Get the free How to Value Your Charitable Stock DonationsWhat is the tax deduction for donations ...

Show details

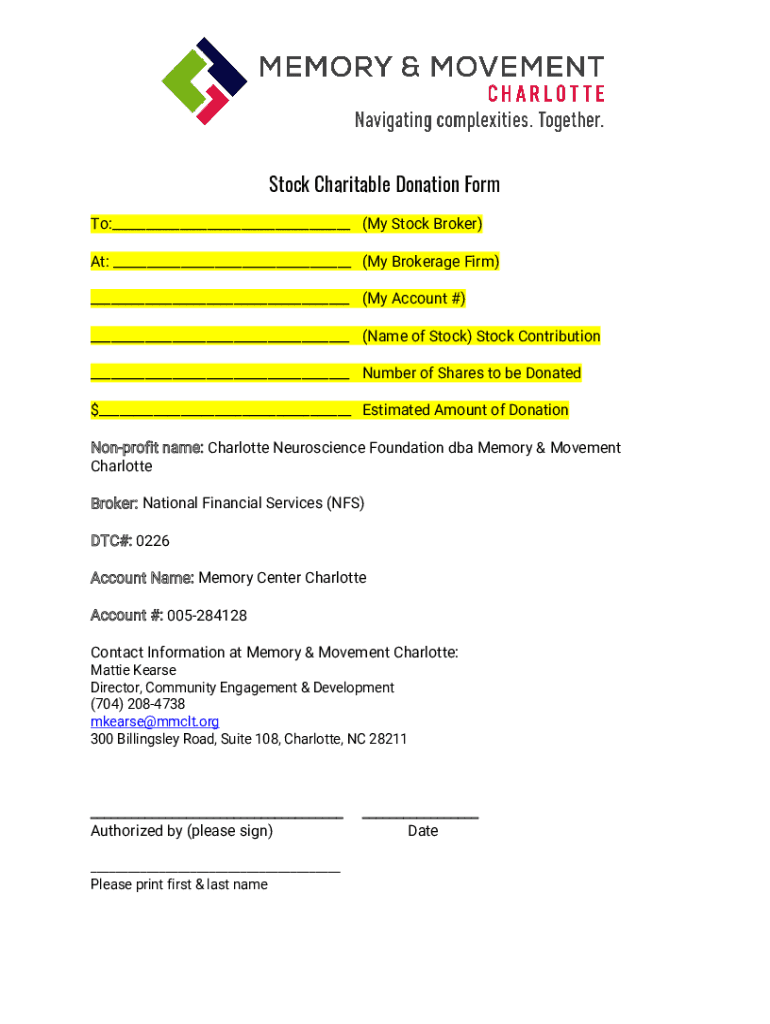

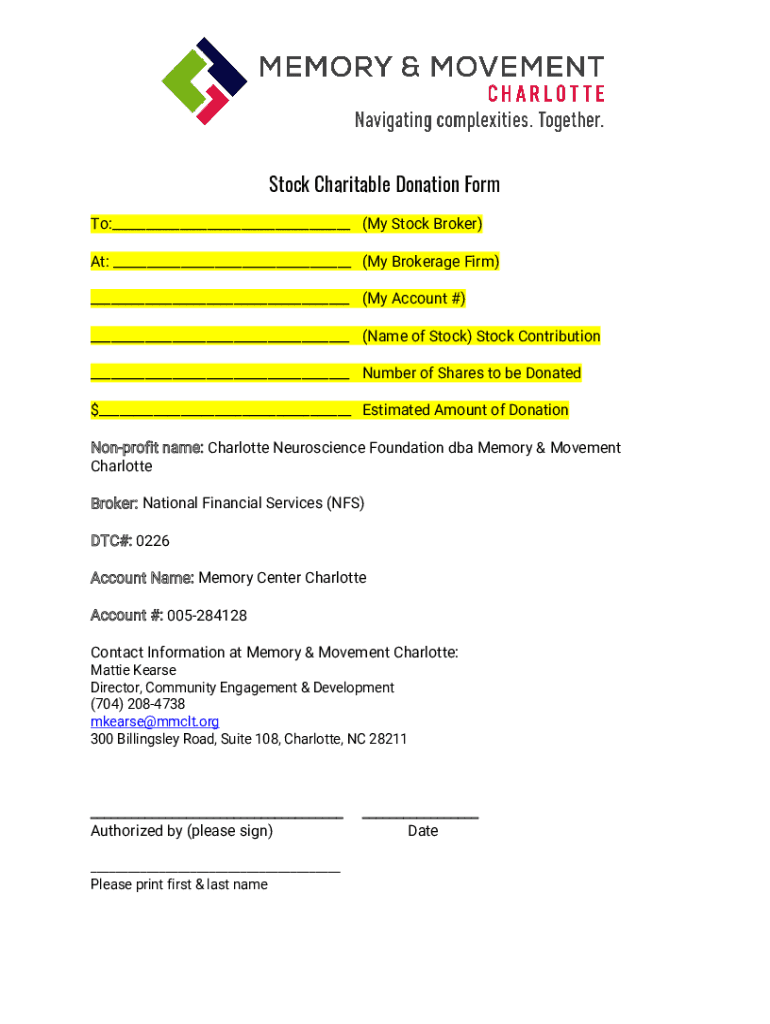

Stock Charitable Donation Form To: (My Stock Broker) At: (My Brokerage Firm) (My Account #) (Name of Stock) Stock Contribution Number of Shares to be Donated $ Estimated Amount of Donation Nonprofit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to value your

Edit your how to value your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to value your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to value your online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to value your. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to value your

How to fill out how to value your

01

To fill out how to value your, follow these steps:

02

Start by gathering all the necessary information and documents related to the item you want to value. This may include receipts, appraisals, certificates, and any other relevant proof of value.

03

Research the market value of similar items. Look for recent sales data, online listings, and expert opinions to get an idea of the current value range.

04

Consider the condition of your item. Factors like age, wear and tear, and any unique features can affect its value. Be honest and realistic about the condition to get an accurate appraisal.

05

Take professional help if needed. There are professional appraisers and valuation experts who can assess the value of your item more accurately. They may charge a fee for their services.

06

Document your findings and calculations. Keep a record of how you arrived at the estimated value, including any research sources, calculations, and assumptions made.

07

Review and update the valuation periodically. Values of certain items can change over time due to market trends, demand, and other factors. Reassess the value if necessary.

08

Use the valued information for insurance purposes, resale negotiations, estate planning, or any other relevant reasons.

09

Remember, valuing items accurately can be subjective and may require expertise. When in doubt, consult professionals to ensure an accurate assessment.

Who needs how to value your?

01

Anyone who wants to determine the value of a particular item may need to know how to value it.

02

Some common scenarios where individuals may need to value their items include:

03

- People who want to sell their belongings and want to set a fair price.

04

- Individuals seeking insurance coverage for valuable assets and require an estimated value for insurance purposes.

05

- Collectors who want to assess the worth of their collections.

06

- Estate planners who need to determine the value of assets for distribution or tax purposes.

07

- Individuals involved in divorce or legal proceedings where the value of assets plays a crucial role.

08

- People interested in donating items and needing to determine their value for tax deductions.

09

In summary, anyone who wants to establish the worth of an item for personal, financial, legal, or other reasons can benefit from knowing how to value it.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find how to value your?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the how to value your in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the how to value your electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete how to value your on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your how to value your. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is how to value your?

How to value your refers to the process of determining the worth or value of something, usually for financial or tax purposes.

Who is required to file how to value your?

Individuals or entities who own assets that need to be valued for tax purposes are required to file how to value your.

How to fill out how to value your?

You can fill out how to value your by providing detailed information about the assets being valued, such as their description, valuation method used, and supporting documentation.

What is the purpose of how to value your?

The purpose of how to value your is to accurately determine the value of assets for tax assessment or reporting purposes.

What information must be reported on how to value your?

Information such as asset description, valuation method, valuation date, and supporting documentation must be reported on how to value your.

Fill out your how to value your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Value Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.