Get the free Insurance Reserve

Show details

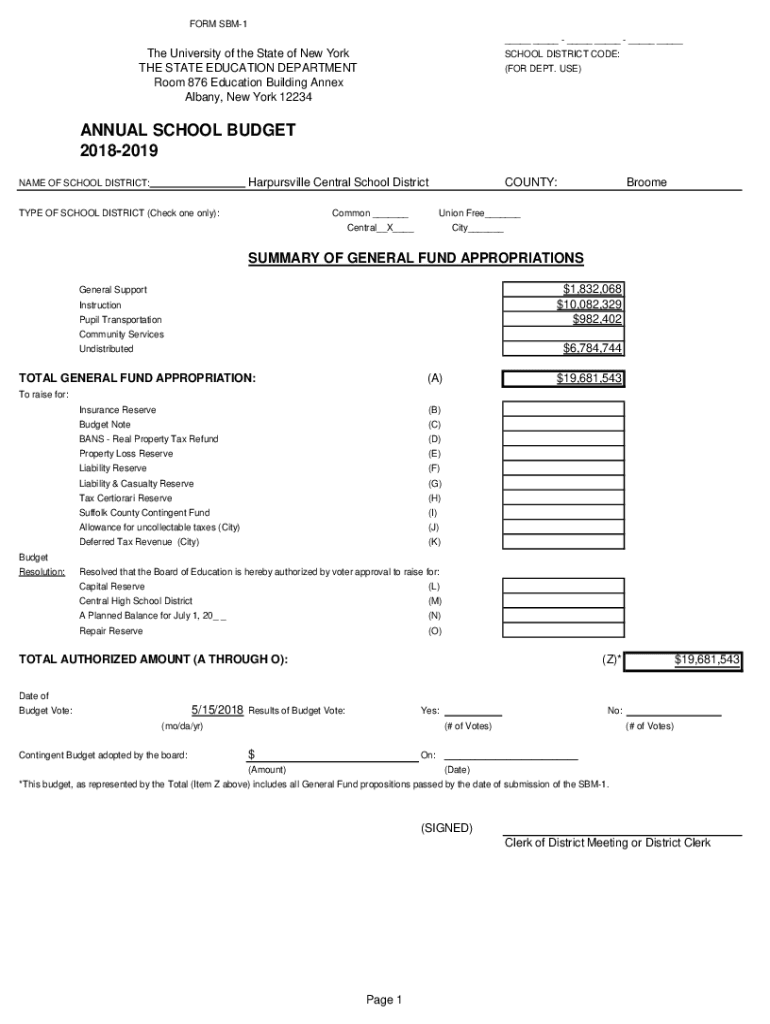

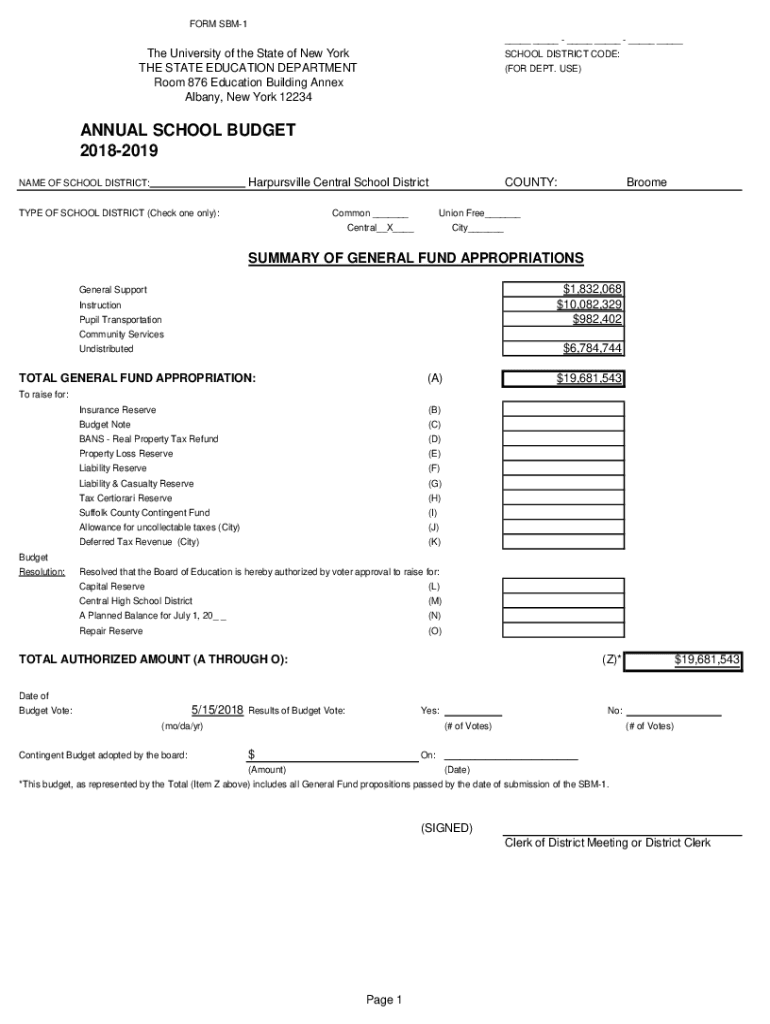

FORM SBM1 The University of the State of New York THE STATE EDUCATION DEPARTMENT Room 876 Education Building Annex Albany, New York 12234SCHOOL DISTRICT CODE: (FOR DEPT. USE)ANNUAL SCHOOL BUDGET 20182019

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance reserve

Edit your insurance reserve form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance reserve form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance reserve online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance reserve. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance reserve

How to fill out insurance reserve

01

Determine the purpose of the insurance reserve and the specific expenses it will cover.

02

Calculate the ideal amount of the reserve based on factors such as your financial obligations, risk factors, and budget.

03

Research different insurance providers and policies to find the best options for your needs.

04

Fill out the necessary paperwork provided by the insurance company, providing accurate and detailed information about yourself and your assets.

05

Pay the required premiums and ensure that the payments are made on time to maintain the coverage.

06

Regularly review and update your insurance reserve to ensure it aligns with any changes in your financial situation or coverage needs.

07

Seek professional advice from insurance agents or financial advisors if you have any doubts or concerns.

08

Keep all insurance reserve documents in a safe place and inform your trusted family members or beneficiaries about its existence.

Who needs insurance reserve?

01

Anyone who wants to protect themselves or their assets from unforeseen circumstances, such as accidents, illnesses, natural disasters, or financial setbacks, can benefit from having an insurance reserve.

02

Insurance reserves are particularly important for individuals who have dependents or financial obligations that would be difficult to meet without a safety net.

03

Businesses and organizations also need insurance reserves to mitigate risks and ensure continuity in case of unexpected events.

04

Ultimately, insurance reserves are designed to provide peace of mind and financial security, making them relevant for a wide range of individuals and entities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send insurance reserve to be eSigned by others?

When you're ready to share your insurance reserve, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I edit insurance reserve on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing insurance reserve.

How do I fill out insurance reserve using my mobile device?

Use the pdfFiller mobile app to fill out and sign insurance reserve on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is insurance reserve?

Insurance reserve is a fund set aside by an insurance company to cover potential future claims or losses.

Who is required to file insurance reserve?

Insurance companies are required to file insurance reserve in order to comply with regulations and ensure financial stability.

How to fill out insurance reserve?

Insurance reserve is typically filled out by insurance companies using specific guidelines provided by regulatory authorities.

What is the purpose of insurance reserve?

The purpose of insurance reserve is to ensure that insurance companies have enough funds to cover future claims and liabilities.

What information must be reported on insurance reserve?

Information such as the amount of funds set aside, the types of claims covered, and the calculation methods used must be reported on insurance reserve.

Fill out your insurance reserve online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Reserve is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.