Get the free COVID-19 Mortgage Forbearance: What To Know Before You ...

Show details

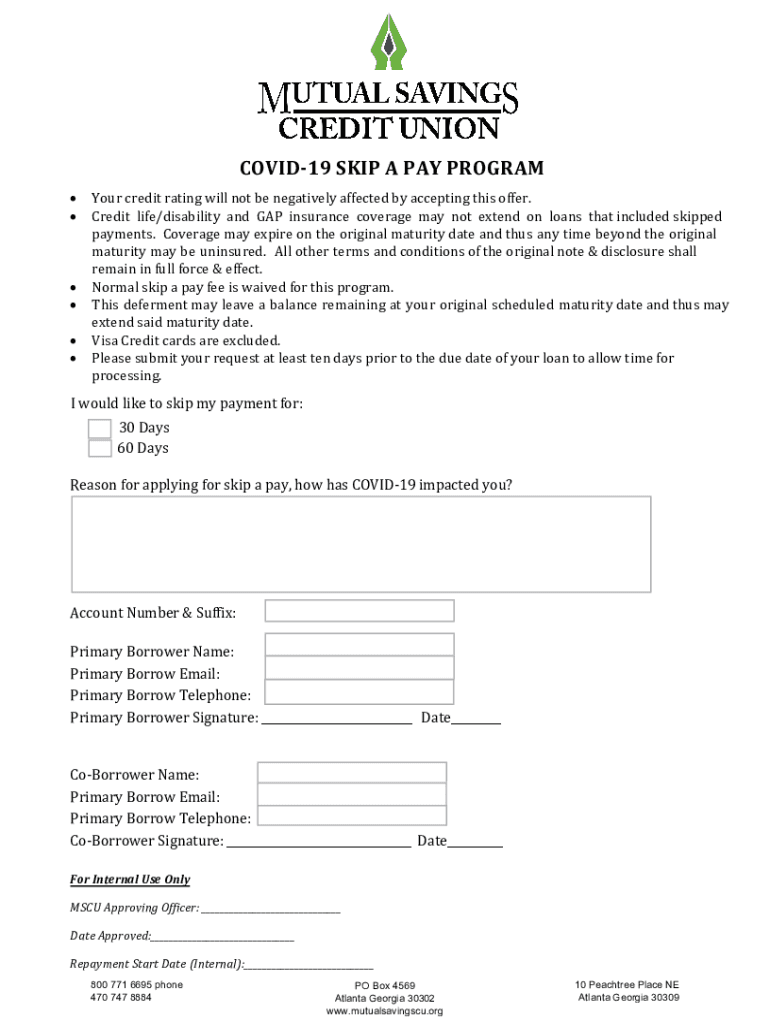

COVID-19 SKIP A PAY PROGRAM Your credit rating will not be negatively affected by accepting this offer. Credit life/disability and GAP insurance coverage may not extend on loans that included skipped

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign covid-19 mortgage forbearance what

Edit your covid-19 mortgage forbearance what form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your covid-19 mortgage forbearance what form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing covid-19 mortgage forbearance what online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit covid-19 mortgage forbearance what. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out covid-19 mortgage forbearance what

How to fill out covid-19 mortgage forbearance what

01

To fill out covid-19 mortgage forbearance, follow these steps:

02

Contact your mortgage servicer:

03

- Find the contact information for your mortgage servicer. You can typically find this on your monthly mortgage statement or on their website.

04

- Call or email your mortgage servicer to inform them that you are experiencing financial hardship due to the COVID-19 pandemic and would like to request mortgage forbearance.

05

Provide necessary information:

06

- Be prepared to provide your loan number and personal information, such as your name, address, and contact details.

07

- Explain your specific financial situation and the impact COVID-19 has had on your ability to make mortgage payments.

08

Discuss forbearance options:

09

- Your mortgage servicer will explain the available forbearance options and their terms.

10

- Ask any questions you have and clarify the duration of the forbearance period, the terms for repayment, and any other important details.

11

Submit the request:

12

- If you agree to the terms, follow the instructions provided by your mortgage servicer to officially request mortgage forbearance.

13

- Some servicers may require you to submit a written request, while others may have an online application or a specific phone line to request forbearance.

14

- Make sure to keep a copy of your request for your records.

15

Follow up and maintain communication:

16

- Stay in touch with your mortgage servicer to ensure your forbearance request is being processed.

17

- Keep records of all communications, as well as the agreed-upon terms.

18

- Continue to monitor your mortgage statements and stay informed about any updates or changes to your mortgage forbearance agreement.

19

- When the forbearance period ends, work with your mortgage servicer to develop a plan for repayment based on your situation and financial ability.

Who needs covid-19 mortgage forbearance what?

01

Covid-19 mortgage forbearance is designed for those who are facing financial hardships due to the COVID-19 pandemic and are unable to make their mortgage payments.

02

Specific groups of individuals who may benefit from mortgage forbearance include:

03

- Homeowners who have lost their jobs or experienced reduced income due to business closures or layoffs caused by the pandemic.

04

- Individuals who have become ill with COVID-19 and are unable to work or generate income during their recovery.

05

- Self-employed individuals or small business owners who have experienced a decline in business revenue due to the economic impact of the pandemic.

06

- Individuals who have experienced a significant increase in expenses related to COVID-19, such as medical bills or caregiving costs.

07

- Homeowners who are currently unable to sell their homes or refinance their mortgages due to market conditions and need temporary relief from mortgage payments.

08

It is important to note that eligibility criteria and specific requirements may vary depending on the mortgage servicer and the terms of the forbearance program. It is recommended to contact your mortgage servicer for detailed information and to discuss your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the covid-19 mortgage forbearance what electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your covid-19 mortgage forbearance what.

Can I create an eSignature for the covid-19 mortgage forbearance what in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your covid-19 mortgage forbearance what and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out covid-19 mortgage forbearance what using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign covid-19 mortgage forbearance what and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is covid-19 mortgage forbearance what?

Covid-19 mortgage forbearance is a temporary pause or reduction in mortgage payments offered to borrowers who are facing financial hardship due to the pandemic.

Who is required to file covid-19 mortgage forbearance what?

Borrowers who are experiencing financial difficulties due to the impact of Covid-19 are eligible to apply for mortgage forbearance.

How to fill out covid-19 mortgage forbearance what?

To apply for Covid-19 mortgage forbearance, borrowers need to contact their loan servicer and request a forbearance agreement. They may need to provide proof of hardship and financial information.

What is the purpose of covid-19 mortgage forbearance what?

The purpose of Covid-19 mortgage forbearance is to provide relief to borrowers who are struggling to make their mortgage payments due to the financial impact of the pandemic.

What information must be reported on covid-19 mortgage forbearance what?

Borrowers may need to provide information such as their financial situation, the reason for the request, and any documentation to support their hardship.

Fill out your covid-19 mortgage forbearance what online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Covid-19 Mortgage Forbearance What is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.