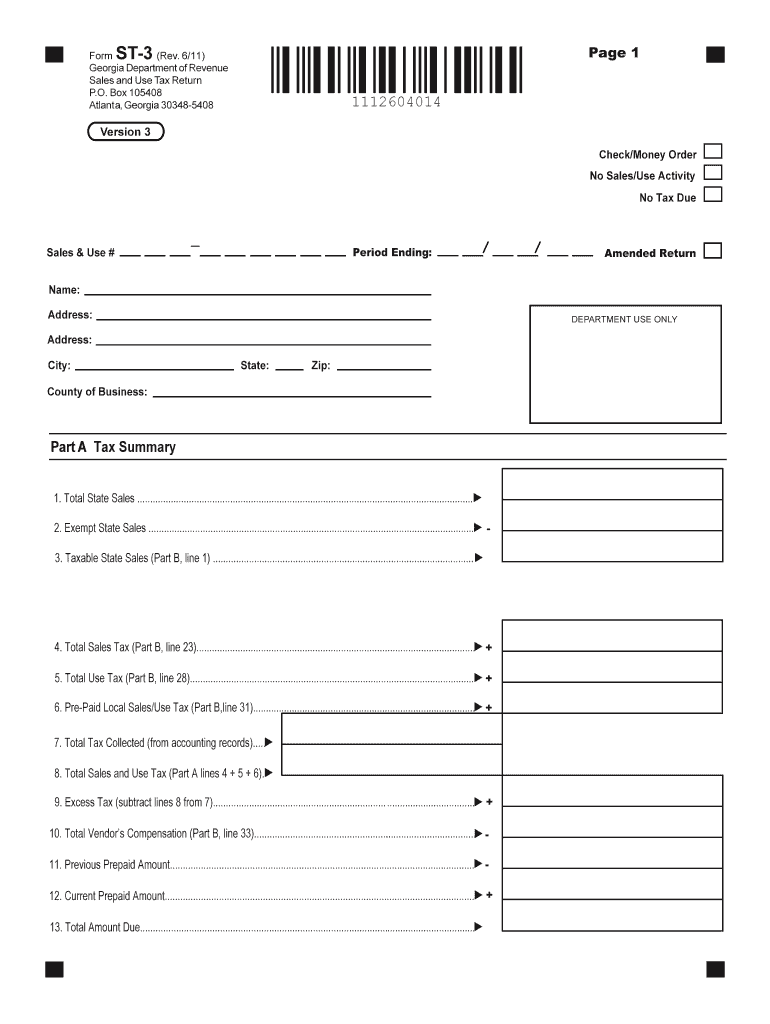

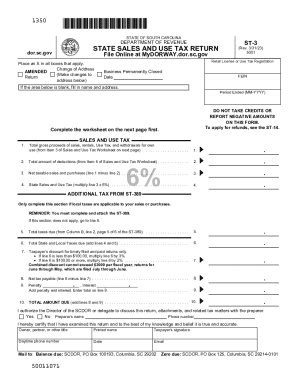

Who needs a form ST-3?

Form GA ST-3 or the Sales and Use Tax Return is to be filed by all the entrepreneurs registered for sales and use tax purposes in the State of Georgia.

What is tax form ST-3 for?

This tax return is requested by the Department of Revenue. All taxpayers have to report their taxable sales, and they can calculate penalty and interest monthly, quarterly and annually based on this form. If is no sales were made, the taxpayer still has to complete and send the payment voucher included in the form and check the appropriate box on it (page five of the form).

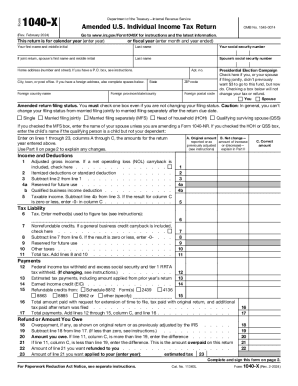

It can also be used as an amended return.

Is it accompanied by other forms?

You don’t need to file any other documents to accompany this form.

When is form ST-3 due?

The State of Georgia requires residents to complete and file sales and use tax returns as well as make all payments every month. It is due on, or before, the last day of month following the end of the filing period.

How do I fill out form ST-3?

Make sure you put the correct Georgia Sales and Use tax number and name and full address of the entrepreneur in the top table of the first sheet. If this is an amended return, check the box on the right of the table. In Part A, enter the total exempt and taxable state sales and details of all due taxes. Part B is the Sales Tax Distribution Table that is to explain the taxable sales and amount of taxes due. Part C is the TOPMOST Sales and Use Tax explanation. And Part D is to calculate the Vendor’s Compensation. Part E is the indication of bad debt reporting and Part F is for certification and signature. The next part of the form is the Payment Voucher.

Where do I submit Sales and Use Tax Return?

Send the form by mail to the Department of Revenue in the State of Georgia at the address: PO BOX 105408, Atlanta, GA 30348-54.