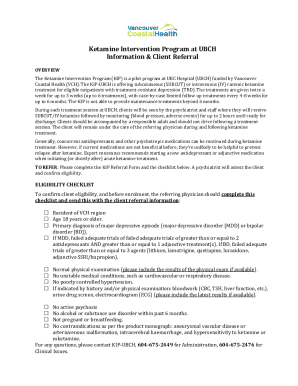

Get the free 2014 Qualified Dividends and Capital Gain Tax

Show details

2014 Qualified Dividends and Capital Gain Tax WorksheetLine44 See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2014 qualified dividends and

Edit your 2014 qualified dividends and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 qualified dividends and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2014 qualified dividends and online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2014 qualified dividends and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014 qualified dividends and

How to fill out 2014 qualified dividends and:

01

Gather all necessary documents such as your Form 1099-DIV, which should report any dividends you received throughout the year. Make sure you have accurate information related to the dividends you received.

02

Understand the requirements for qualified dividends. Qualified dividends are typically dividends received from U.S. corporations or qualified foreign corporations. These dividends are taxed at a lower rate than ordinary dividends.

03

Determine your eligibility for the qualified dividends tax rate. To be eligible, you must meet certain holding period requirements, which generally require you to hold the stock for a specific amount of time before the dividend is paid. Consult the IRS guidelines or a tax professional to ensure you meet the criteria.

04

Complete Schedule B (Form 1040 or 1040A) if you received more than $1,500 in ordinary dividends or if you need to report any capital gains or losses. This schedule is used to calculate your taxable dividends and capital gains.

05

Transfer the information from your Form 1099-DIV and Schedule B onto your Form 1040 or 1040A. Make sure to accurately report all dividend income and follow the specific instructions for each form.

06

Calculate the tax owed on your qualified dividends. The tax rate for qualified dividends depends on your income bracket. Consult the tax tables or use tax software to determine the correct tax rate for your situation.

07

Complete any additional forms or schedules that may be required based on your individual tax situation. This could include forms such as the Child Tax Credit, Education Credits, or Schedule D for capital gains and losses.

08

Double-check all your information for accuracy and completeness before submitting your tax return. It's important to review all the forms and attachments to ensure everything is filled out correctly.

09

File your tax return by the appropriate deadline, usually April 15th, or request an extension if needed. Be mindful of any state tax requirements as well.

Who needs 2014 qualified dividends and:

01

Individual taxpayers who received dividends from U.S. corporations or qualified foreign corporations in the year 2014.

02

Taxpayers who want to take advantage of the lower tax rates applied to qualified dividends.

03

Individuals who meet the holding period requirements for their dividend-earning stocks and are eligible for the qualified dividends tax rate.

04

Taxpayers who need to report dividend income on their annual tax return and want to ensure they accurately report all taxable dividends.

05

Individuals who want to minimize their tax liability by correctly reporting and calculating their qualified dividends.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2014 qualified dividends and?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the 2014 qualified dividends and. Open it immediately and start altering it with sophisticated capabilities.

How can I edit 2014 qualified dividends and on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 2014 qualified dividends and, you need to install and log in to the app.

How can I fill out 2014 qualified dividends and on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 2014 qualified dividends and. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is qualified dividends and capital?

Qualified dividends and capital gains are types of investment income that are taxed at a lower rate than ordinary income. They must meet specific criteria set by the IRS to qualify for this lower tax rate.

Who is required to file qualified dividends and capital?

Individuals who receive qualified dividends and capital gains during the tax year are required to report this income on their tax return.

How to fill out qualified dividends and capital?

Qualified dividends and capital gains can be reported on Schedule D of Form 1040. Taxpayers must provide detailed information about each investment transaction that resulted in qualified dividends or capital gains.

What is the purpose of qualified dividends and capital?

The purpose of taxing qualified dividends and capital gains at a lower rate is to encourage investment in the stock market and other financial instruments. This can help stimulate economic growth.

What information must be reported on qualified dividends and capital?

Taxpayers must report the amount of qualified dividends and capital gains received, as well as any related expenses or deductions that may apply.

Fill out your 2014 qualified dividends and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Qualified Dividends And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.