Get the free Making a ift to Hughes Hall - Hughes Hall, Cambridge

Show details

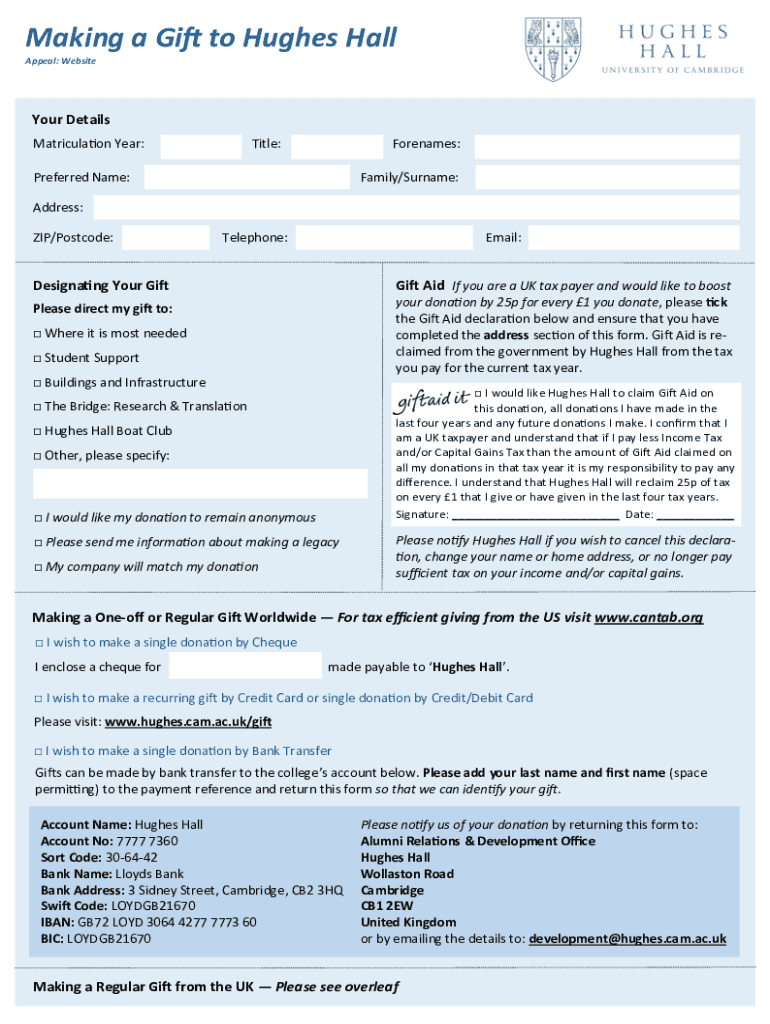

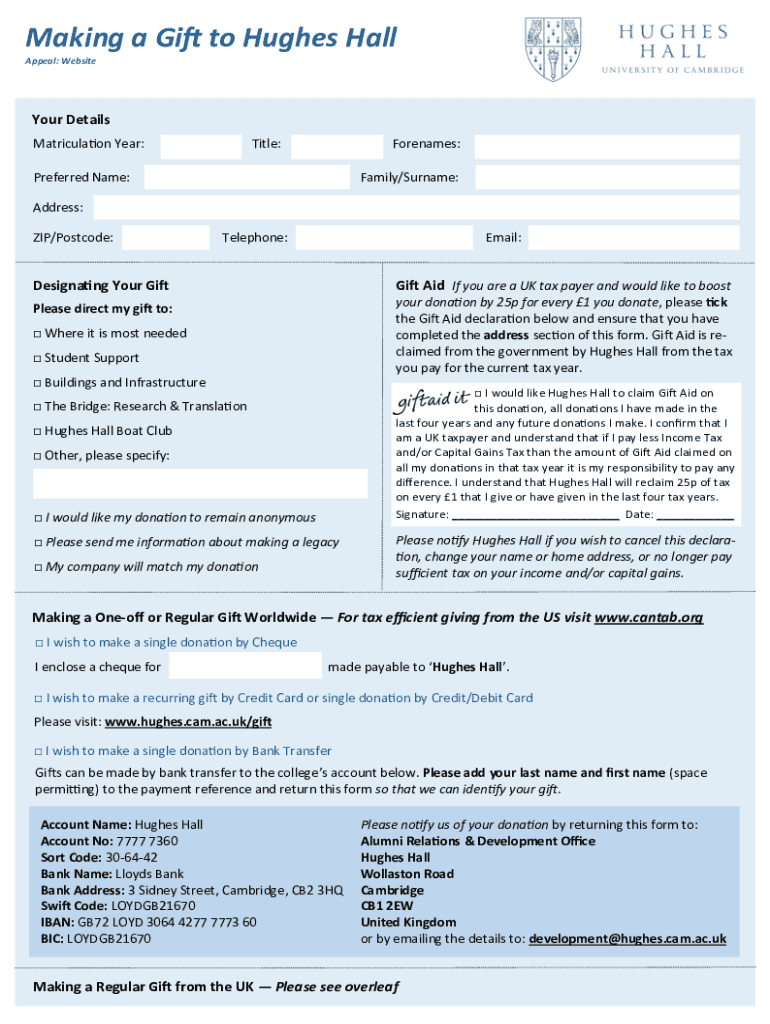

Making a Gift to Hughes Hall

Appeal: WebsiteYour Details

Matriculation Year:Title:Forenames:Preferred Name:Family/Surname:Address:

ZIP/Postcode:Telephone:Email:Designating Your Nightlight Aid If you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign making a ift to

Edit your making a ift to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your making a ift to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing making a ift to online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit making a ift to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out making a ift to

How to fill out making a ift to

01

To fill out making a ift, follow these steps:

02

Gather all the necessary information about the recipient of the gift, including their name, address, and any specific preferences they may have.

03

Determine the purpose of the gift and choose an appropriate item or experience to give.

04

Consider your budget and select a gift that is within your means.

05

Take into account the occasion or event for which the gift is being given.

06

When purchasing the gift, make sure to keep the recipient's interests and tastes in mind.

07

Wrap the gift neatly and present it in a thoughtful and considerate manner.

08

If desired, include a personalized note or card to accompany the gift.

09

Double-check the address and shipping details if the gift needs to be mailed, and ensure it will arrive in a timely manner.

10

Deliver the gift to the recipient or send it via mail or delivery service.

11

Follow up with the recipient to ensure the gift was received and appreciated.

12

Remember, the most important aspect of giving a gift is the thought and effort put into it. Personalize the gift to make it meaningful and special for the recipient.

Who needs making a ift to?

01

Anyone can benefit from making a gift to someone else. Whether it's a friend, family member, colleague, or acquaintance, making a gift allows you to show your appreciation, celebrate special occasions, strengthen relationships, and make someone feel valued. Giving a gift is a universal gesture of kindness and is often done to express love, gratitude, congratulations, or support. Ultimately, anyone who wants to make someone else feel special or loved can benefit from making a gift to them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute making a ift to online?

pdfFiller has made it simple to fill out and eSign making a ift to. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in making a ift to without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit making a ift to and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit making a ift to on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as making a ift to. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is making a ift to?

Making a ift to refers to transferring assets, usually money or property, to another party as a gift.

Who is required to file making a ift to?

Individuals who transfer assets as gifts are required to file a gift tax return.

How to fill out making a ift to?

To fill out a gift tax return, individuals need to provide information on the assets transferred, the fair market value, and any deductions or exemptions claimed.

What is the purpose of making a ift to?

The purpose of making a gift is to transfer assets to another party without receiving anything in return.

What information must be reported on making a ift to?

Information such as the value of the gift, the relationship between the donor and the recipient, and any potential tax liabilities must be reported on a gift tax return.

Fill out your making a ift to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Making A Ift To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.