Get the free Non profit organizations in Yuma County key elements of ...

Show details

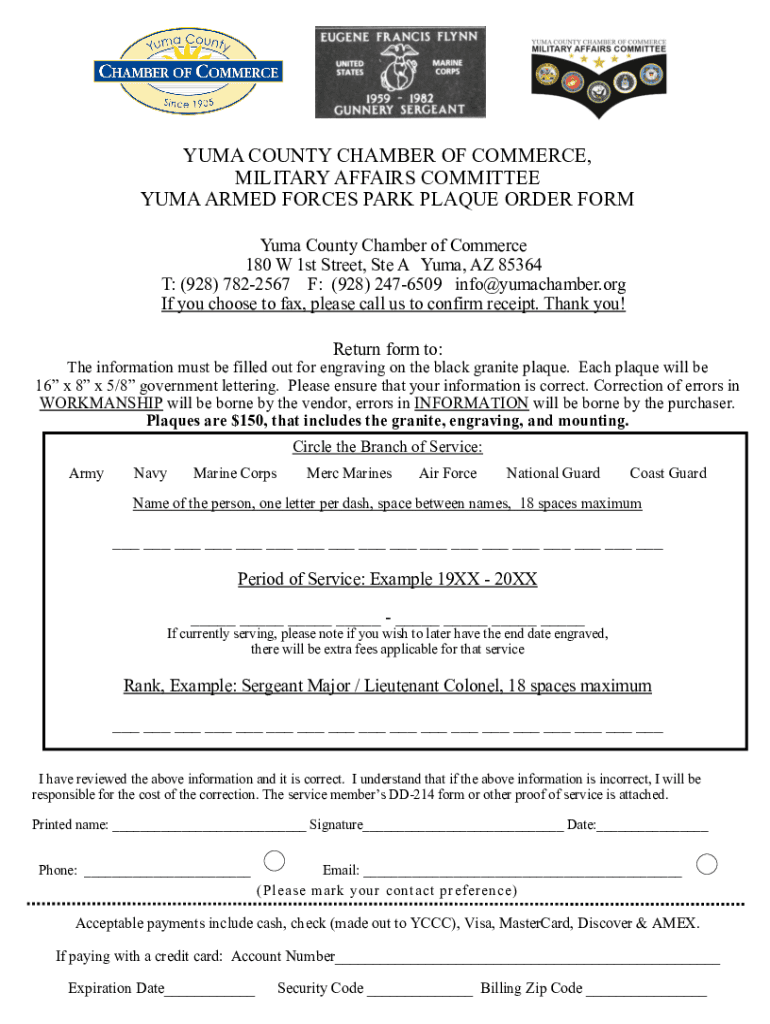

YUMA COUNTY CHAMBER OF COMMERCE,

MILITARY AFFAIRS COMMITTEE

YUMA ARMED FORCES PARK PLAQUE ORDER FORM

Yuma County Chamber of Commerce

180 W 1st Street, Ste A Yuma, AZ 85364

T: (928) 7822567 F: (928)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non profit organizations in

Edit your non profit organizations in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non profit organizations in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non profit organizations in online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non profit organizations in. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non profit organizations in

How to fill out non profit organizations in

01

Start by gathering all the necessary information about your non-profit organization, such as its name, mission, and goals.

02

Create a legal structure for your organization, such as a non-profit corporation or a trust.

03

Register your organization with the appropriate government agencies or authorities.

04

Develop a comprehensive business plan outlining how your organization will operate, fundraise, and achieve its goals.

05

Establish a board of directors or trustees who will oversee the organization's activities.

06

Apply for tax-exempt status with the IRS to benefit from tax advantages and attract potential donors.

07

Create a financial management system for tracking income, expenses, and donations.

08

Develop a marketing and communication strategy to raise awareness about your organization and attract supporters.

09

Start fundraising efforts through events, grants, donations, or sponsorships.

10

Continually evaluate and review your organization's activities, making any necessary adjustments to ensure its effectiveness and success.

Who needs non profit organizations in?

01

Non-profit organizations are needed by various groups of people or communities, including:

02

- Individuals facing social or economic challenges who can benefit from the organization's programs and services.

03

- Communities affected by natural disasters or other emergencies, who need assistance and relief efforts.

04

- Environmental activists and conservationists who strive to protect and preserve the natural world.

05

- Education and research institutions that rely on non-profit organizations for funding and support.

06

- Individuals or groups with specific medical needs or conditions, who look to non-profit organizations for research, resources, and support.

07

- Artists, musicians, and cultural organizations that require funding and platforms to showcase their talents.

08

- Advocacy groups fighting for social justice, human rights, equality, and fairness.

09

- Animal welfare organizations dedicated to rescuing and providing care for abandoned or mistreated animals.

10

- Faith-based communities providing spiritual support, guidance, and community services.

11

- Various other organizations or individuals looking to make a positive impact on society and bring about positive change.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non profit organizations in online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your non profit organizations in to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out non profit organizations in using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign non profit organizations in and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out non profit organizations in on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your non profit organizations in by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is non profit organizations in?

Non profit organizations are organizations that operate for the greater good or benefit of society, rather than to make a profit for owners or shareholders.

Who is required to file non profit organizations in?

Non profit organizations are typically required to file with the appropriate government agency, such as the IRS in the United States, in order to maintain their tax-exempt status.

How to fill out non profit organizations in?

Filing requirements for non profit organizations vary by country and jurisdiction, but generally involve submitting financial reports, organizational information, and other required documentation.

What is the purpose of non profit organizations in?

The purpose of non profit organizations is to serve a charitable, educational, religious, or other socially beneficial purpose, rather than to generate profits for owners or shareholders.

What information must be reported on non profit organizations in?

Non profit organizations typically must report information such as financial statements, board member names, mission statement, and details of programs and activities.

Fill out your non profit organizations in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Profit Organizations In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.