Get the free Estate Planning and the Fiduciary Exception to Attorney ...

Show details

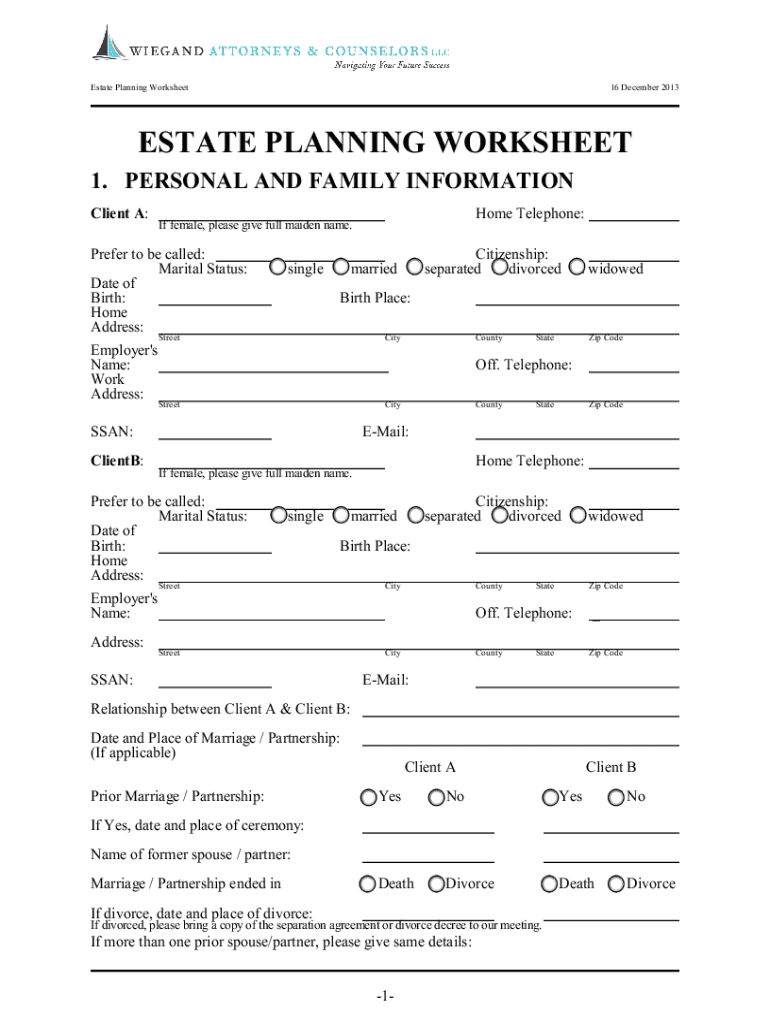

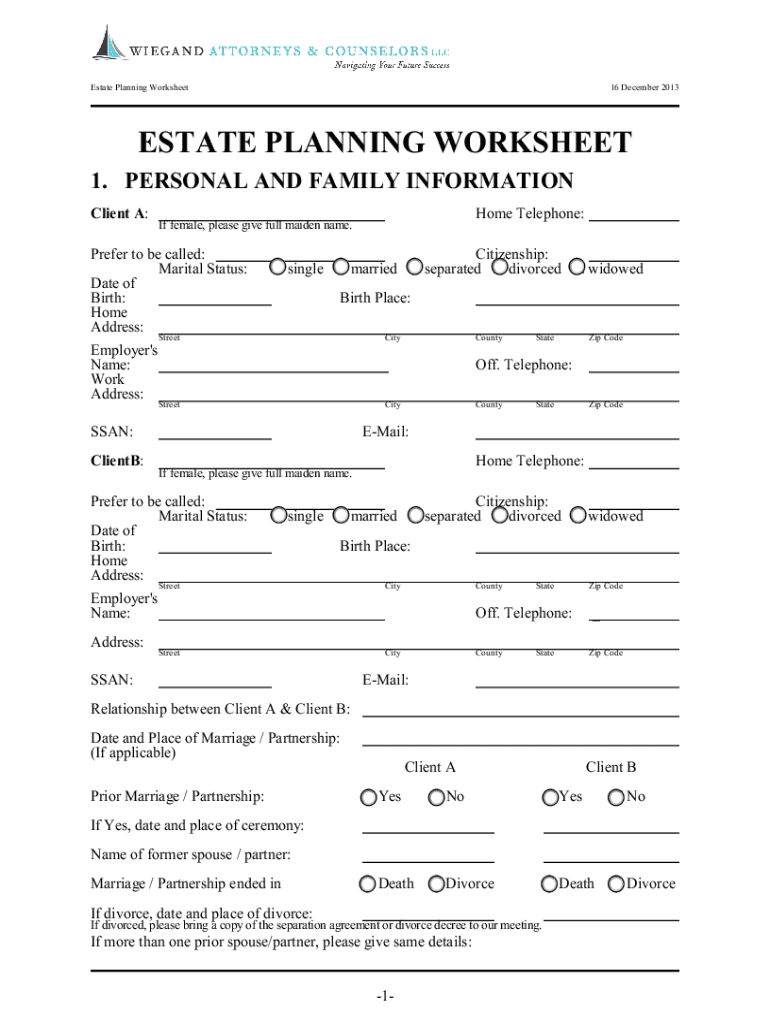

ESTATE PLANNING WORKSHEETPRIVILEGED AND CONFIDENTIAL SUBJECT TO ATTORNEY CLIENT PRIVILEGE (if returned directly to the undersigned attorney)ROBERT LIGAND II and KIMBERLY J. REMDOC Practice focused

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate planning and form

Edit your estate planning and form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate planning and form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate planning and form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit estate planning and form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate planning and form

How to fill out estate planning and form

01

To fill out an estate planning form, follow these steps:

02

Gather all necessary information, including personal details, a list of assets, beneficiaries, and any debts or liabilities.

03

Consult with an attorney or estate planner to understand the specific requirements and legal aspects of estate planning in your jurisdiction.

04

Start with a basic template or form provided by your attorney or an online resource. Ensure it covers all the essential aspects of estate planning such as a will, power of attorney, healthcare directives, and trusts if necessary.

05

Provide accurate and complete information in the form. Be specific about your assets, beneficiaries, and any specific instructions or preferences.

06

Review the completed form thoroughly to ensure there are no errors or omissions. Seek professional advice or legal assistance if needed.

07

Sign the form in the presence of witnesses or as per the legal requirements of your jurisdiction.

08

Keep a copy of the completed form for your records and share copies with your attorney, executor, or trusted family members.

09

Regularly review and update your estate planning documents as circumstances change.

Who needs estate planning and form?

01

Estate planning and forms are essential for anyone who wants to ensure their assets and property are distributed according to their wishes after their death.

02

Specifically, the following individuals may benefit from estate planning and forms:

03

- Individuals with significant assets and property

04

- Parents or guardians who want to designate a guardian for their minor children

05

- Individuals who want to avoid probate and ensure a smooth transfer of assets

06

- Individuals who want to minimize estate taxes and preserve wealth for future generations

07

- Individuals with specific healthcare preferences or end-of-life instructions

08

- Business owners or entrepreneurs

09

- Individuals with complex family or financial situations

10

- Individuals who want to provide for charitable organizations or make philanthropic contributions.

11

Ultimately, estate planning and forms are useful for anyone who wants to have control over the distribution of their assets and ensure their wishes are followed after their passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute estate planning and form online?

pdfFiller has made it easy to fill out and sign estate planning and form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the estate planning and form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your estate planning and form.

How do I fill out the estate planning and form form on my smartphone?

Use the pdfFiller mobile app to complete and sign estate planning and form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is estate planning and form?

Estate planning is the process of anticipating and arranging for the disposal of an estate. Estate planning forms include documents such as wills, trusts, and power of attorney.

Who is required to file estate planning and form?

Individuals with assets or property that they wish to pass on to heirs or beneficiaries are required to file estate planning forms.

How to fill out estate planning and form?

Estate planning forms can be filled out by providing information about assets, beneficiaries, and instructions for the distribution of the estate.

What is the purpose of estate planning and form?

The purpose of estate planning is to ensure that assets are distributed according to the individual's wishes after their passing.

What information must be reported on estate planning and form?

Information such as assets, debts, beneficiaries, and instructions for distribution must be reported on estate planning forms.

Fill out your estate planning and form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Planning And Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.