Get the free Subordination of Mortgage - Madison Title

Show details

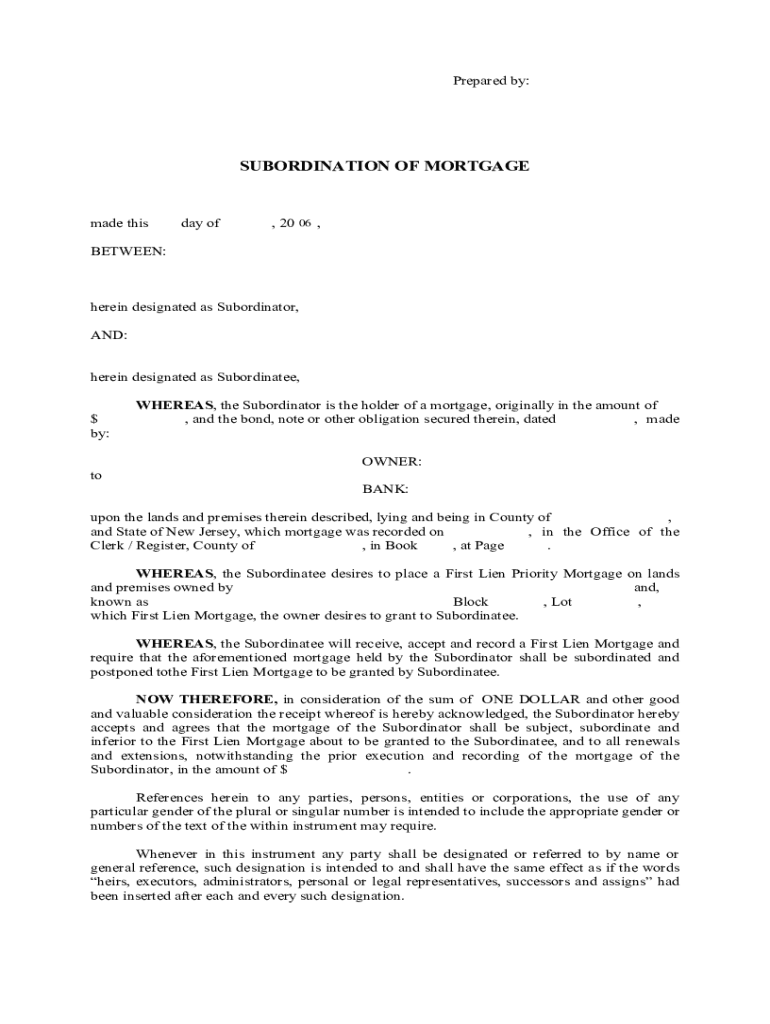

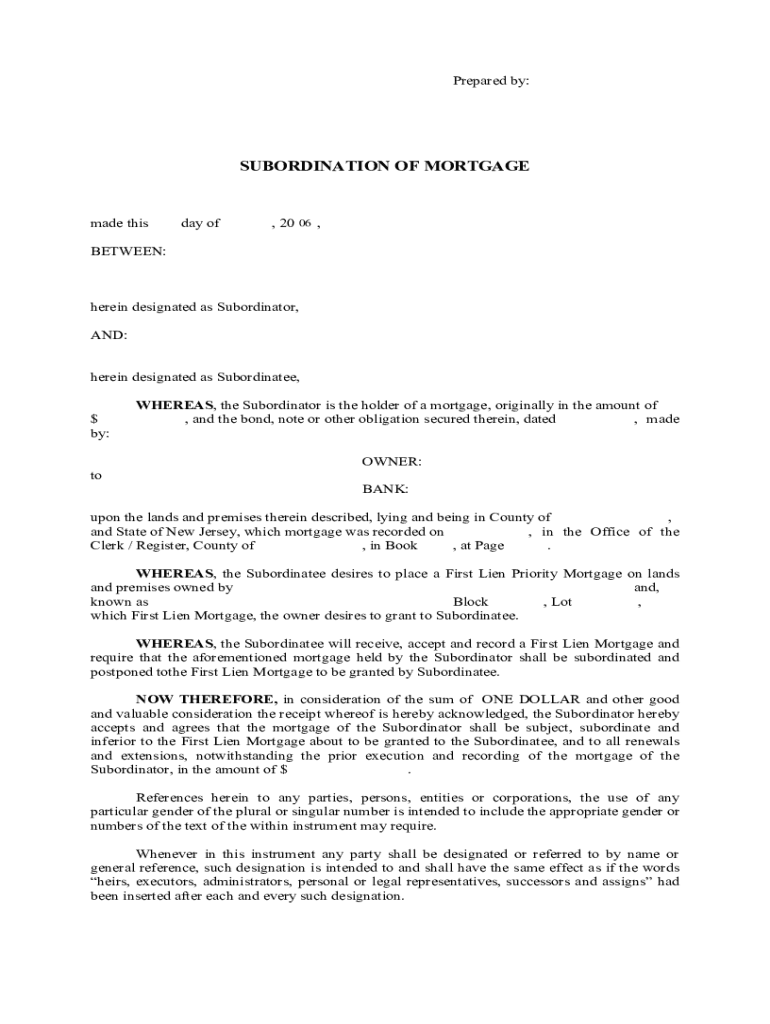

Prepared by:SUBORDINATION OF MORTGAGE made this day of, 20 06, BETWEEN:herein designated as Subordinator, AND: herein designated as Subordinate, $ by:WHEREAS, the Subordinator is the holder of a mortgage,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign subordination of mortgage

Edit your subordination of mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subordination of mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing subordination of mortgage online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit subordination of mortgage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out subordination of mortgage

How to fill out subordination of mortgage

01

To fill out a subordination of mortgage, follow these steps:

1. Start by gathering all the necessary documents, including the original mortgage agreement, the new mortgage agreement, and any other relevant paperwork.

02

Review the terms and conditions of both mortgages to ensure that they can be properly subordinated. Pay attention to any clauses or provisions that may prohibit or restrict subordination.

03

Prepare a subordination agreement that clearly states the intention to subordinate the original mortgage to the new mortgage. Include details such as the names of the parties involved, the loan amounts, and the conditions for subordination.

04

Consult with a real estate attorney or mortgage professional to ensure that the subordination agreement meets all legal requirements and is enforceable.

05

Sign the subordination agreement in the presence of a notary public or other authorized witness. Make copies of the signed agreement for all parties involved.

06

Submit the subordination agreement to the appropriate parties, including the lenders of both mortgages and any other relevant parties such as title companies or insurance providers.

07

Follow up with the lenders to ensure that the subordination is properly recorded and reflected in the public records.

08

Keep copies of all documents and correspondence related to the subordination of mortgage for future reference.

Who needs subordination of mortgage?

01

A subordination of mortgage is generally needed in the following situations:

02

- Homeowners who wish to refinance their existing mortgage but have a second mortgage or home equity loan that needs to be subordinated to the new first mortgage.

03

- Borrowers who want to use their property as collateral for a loan, but there is already an existing mortgage that needs to be subordinated to the new loan.

04

- Property owners who are seeking additional financing, such as a home equity line of credit, but need to have their existing mortgage subordinated to the new loan.

05

- Developers or builders who have obtained construction loans or financing for a real estate project, but need to subordinate these existing loans to new loans.

06

- Individuals or businesses involved in complex real estate transactions, such as leasehold financing or mezzanine financing, where subordination may be a requirement.

07

It is important to consult with a real estate attorney or mortgage professional to determine if a subordination of mortgage is necessary or beneficial in a specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send subordination of mortgage for eSignature?

Once you are ready to share your subordination of mortgage, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit subordination of mortgage on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit subordination of mortgage.

How do I fill out subordination of mortgage using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign subordination of mortgage and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is subordination of mortgage?

Subordination of mortgage is when a lender agrees to give up their priority position for repayment in exchange for another lender moving into first position.

Who is required to file subordination of mortgage?

Both lenders involved in the subordination agreement are required to file the subordination of mortgage.

How to fill out subordination of mortgage?

Subordination of mortgage can be filled out by including details of the existing mortgage, the new mortgage, and the agreement between the lenders to change the priority of repayment.

What is the purpose of subordination of mortgage?

The purpose of subordination of mortgage is to allow for a refinancing or second mortgage while maintaining the priority of repayment for the lenders involved.

What information must be reported on subordination of mortgage?

The subordination of mortgage should include details of the existing mortgage, the new mortgage, the agreement between the lenders, and any other relevant information.

Fill out your subordination of mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Subordination Of Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.