Get the free CASH & NON-CASH DONATIONS

Show details

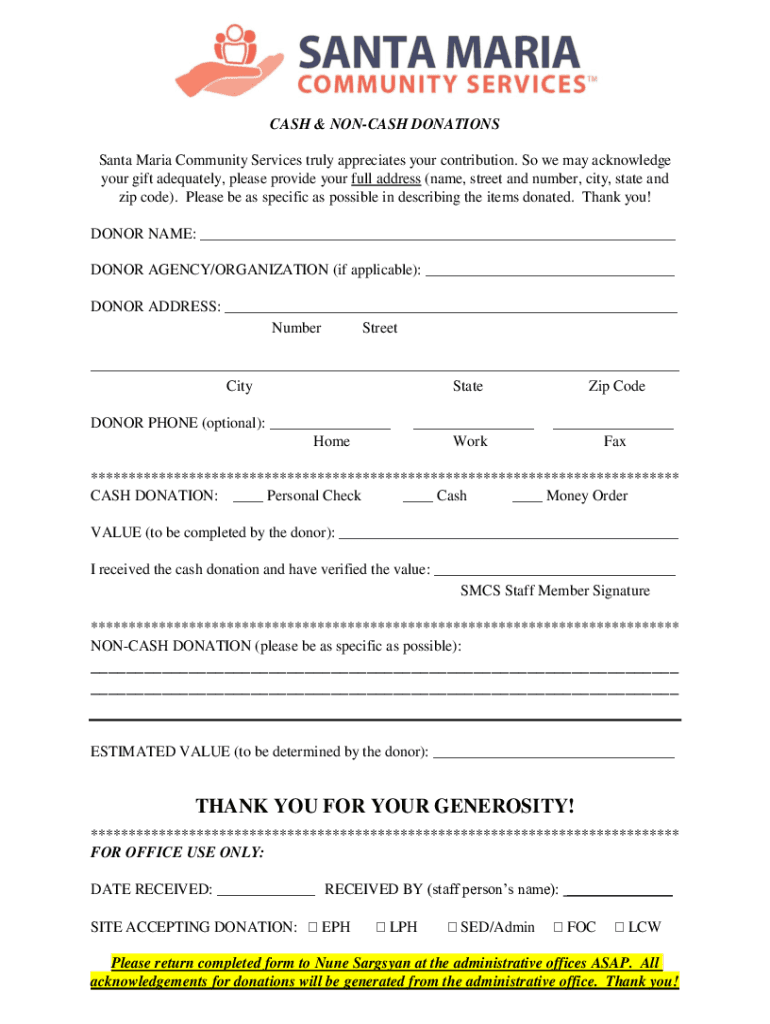

CASH & MONASH DONATIONS Santa Maria Community Services truly appreciates your contribution. So we may acknowledge your gift adequately, please provide your full address (name, street and number, city,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash amp non-cash donations

Edit your cash amp non-cash donations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash amp non-cash donations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash amp non-cash donations online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cash amp non-cash donations. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash amp non-cash donations

How to fill out cash amp non-cash donations

01

Start by identifying the organization or recipient you want to donate to.

02

Determine whether you want to make a cash donation or a non-cash donation. Cash donation involves giving money directly, while non-cash donation can include items like clothes, food, or toys.

03

If making a cash donation, decide on the amount you want to donate. Consider your budget and the needs of the recipient.

04

Contact the organization or recipient to inquire about their donation process and any specific requirements they may have.

05

Follow the instructions provided by the organization or recipient to fill out the necessary donation forms. These forms may include personal information, donation amount, and purpose of the donation.

06

If making a non-cash donation, gather the items you wish to donate. Ensure they are in good condition and meet any specific criteria mentioned by the recipient.

07

Contact the organization or recipient to arrange the drop-off or pick-up of the donated items. Some organizations may have designated drop-off locations, while others may offer home pick-up services.

08

Fill out any necessary documentation provided by the organization or recipient regarding the non-cash donation. This may include descriptions of the donated items, their value, and any tax-related information.

09

Make the donation by providing the cash or handing over the non-cash items as agreed upon. Obtain any receipts or acknowledgment letters for tax purposes, if applicable.

10

Follow up with the organization or recipient to ensure the donation was received and to express any additional concerns or questions.

Who needs cash amp non-cash donations?

01

Various individuals, communities, and organizations may require cash and non-cash donations. Some examples include:

02

- Non-profit organizations working towards a specific cause or providing support to marginalized groups.

03

- Disaster relief organizations helping those affected by natural disasters or emergencies.

04

- Homeless shelters or organizations assisting individuals experiencing homelessness.

05

- Orphanages and foster care programs supporting children in need.

06

- Food banks and soup kitchens providing meals to individuals and families facing food insecurity.

07

- Educational institutions or scholarship programs supporting students who lack financial resources.

08

- Medical charities or clinics offering healthcare services to underserved communities.

09

Overall, anyone in need who can benefit from financial or material assistance may require cash and non-cash donations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cash amp non-cash donations in Chrome?

Install the pdfFiller Google Chrome Extension to edit cash amp non-cash donations and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my cash amp non-cash donations in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your cash amp non-cash donations and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the cash amp non-cash donations form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign cash amp non-cash donations and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is cash & non-cash donations?

Cash donations are monetary contributions made by individuals or organizations, while non-cash donations are gifts of property or other assets.

Who is required to file cash & non-cash donations?

Individuals or organizations who receive cash or non-cash donations are required to file them with the appropriate tax authorities.

How to fill out cash & non-cash donations?

Cash donations can be reported using bank statements or receipts, while non-cash donations may require appraisals or documentation of fair market value.

What is the purpose of cash & non-cash donations?

The purpose of cash and non-cash donations is to support charitable causes, organizations, or individuals in need.

What information must be reported on cash & non-cash donations?

Information such as the donor's name, amount or value of the donation, date of donation, and the recipient organization must be reported on cash and non-cash donations.

Fill out your cash amp non-cash donations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Amp Non-Cash Donations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.