Get the free benefit trust or p nvate foundatto)

Show details

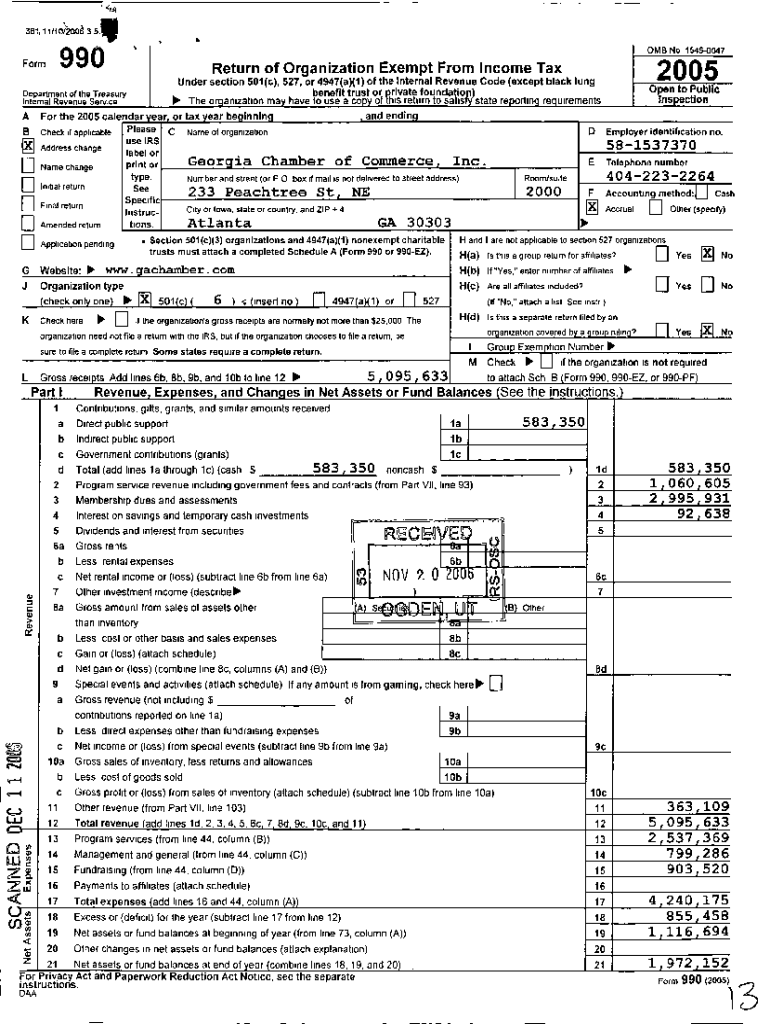

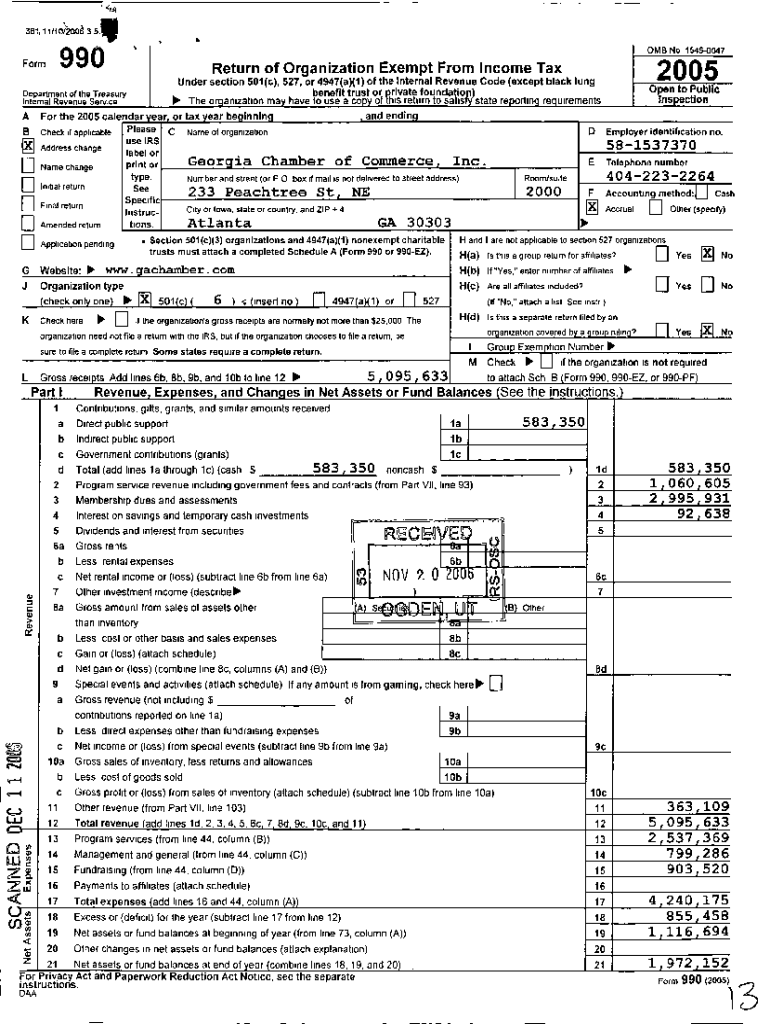

381,11/ 10/2006 359 OMB No 1545004Form4990Return of Organization Exempt From Income Tax2005Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign benefit trust or p

Edit your benefit trust or p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your benefit trust or p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit benefit trust or p online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit benefit trust or p. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out benefit trust or p

How to fill out benefit trust or p

01

To fill out a benefit trust or p, follow these steps:

02

Gather all the necessary information, such as the names and contact information of the beneficiaries, the assets to be included in the trust, and any specific instructions or conditions for the trust.

03

Consult with a legal professional or estate planner to ensure you understand the legal requirements and implications of creating a benefit trust or p.

04

Determine the type of benefit trust or p that best suits your needs. There are different types of trusts available, such as revocable or irrevocable trusts, and each has different benefits and implications.

05

Create the necessary legal documents, including a trust agreement or a will that includes provisions for the benefit trust or p.

06

Name a trustee who will be responsible for managing and distributing the assets in accordance with the terms of the trust. Consider choosing someone who is knowledgeable and trustworthy.

07

Fund the trust by transferring the assets you want to include in the trust into its ownership. This may involve changing the titles or ownership documents of the assets.

08

Review and update the trust periodically to ensure it still aligns with your goals and wishes. Changes in personal circumstances or laws may require modifications to the trust.

09

Communicate the existence of the benefit trust or p to the beneficiaries and provide them with any relevant information or instructions they need to know.

10

Keep the trust documents in a safe and accessible place, and inform your loved ones and the trustee where to find them if needed.

11

Consider seeking professional advice from an attorney or financial advisor throughout the process to ensure all legal and financial aspects are properly addressed.

Who needs benefit trust or p?

01

A benefit trust or p may be necessary for individuals or families who:

02

- Have significant assets they want to protect and ensure are properly managed and distributed according to their wishes.

03

- Want to provide for the financial well-being of their loved ones or future generations.

04

- Have beneficiaries with special needs who may require ongoing financial support and care.

05

- Wish to minimize the potential impact of estate taxes or other legal implications on their assets.

06

- Want to maintain some control or influence over how their assets are used and distributed even after their death.

07

- Are concerned about the potential mismanagement or misuse of their assets by beneficiaries.

08

- Desire a structured and organized approach to managing and transferring their assets upon their passing.

09

- Have specific charitable or philanthropic goals they want to support through their assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit benefit trust or p from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your benefit trust or p into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I sign the benefit trust or p electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your benefit trust or p.

How do I fill out benefit trust or p using my mobile device?

Use the pdfFiller mobile app to complete and sign benefit trust or p on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is benefit trust or p?

Benefit trust or p is a legal entity created to hold assets for the benefit of specific individuals or organizations.

Who is required to file benefit trust or p?

Those who create or manage a benefit trust or p are typically required to file relevant tax forms.

How to fill out benefit trust or p?

Benefit trust or p forms can be filled out by providing accurate information regarding the trust's assets, beneficiaries, and income.

What is the purpose of benefit trust or p?

The purpose of a benefit trust or p is to safeguard assets and distribute benefits to designated individuals or organizations.

What information must be reported on benefit trust or p?

Information such as trust assets, income, expenses, and distributions must be reported on a benefit trust or p.

Fill out your benefit trust or p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Benefit Trust Or P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.