Get the free 1099R Forms - Fire & Police Pension Association (FPPA)

Show details

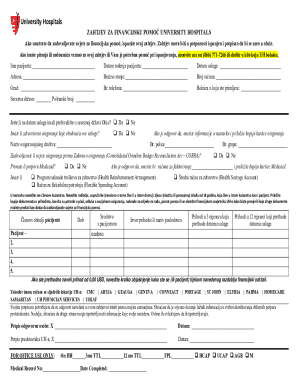

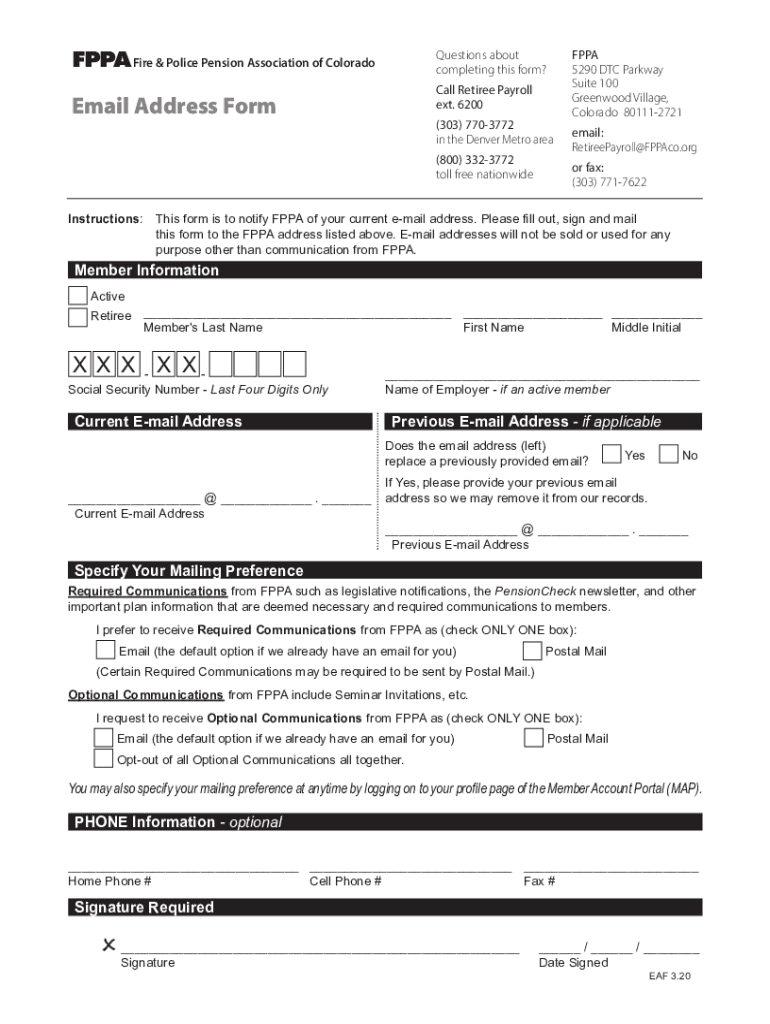

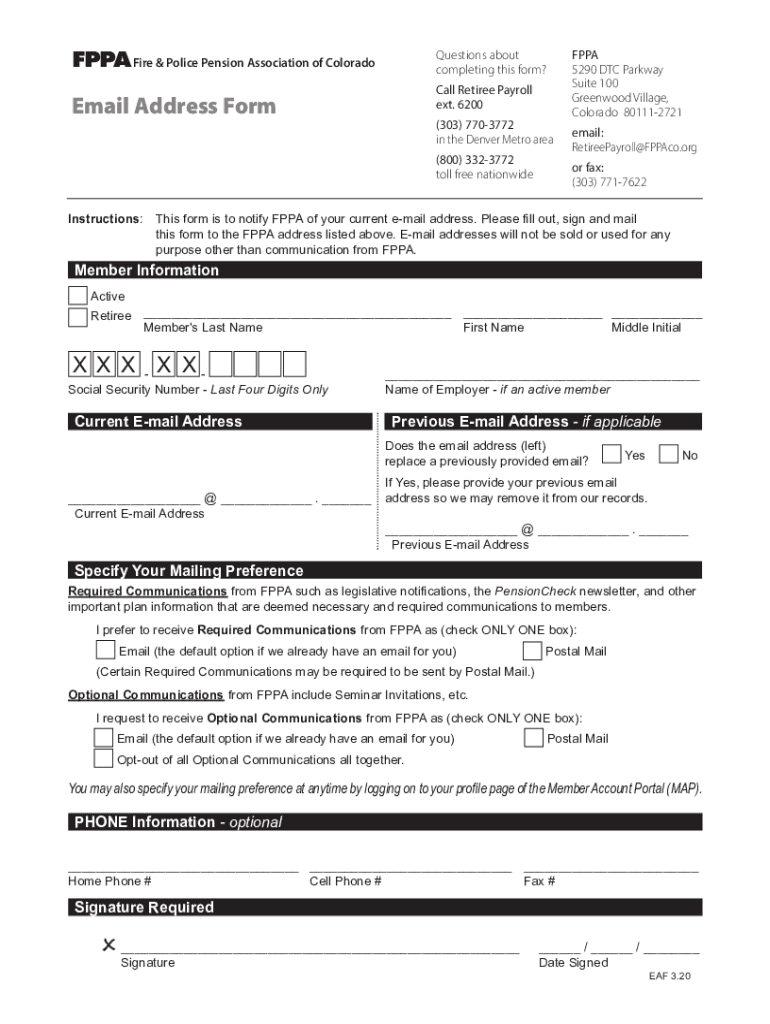

FPGA Fire & Police Pension Association of ColoradoQuestions about completing this form? Call Retiree Payroll ext. 6200Email Address Form(303) 7703772 in the Denver Metro area (800) 3323772 toll-free

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1099r forms - fire

Edit your 1099r forms - fire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1099r forms - fire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1099r forms - fire online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1099r forms - fire. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1099r forms - fire

How to fill out 1099r forms - fire

01

Step 1: Obtain the necessary forms. You can download Form 1099-R from the IRS website or request a copy by mail.

02

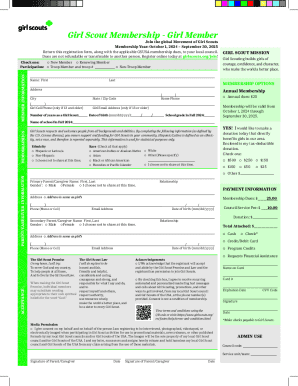

Step 2: Fill out the payer's information. Enter the name, address, and employer identification number (EIN) of the payer.

03

Step 3: Provide recipient information. Fill in the recipient's name, address, and taxpayer identification number (TIN).

04

Step 4: Enter distribution information. Specify the amount of the distribution and the applicable codes to indicate the type of payment.

05

Step 5: Report any federal income tax withheld. If any federal income tax was withheld from the distribution, include it in this section.

06

Step 6: Complete the state information. Fill in the state tax withheld, if applicable.

07

Step 7: Review and submit the form. Double-check all the information you entered and sign the form before submitting it.

Who needs 1099r forms - fire?

01

Anyone who made a distribution of $10 or more from a retirement account needs to file Form 1099-R.

02

Additionally, financial institutions, insurance companies, and government agencies who made distributions to recipients need to file this form.

03

The form is required to report distributions such as pensions, annuities, retirement plans, IRAs, or other similar accounts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 1099r forms - fire online?

With pdfFiller, you may easily complete and sign 1099r forms - fire online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in 1099r forms - fire without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 1099r forms - fire, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the 1099r forms - fire form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 1099r forms - fire and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is 1099r forms - fire?

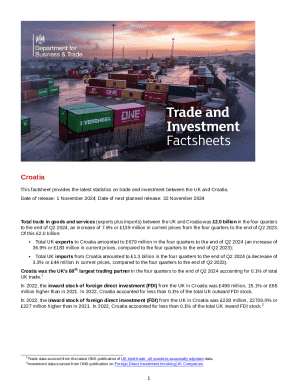

1099-R forms are tax forms used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc.

Who is required to file 1099r forms - fire?

Any person or business who makes reportable distributions of $10 or more is required to file 1099-R forms.

How to fill out 1099r forms - fire?

Fill out the form with the payer's information, recipient's information, distribution amounts, and any federal or state income tax withheld.

What is the purpose of 1099r forms - fire?

The purpose of 1099-R forms is to report distributions from retirement accounts or insurance contracts to the IRS and the recipients.

What information must be reported on 1099r forms - fire?

Information such as the payer's and recipient's names, addresses, identification numbers, distribution amounts, and any tax withheld.

Fill out your 1099r forms - fire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1099r Forms - Fire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.