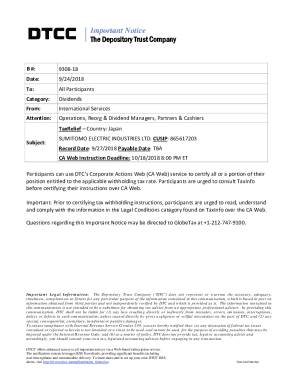

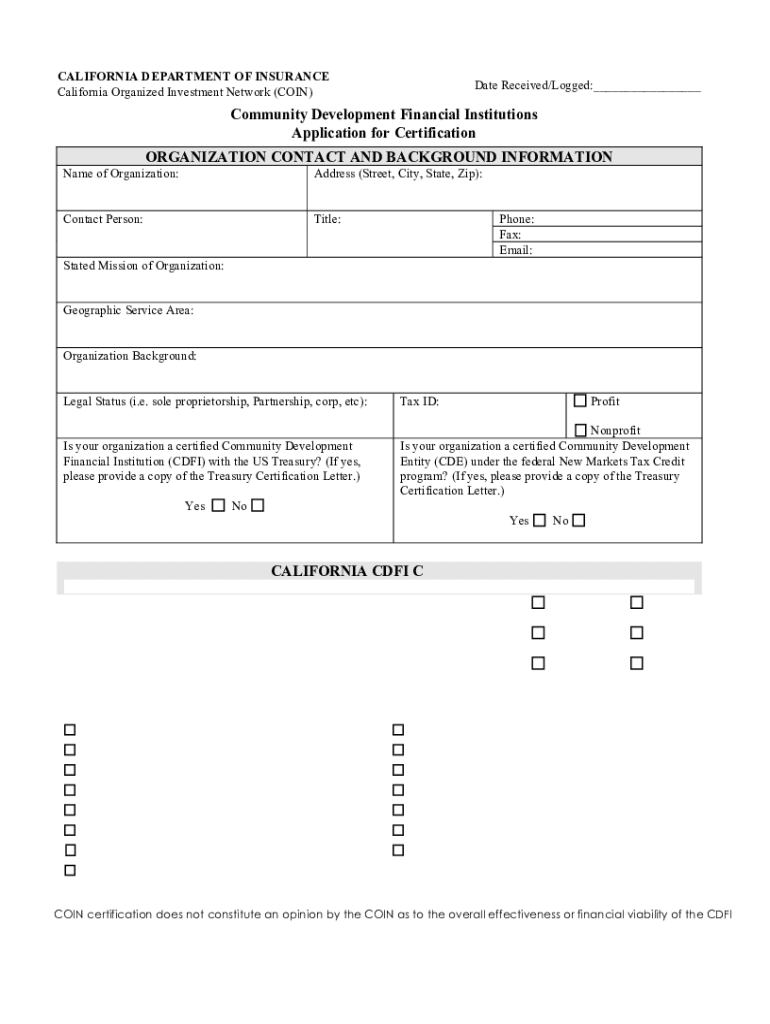

Get the free Community Development financial Institutions Application for Certification

Show details

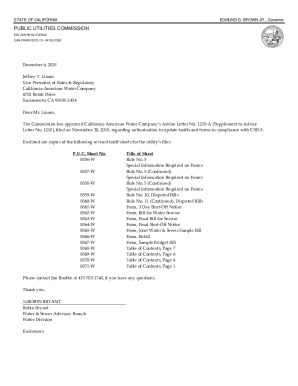

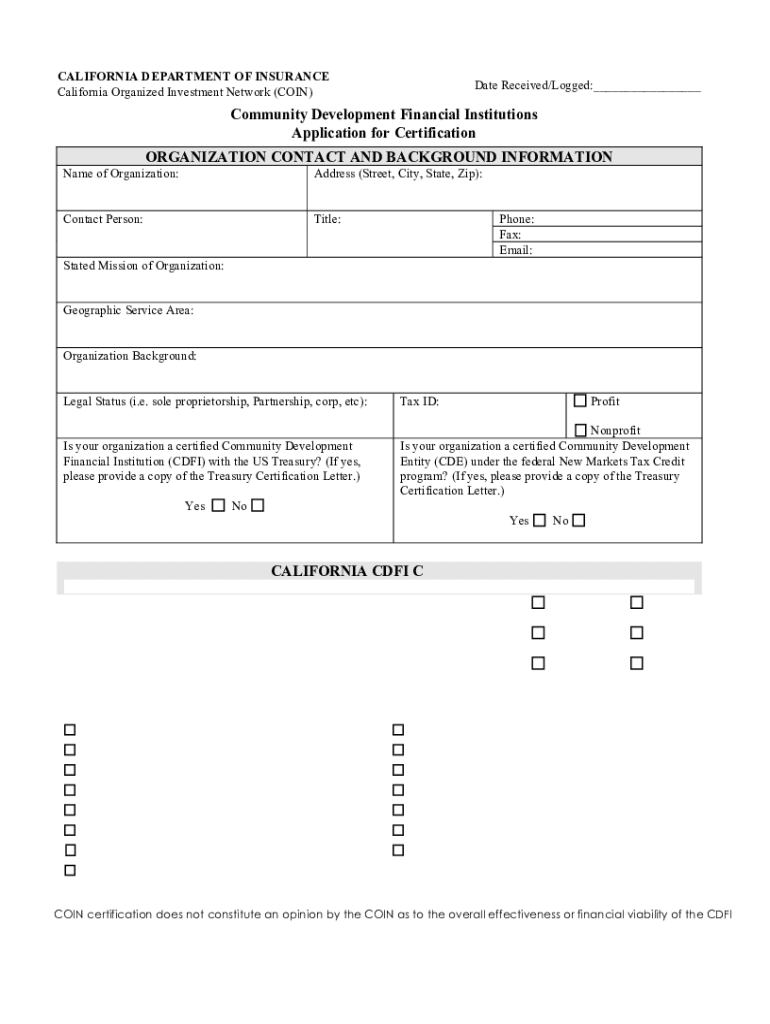

State of California Department of InsuranceCOMMUNITY DEVELOPMENT FINANCIAL INSTITUTIONS FOR CERTIFICATION CDI004 (Rev. 6/2015)CALIFORNIA DEPARTMENT OF INSURANCE California Organized Investment Network

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign community development financial institutions

Edit your community development financial institutions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your community development financial institutions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing community development financial institutions online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit community development financial institutions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out community development financial institutions

How to fill out community development financial institutions

01

Start by researching community development financial institutions (CDFIs) in your area. Look for organizations that have a focus on providing affordable financial services to low-income communities.

02

Contact the CDFIs you have identified and gather information on their application process. They may have specific requirements and documents that need to be submitted.

03

Prepare the necessary documents such as financial statements, business plans, and any other supporting documents requested by the CDFIs.

04

Fill out the application form provided by the CDFIs. Make sure to provide accurate and comprehensive information about your community development project or business.

05

Double-check all the information entered in the application form to ensure accuracy.

06

Submit the completed application form and all required documents to the CDFIs.

07

Follow up with the CDFIs to inquire about the status of your application and provide any additional information or clarification, if needed.

08

Await a decision from the CDFIs regarding your application. They may conduct a review process to evaluate the feasibility and impact of your community development project or business.

09

If your application is approved, work closely with the CDFIs to secure the necessary financing and support for your community development initiatives.

10

Keep track of the progress and outcomes of your community development efforts and maintain a strong relationship with the CDFIs to ensure ongoing support.

Who needs community development financial institutions?

01

Community development financial institutions (CDFIs) are needed by individuals and groups who are looking to make a positive impact in low-income communities.

02

Non-profit organizations working to provide affordable housing, job training, or other community services often require the financial resources and expertise that CDFIs can offer.

03

Entrepreneurs and small business owners who want to start or expand their businesses in underserved areas may benefit from CDFIs' access to funding and technical assistance.

04

Individuals seeking affordable financial services, such as loans or savings accounts, can turn to CDFIs as an alternative to traditional banks that may not serve their community adequately.

05

Local governments and municipalities that aim to promote economic development and neighborhood revitalization can partner with CDFIs to leverage their resources and knowledge.

06

Community organizations and grassroots initiatives focused on improving educational opportunities, healthcare access, or other social aspects in low-income areas can utilize the support and financing options offered by CDFIs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send community development financial institutions to be eSigned by others?

When you're ready to share your community development financial institutions, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in community development financial institutions?

The editing procedure is simple with pdfFiller. Open your community development financial institutions in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in community development financial institutions without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your community development financial institutions, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is community development financial institutions?

Community Development Financial Institutions (CDFIs) are specialized financial institutions that serve low-income communities and provide financial services to individuals and businesses who may not have access to traditional banking services.

Who is required to file community development financial institutions?

CDFIs are required to file their financial information with the U.S. Department of the Treasury's Community Development Financial Institutions Fund (CDFI Fund) in order to maintain their certification.

How to fill out community development financial institutions?

CDFIs must fill out the required forms provided by the CDFI Fund, including financial statements, impact data, and other relevant information about their activities.

What is the purpose of community development financial institutions?

The purpose of CDFIs is to promote economic development in underserved communities by providing access to capital, credit, and financial services.

What information must be reported on community development financial institutions?

CDFIs must report on their financial performance, impact on the community, and compliance with regulations set forth by the CDFI Fund.

Fill out your community development financial institutions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Community Development Financial Institutions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.