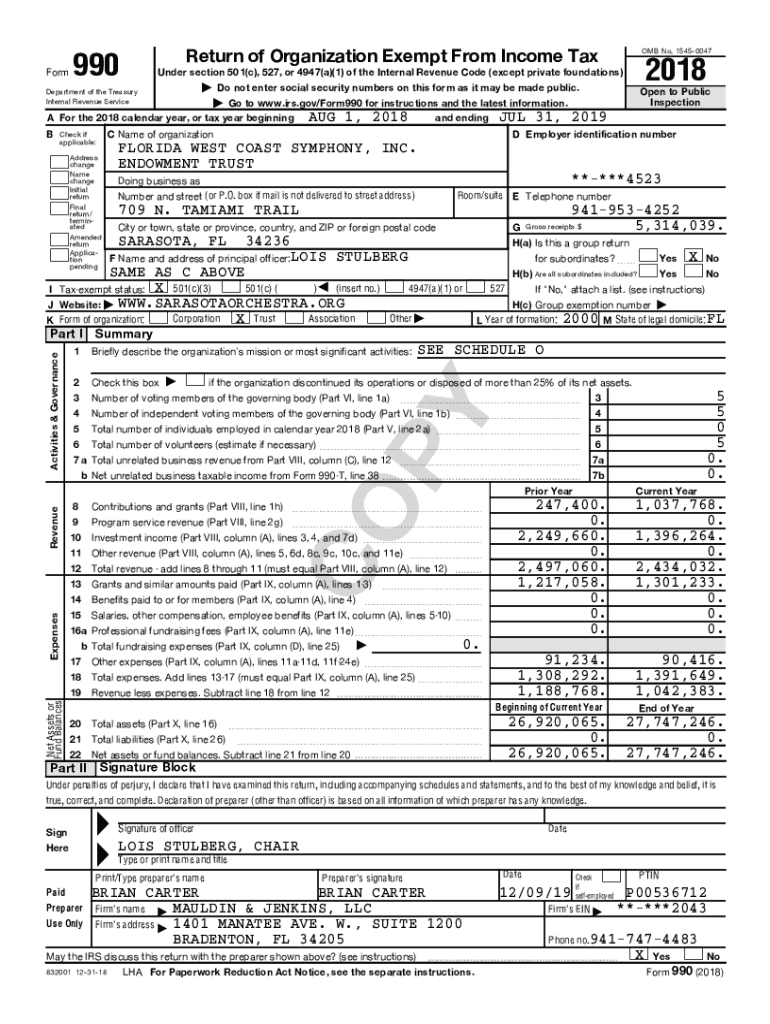

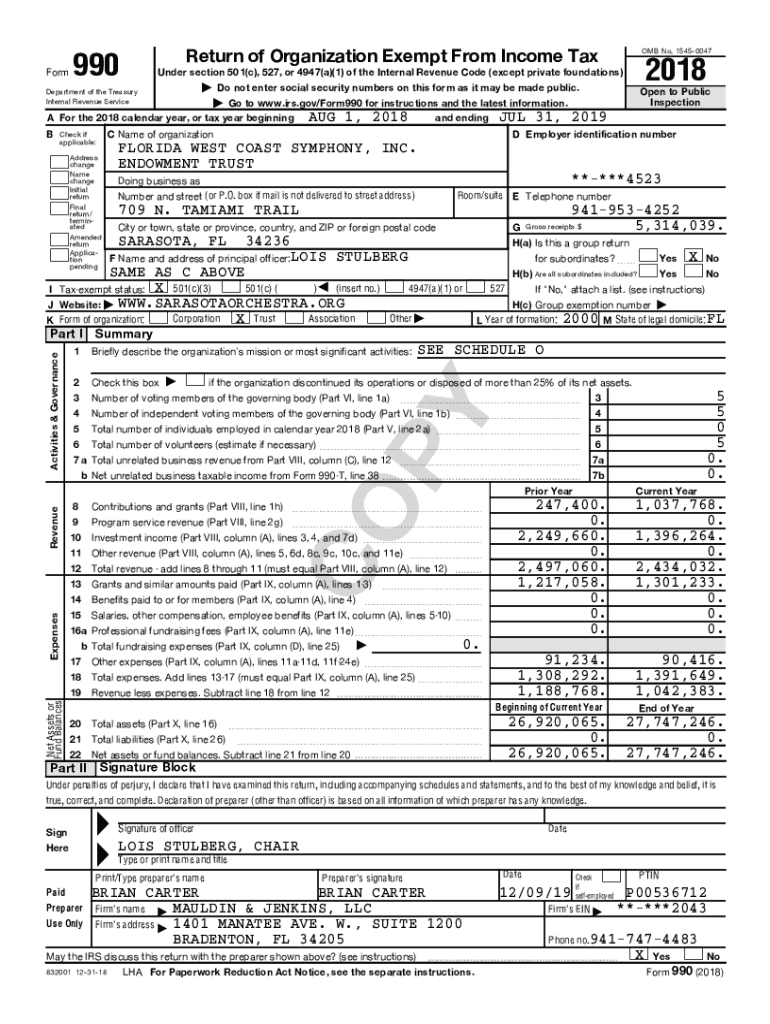

Form990OMB No. 15450047Return of Organization Exempt From Income Tax2018Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) Do not enter social security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign endowment trust

Edit your endowment trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your endowment trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing endowment trust online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit endowment trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out endowment trust

How to fill out endowment trust

01

To fill out an endowment trust, follow these steps:

02

Start by gathering all the necessary paperwork, such as the trust agreement, beneficiary information, and any relevant financial documents.

03

Review the trust agreement thoroughly to understand its provisions and requirements.

04

Identify the specific assets that will be transferred to the trust.

05

Determine the trust beneficiaries and specify their respective shares or interests.

06

Complete the necessary forms or documents to legally establish the trust.

07

Consult with an attorney or financial advisor to ensure compliance with legal and financial regulations.

08

Fund the trust by transferring the identified assets into the trust's name.

09

Provide all required documentation to the appropriate authorities or institutions involved, such as banks or insurance companies, to update beneficiary designations and ownership details.

10

Keep a copy of the completed trust documents for future reference.

11

Regularly review and update the trust as needed to reflect any changes in beneficiaries, assets, or legal requirements.

Who needs endowment trust?

01

Endowment trusts are beneficial for various individuals and organizations, including:

02

- Non-profit organizations that want to secure long-term funding for their operations.

03

- Universities or educational institutions that wish to establish scholarship programs or ensure financial sustainability.

04

- Charitable foundations or philanthropists who aim to leave a lasting legacy and support causes they care about.

05

- Individuals who want to provide for future generations or specific beneficiaries and safeguard their assets.

06

- Families seeking to protect their wealth and pass it down to future generations while minimizing tax implications.

07

- Businesses or companies looking to establish dedicated funds or trusts for employee benefits or corporate giving programs.

08

Overall, endowment trusts offer a strategic way to preserve capital, generate income, and achieve long-term financial goals while supporting charitable or philanthropic endeavors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find endowment trust?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the endowment trust in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit endowment trust online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your endowment trust to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit endowment trust on an Android device?

With the pdfFiller Android app, you can edit, sign, and share endowment trust on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is endowment trust?

An endowment trust is a financial vehicle set up to provide a source of income for a specific purpose, such as funding a university scholarship or supporting a charitable organization.

Who is required to file endowment trust?

Endowment trusts are typically required to be filed by organizations or individuals who have set up the trust and are responsible for overseeing its management and distribution of funds.

How to fill out endowment trust?

To fill out an endowment trust, you will need to provide detailed information about the trust's purpose, beneficiaries, assets, and distribution plans. It is recommended to seek the assistance of a legal or financial advisor to ensure all necessary information is accurately reported.

What is the purpose of endowment trust?

The purpose of an endowment trust is to provide a stable source of income for a specific cause or organization. The funds in the trust are typically invested to generate returns that can be used to support the intended purpose.

What information must be reported on endowment trust?

Information that must be reported on an endowment trust includes details about the trust's assets, income, expenses, beneficiaries, and distribution plans. Additionally, any changes to the trust's structure or management must also be reported.

Fill out your endowment trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Endowment Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.