Get the free HSA - Health Savings AccountBenefitsWEX Inc.

Show details

HCA Health savings Account Health Savings Account (HSA) A Health Savings Account is a tax advantaged medical savings account available to employees who are enrolled in a high deductible health plan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa - health savings

Edit your hsa - health savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa - health savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hsa - health savings online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hsa - health savings. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa - health savings

How to fill out hsa - health savings

01

To fill out an HSA (Health Savings Account), follow these steps:

02

Determine if you are eligible to open an HSA. You must have a high deductible health plan (HDHP) and not be enrolled in Medicare.

03

Research different HSA providers and compare their fees, investment options, and contribution limits.

04

Choose a provider that suits your needs and open an HSA account.

05

Provide the necessary personal and financial information to set up your HSA.

06

Decide how much you want to contribute to your HSA each year. Remember, there are annual contribution limits set by the IRS.

07

Make regular contributions to your HSA either through employer contributions or self-contributions.

08

Keep track of your HSA expenses and save all receipts for medical expenses that you plan to pay with HSA funds.

09

Use your HSA funds to pay for eligible medical expenses, such as doctor visits, prescription medications, and certain medical supplies.

10

Monitor your HSA balance and ensure you are staying within the IRS guidelines for contributions and qualified expenses.

11

Stay informed about any changes in HSA regulations and tax laws that may affect your account.

12

Remember to consult a financial advisor or tax professional for personalized guidance on filling out an HSA.

Who needs hsa - health savings?

01

Anyone who has a high deductible health plan (HDHP) and wants to save for medical expenses can benefit from having an HSA.

02

The following individuals may specifically benefit from an HSA:

03

- Self-employed individuals

04

- Small business owners

05

- Employees with high deductible health insurance plans

06

- Individuals who anticipate upcoming medical expenses

07

- Individuals who want to save for future healthcare costs

08

HSA can provide tax advantages and flexibility in managing healthcare expenses. However, it's important to evaluate individual financial situations and consult a financial advisor before deciding if an HSA is the right option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my hsa - health savings in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your hsa - health savings and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit hsa - health savings in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your hsa - health savings, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the hsa - health savings electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your hsa - health savings in minutes.

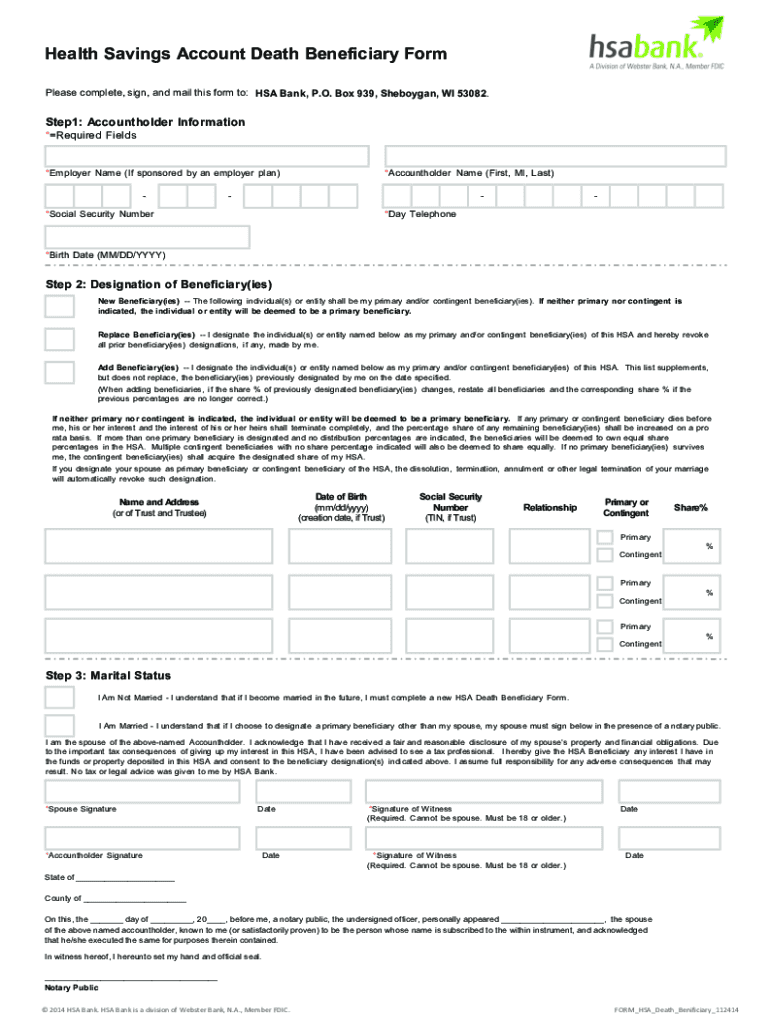

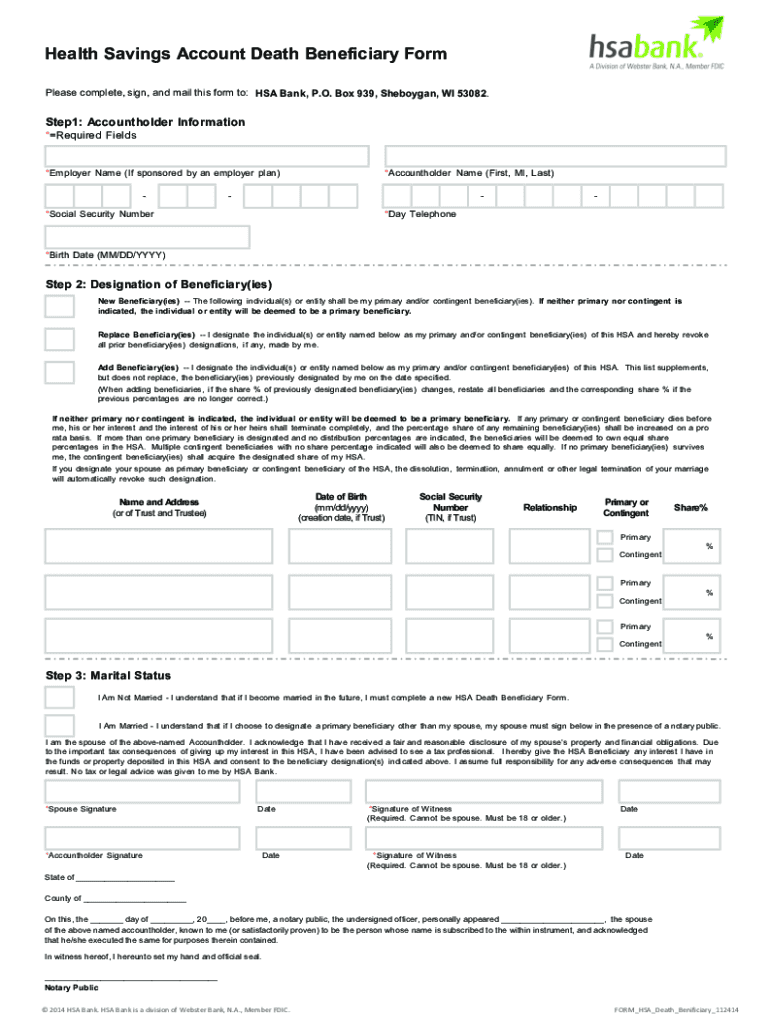

What is hsa - health savings?

Health Savings Accounts (HSAs) are tax-advantaged accounts that allow individuals to save money for medical expenses. Contributions to an HSA are tax-deductible, and funds can be withdrawn tax-free for qualifying medical expenses.

Who is required to file hsa - health savings?

Individuals who have an HSA must file IRS Form 8889 with their federal tax return to report contributions, distributions, and other details of the account.

How to fill out hsa - health savings?

To fill out an HSA, complete IRS Form 8889 by providing information on your HSA contributions, distributions, and any qualifying medical expenses. Be sure to include any amounts carried over from previous years.

What is the purpose of hsa - health savings?

The purpose of an HSA is to provide individuals with a way to save for medical expenses while receiving tax benefits, promoting health care savings and flexibility in managing medical costs.

What information must be reported on hsa - health savings?

You must report total contributions made to the HSA, distributions taken from the HSA, any qualified medical expenses paid from the HSA, and any amounts rolled over from other HSAs.

Fill out your hsa - health savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa - Health Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.