Get the free Tax levy on ballot seeks to boost ADAMH funding, help ...

Show details

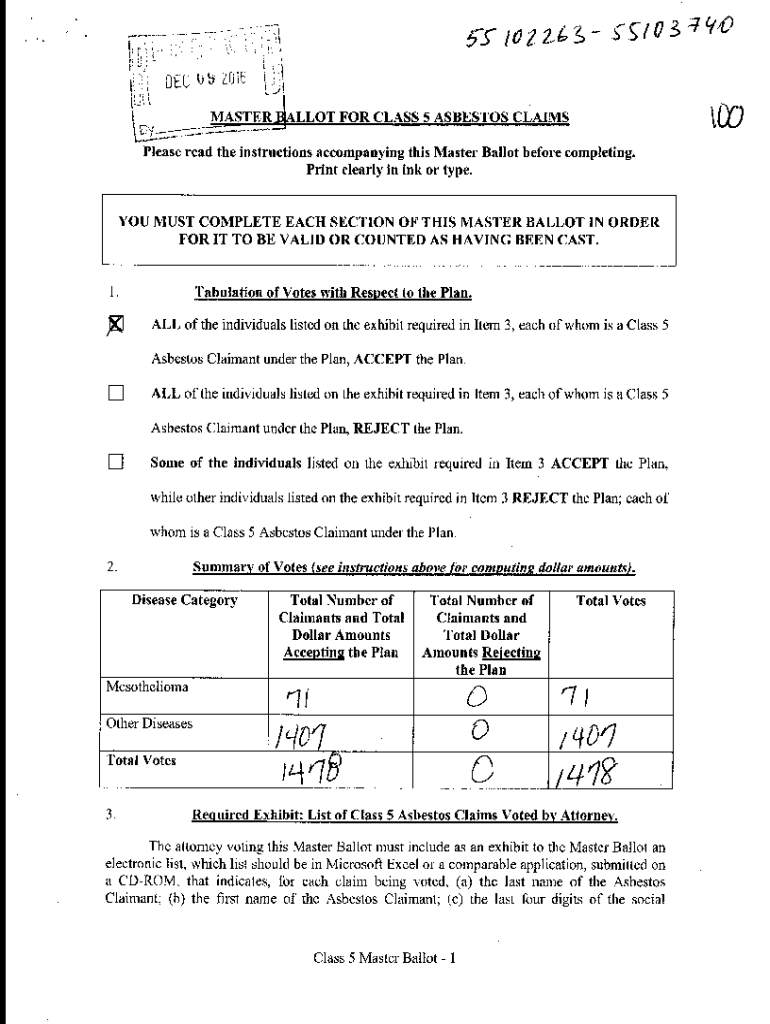

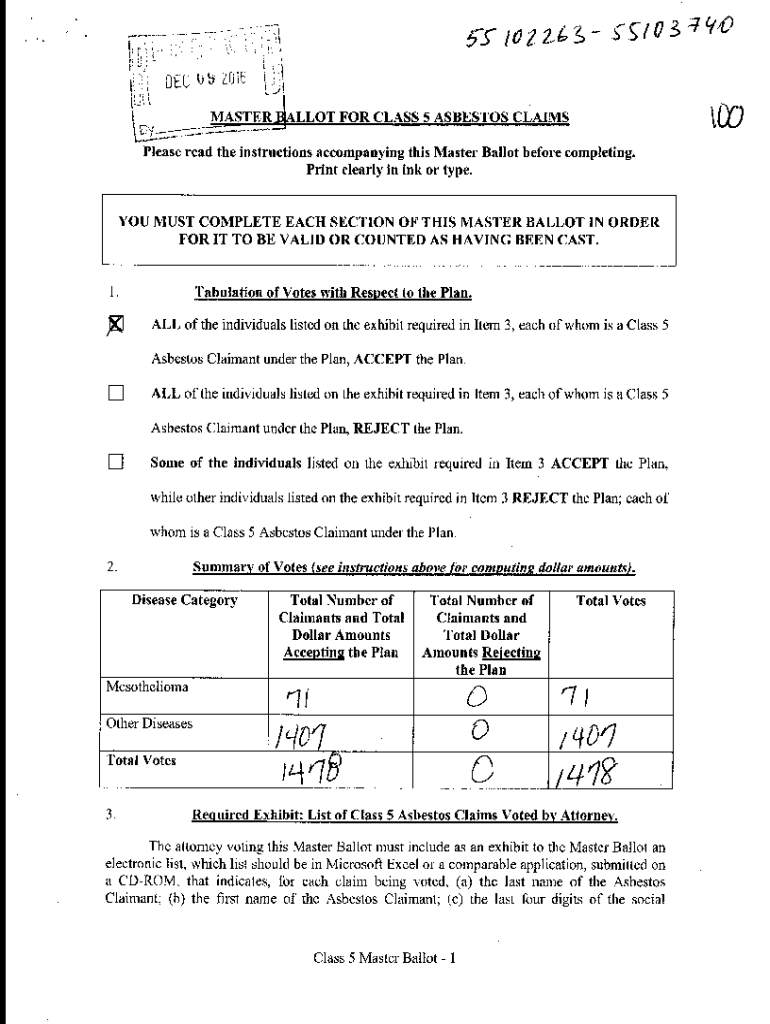

Harris Schwartz, L.C. Vote Listless Name Injured Party Adams Adams Adams, Estate Adams, Estate Adkins Makers Aldridge Alive, Jr. Allen, Estate Allen, Jr., Estate Allan, Estate Alton Alvaro, Estate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax levy on ballot

Edit your tax levy on ballot form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax levy on ballot form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax levy on ballot online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax levy on ballot. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax levy on ballot

How to fill out tax levy on ballot

01

To fill out a tax levy on the ballot, follow these steps:

02

Read the instructions on the ballot carefully to understand the requirements.

03

Find the section for the tax levy and read the details about the proposal.

04

Mark your choice by selecting the appropriate box or filling in the circle next to your preferred option.

05

If there is a write-in option, write the name or details as instructed.

06

Double-check your choices and make sure you haven't made any unintentional errors.

07

Place the completed ballot in the provided envelope and seal it.

08

Follow any additional instructions such as signing the envelope or including additional documents.

09

Submit your filled-out tax levy ballot as per the given guidelines.

Who needs tax levy on ballot?

01

Tax levies on the ballot are needed by local governments to propose and secure additional funding for various purposes.

02

Those who need tax levy on the ballot include:

03

- School districts seeking to fund educational programs or facility improvements

04

- Municipalities aiming to finance public infrastructure projects like road repairs or park renovations

05

- Public service agencies requiring funds for emergency services, healthcare, or social welfare programs

06

- Special districts such as water, fire, or library districts seeking additional resources for operations and maintenance

07

- Any governmental entity that requires voter approval for raising taxes or implementing new revenue streams

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax levy on ballot in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax levy on ballot and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit tax levy on ballot online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your tax levy on ballot and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit tax levy on ballot straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tax levy on ballot, you need to install and log in to the app.

What is tax levy on ballot?

Tax levy on ballot is a measure that allows voters to decide on whether to increase or maintain a specific tax rate for a designated purpose, such as funding public services or infrastructure projects.

Who is required to file tax levy on ballot?

Typically, government authorities or agencies, such as school districts or municipal governments, are required to file tax levy measures on the ballot.

How to fill out tax levy on ballot?

Tax levy measures are typically proposed by the governing body of the jurisdiction, then reviewed and approved by legal counsel before being placed on the ballot for voter consideration.

What is the purpose of tax levy on ballot?

The purpose of tax levy on ballot is to give voters a direct say in whether or not to increase or maintain a tax rate to fund specific projects or services.

What information must be reported on tax levy on ballot?

Tax levy measures on the ballot typically include the proposed tax rate increase, the specific purpose for which the funds will be used, and any potential impact on taxpayers.

Fill out your tax levy on ballot online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Levy On Ballot is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.