Get the free EXTENUATING CIRCUMSTANCES FOR LATE-FILED

Show details

MIA MIDADE COUNTY PROPERTY APPRAISER EXEMPTIONS DIVISIONPEDRO J. GARCIA PROPERTY APPRAISER EXTENUATING CIRCUMSTANCES FOR LATERALED EXEMPTION APPLICATION Parcel Number: Property Address: Name: For

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign extenuating circumstances for late-filed

Edit your extenuating circumstances for late-filed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your extenuating circumstances for late-filed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit extenuating circumstances for late-filed online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit extenuating circumstances for late-filed. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out extenuating circumstances for late-filed

How to fill out extenuating circumstances for late-filed

01

To fill out extenuating circumstances for late-filed, follow these steps:

02

Begin by gathering all necessary documentation that supports your claim of extenuating circumstances for filing your documents late.

03

Access the appropriate form or application for extenuating circumstances for late-filed, which is usually available on the official website of the organization or institution you are submitting your documents to.

04

Read the instructions and requirements carefully to ensure you provide all the necessary information and documentation.

05

Fill in your personal details, including your name, contact information, and any identification numbers or codes required.

06

Explain the extenuating circumstances that caused the late filing in detail. Be honest and concise in your explanation, providing relevant dates and events.

07

Attach the supporting documentation that proves your claim, such as medical records, legal documents, or letters from relevant parties.

08

Double-check all the information you have provided to ensure accuracy and completeness.

09

Submit your completed extenuating circumstances for late-filed form or application to the appropriate authority or department as instructed.

10

Follow up on the submission if necessary, and keep copies of all the submitted documents for your records.

11

Wait for a response or decision regarding your extenuating circumstances claim.

Who needs extenuating circumstances for late-filed?

01

Anyone who has valid reasons for filing their documents late may need to provide extenuating circumstances for late-filed.

02

Some common situations where extenuating circumstances may be required include:

03

- Medical emergencies or serious illness that prevented timely submission

04

- Family emergencies or bereavement

05

- Document loss or destruction beyond your control

06

- Natural disasters or other major disruptions

07

- Legal issues or delays caused by court proceedings

08

However, the specific requirements for extenuating circumstances may vary depending on the organization or institution you are dealing with. It is best to consult their guidelines or contact the relevant authority for further clarification.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit extenuating circumstances for late-filed online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your extenuating circumstances for late-filed to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the extenuating circumstances for late-filed form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign extenuating circumstances for late-filed. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out extenuating circumstances for late-filed on an Android device?

Use the pdfFiller Android app to finish your extenuating circumstances for late-filed and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

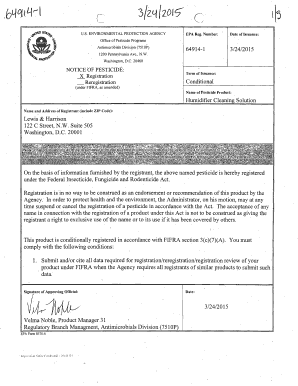

What is extenuating circumstances for late-filed?

Extenuating circumstances for late-filed refers to situations beyond the taxpayer's control that led to the late filing of a tax return or other financial documents.

Who is required to file extenuating circumstances for late-filed?

Taxpayers who were unable to file their tax return or financial documents on time due to circumstances beyond their control are required to file extenuating circumstances for late-filed.

How to fill out extenuating circumstances for late-filed?

Taxpayers can fill out extenuating circumstances for late-filed by providing a detailed explanation of the reasons for the late filing, along with any supporting documentation.

What is the purpose of extenuating circumstances for late-filed?

The purpose of extenuating circumstances for late-filed is to allow taxpayers to explain the reasons for their late filing and potentially avoid penalties for late submission.

What information must be reported on extenuating circumstances for late-filed?

Taxpayers must report details of the circumstances that led to the late filing, as well as any relevant supporting evidence.

Fill out your extenuating circumstances for late-filed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Extenuating Circumstances For Late-Filed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.