Get the free ANNUAL AUDITED REPORT hours FORM SEC

Show details

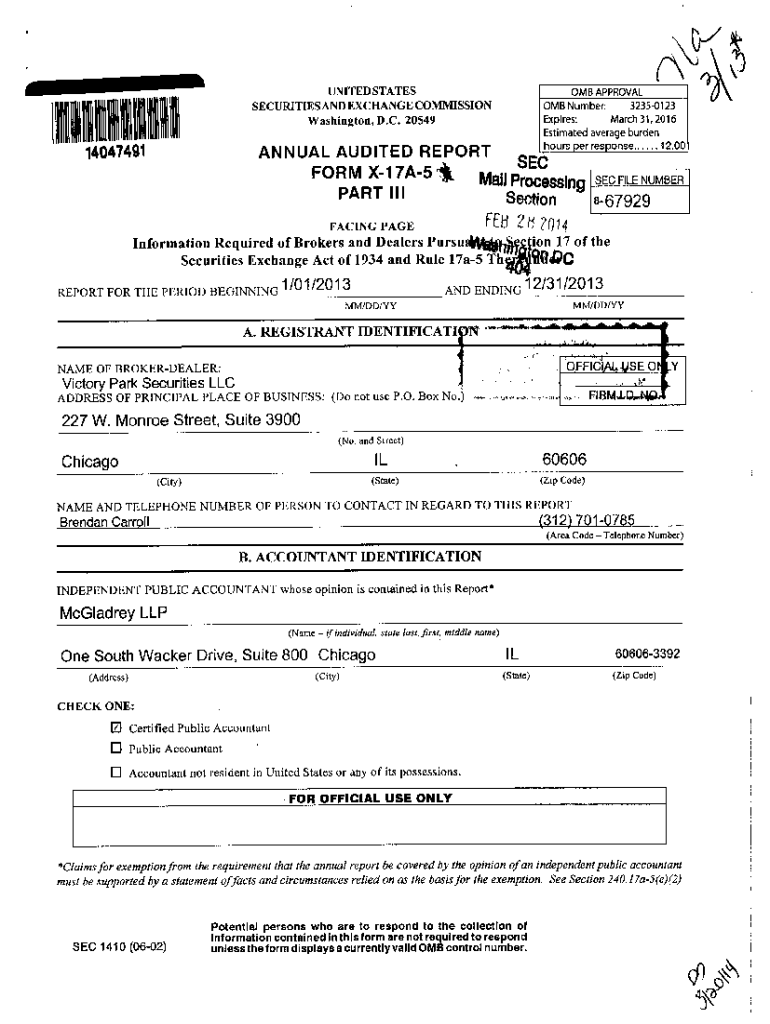

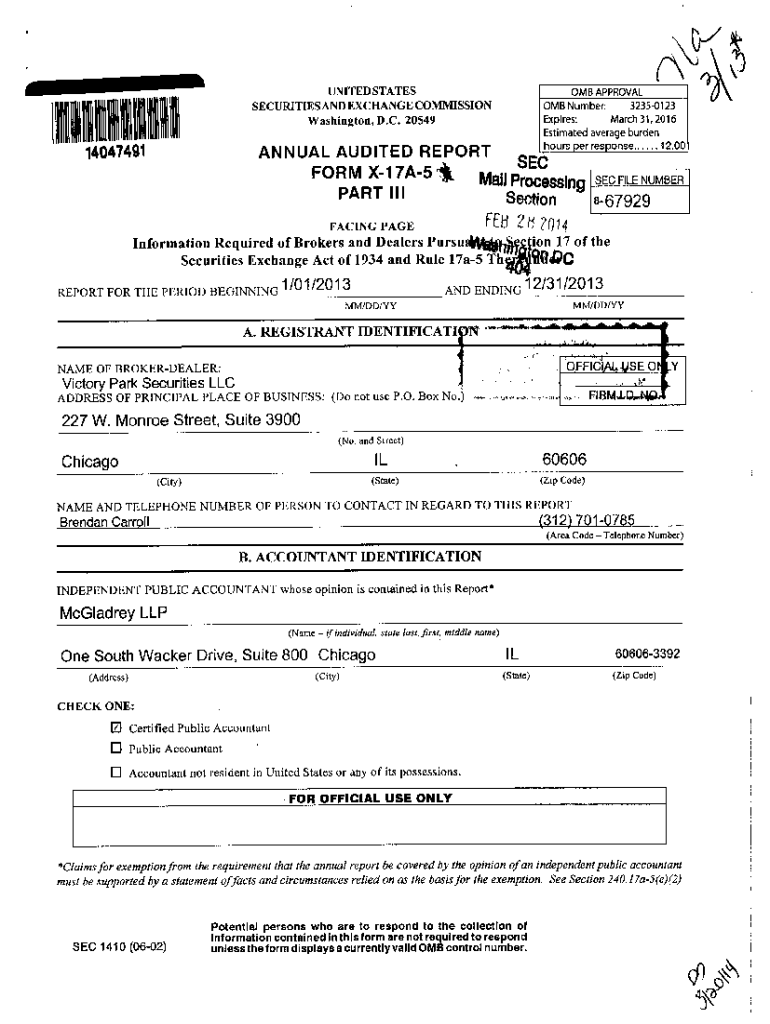

UNITED STATES0MB APPROVAL

0 MB Number

323501AND EXCHANGE COMMISSION

Washington D. C 20549SECURITIESMarchExpiresaverage burdenEstimatedREPORTANNUAL AUDITED14047491FORMX1 7A5PARTIIIInformationRequiredof

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual audited report hours

Edit your annual audited report hours form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual audited report hours form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual audited report hours online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual audited report hours. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual audited report hours

How to fill out annual audited report hours

01

Here is a step-by-step guide on how to fill out annual audited report hours:

02

Start by gathering all the necessary financial documents and records for the period being audited.

03

Review the requirements and guidelines provided by your organization or regulatory body for reporting annual audited hours.

04

Begin by documenting the number of hours worked by each employee or individual for the period being audited.

05

Classify the hours worked into different categories, such as regular working hours, overtime hours, and any other relevant categories specified by the reporting requirements.

06

Calculate the total number of audited hours for each category, ensuring accuracy and compliance with the reporting guidelines.

07

Prepare a summary or detailed report, depending on the specific reporting requirements, that includes the audited hours for each category and any additional information required.

08

Ensure all necessary supporting documentation is attached to the report, such as timesheets, payroll records, or any other relevant documents.

09

Review the completed report for any errors or inconsistencies before submitting it.

10

Submit the annual audited report hours to the designated authority or relevant department in accordance with the specified timeline or deadline.

11

Keep a copy of the report and all supporting documents for record-keeping purposes.

Who needs annual audited report hours?

01

Annual audited report hours are typically required by organizations, regulatory bodies, or governing authorities.

02

Some entities that may require annual audited report hours include:

03

- Companies or businesses for compliance with regulatory standards

04

- Non-profit organizations for financial transparency and accountability

05

- Government agencies for monitoring and auditing purposes

06

- Tax authorities for verifying tax compliance

07

- Investors or stakeholders for evaluating business performance

08

- Banks or lenders for assessing creditworthiness

09

- Professional associations or industry bodies for maintaining professional standards

10

- Contractors or vendors for verifying labor or service hours

11

- Grant-receiving organizations for grant compliance

12

These are just a few examples, and the specific requirements may vary depending on the jurisdiction and industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify annual audited report hours without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your annual audited report hours into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in annual audited report hours without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your annual audited report hours, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete annual audited report hours on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your annual audited report hours, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is annual audited report hours?

Annual audited report hours refer to the number of hours spent auditing financial statements and records over the course of a year.

Who is required to file annual audited report hours?

Companies, organizations, or individuals that are required to undergo an annual audit by law or regulation are typically required to file annual audited report hours.

How to fill out annual audited report hours?

Annual audited report hours are typically filled out by documenting the number of hours spent on each specific audit, including planning, fieldwork, and reporting.

What is the purpose of annual audited report hours?

The purpose of annual audited report hours is to provide transparency and assurance that financial statements are free from material misstatement.

What information must be reported on annual audited report hours?

Information such as the name of the auditor, date of audit, hours spent on each audit procedure, and any significant findings or issues discovered during the audit must be reported on annual audited report hours.

Fill out your annual audited report hours online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Audited Report Hours is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.