Get the free Electric Car Tax Credits, Incentives & Rebates by StateEnel X

Show details

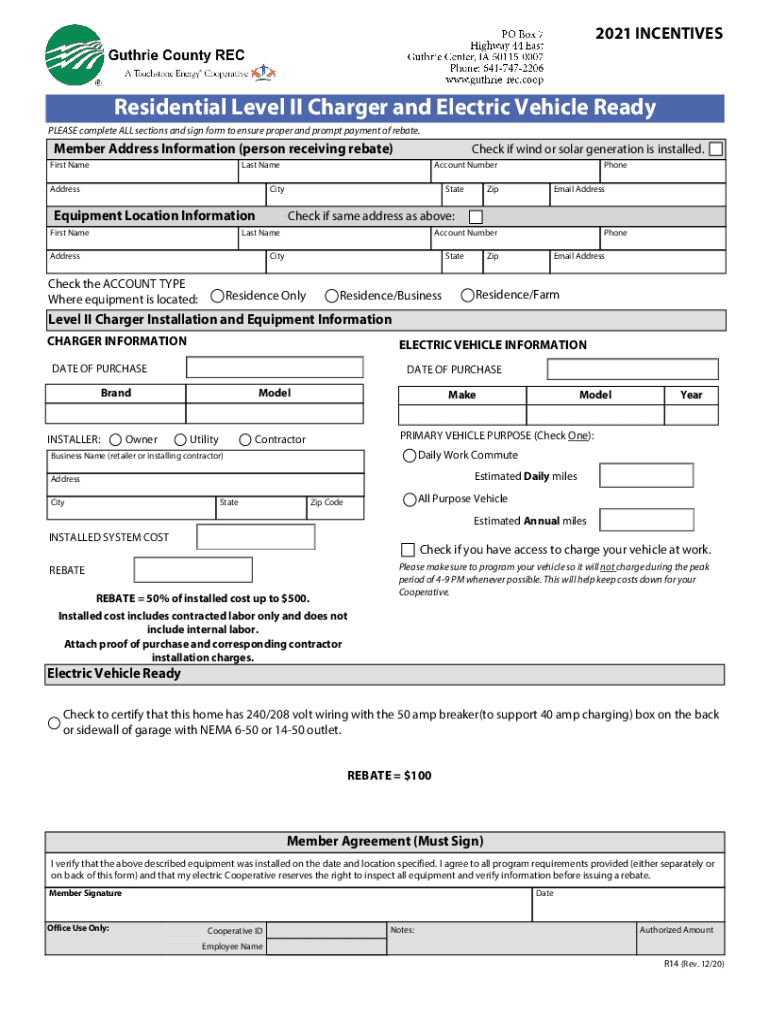

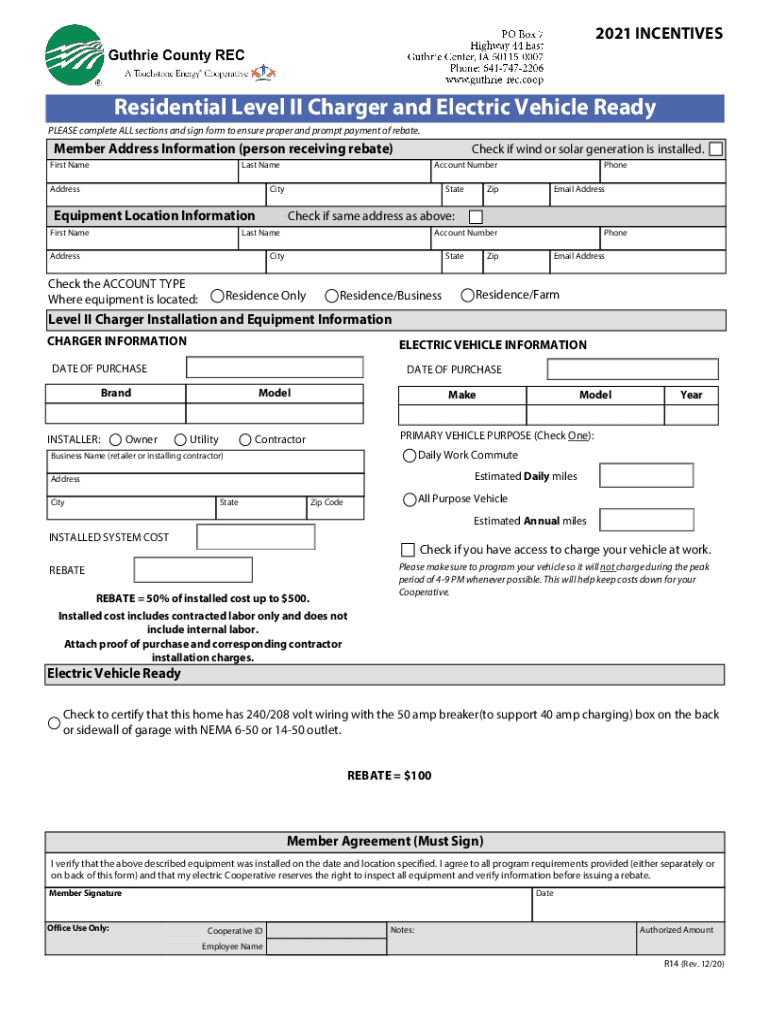

2021 INCENTIVESResidential Level II Charger and Electric Vehicle Ready

PLEASE complete ALL sections and sign form to ensure proper and prompt payment of rebate. Member Address Information (person

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign electric car tax credits

Edit your electric car tax credits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electric car tax credits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing electric car tax credits online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit electric car tax credits. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out electric car tax credits

How to fill out electric car tax credits

01

Step 1: Gather all relevant information and documents such as purchase agreement, vehicle specifications, and tax forms.

02

Step 2: Review the eligibility requirements for electric car tax credits to ensure that you qualify. These requirements may vary depending on your country or state.

03

Step 3: Fill out the tax forms accurately and completely. Provide all necessary information, including the details of the electric car purchase and any additional documentation that may be required.

04

Step 4: Double-check your filled-out forms to avoid any mistakes or errors. Ensure that information is legible and that you have signed and dated the forms where necessary.

05

Step 5: Submit the filled-out forms along with any supporting documents to the appropriate tax authority or department. Follow the specified submission process, whether it's online or through mail.

06

Step 6: Keep copies of all submitted documents and forms for your records. It's important to have proof of submission in case of any future inquiries or audits.

07

Step 7: Monitor the progress of your tax credit application. Check for updates or correspondence from the tax authority and respond promptly if they require any additional information or clarification.

08

Step 8: Once approved, you may receive the electric car tax credit in the form of a refund or a reduction in your tax liability. Follow any instructions provided to claim the credit.

09

Step 9: Ensure that you comply with any reporting obligations related to the electric car tax credit. This may include reporting the credit amount on your tax return or providing updates on any changes to your electric car ownership status.

10

Step 10: Consider consulting with a tax professional or advisor for guidance throughout the process, especially if you have complex tax situations or uncertainties.

Who needs electric car tax credits?

01

Individuals who have purchased or plan to purchase an electric car may need electric car tax credits.

02

Businesses or organizations that use electric cars for their operations or fleet may also benefit from such tax credits.

03

Government entities or agencies promoting electric vehicle adoption may offer tax credits to incentivize individuals and businesses to switch to electric cars.

04

The eligibility criteria and specific requirements for electric car tax credits may vary by jurisdiction, so it's important to check with the relevant tax authority or consult a tax professional for accurate information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send electric car tax credits to be eSigned by others?

When you're ready to share your electric car tax credits, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get electric car tax credits?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the electric car tax credits in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in electric car tax credits?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your electric car tax credits to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is electric car tax credits?

Electric car tax credits are incentives provided by the government to encourage the purchase of electric vehicles. These credits can help reduce the cost of buying and owning an electric car.

Who is required to file electric car tax credits?

Individuals who have purchased or leased an electric vehicle may be eligible to file for electric car tax credits. It is important to check with the tax authorities for specific eligibility criteria.

How to fill out electric car tax credits?

To fill out electric car tax credits, individuals need to gather information about their electric vehicle purchase or lease, including the vehicle's make, model, and purchase price. This information is then reported on the appropriate tax form.

What is the purpose of electric car tax credits?

The purpose of electric car tax credits is to incentivize the adoption of environmentally friendly electric vehicles. These credits help promote the use of cleaner transportation options and reduce reliance on fossil fuels.

What information must be reported on electric car tax credits?

Information such as the make and model of the electric vehicle, the purchase price, and any additional documentation requested by tax authorities must be reported on electric car tax credits.

Fill out your electric car tax credits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electric Car Tax Credits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.