Get the free Property Tax Calculator - League of Minnesota Cities

Show details

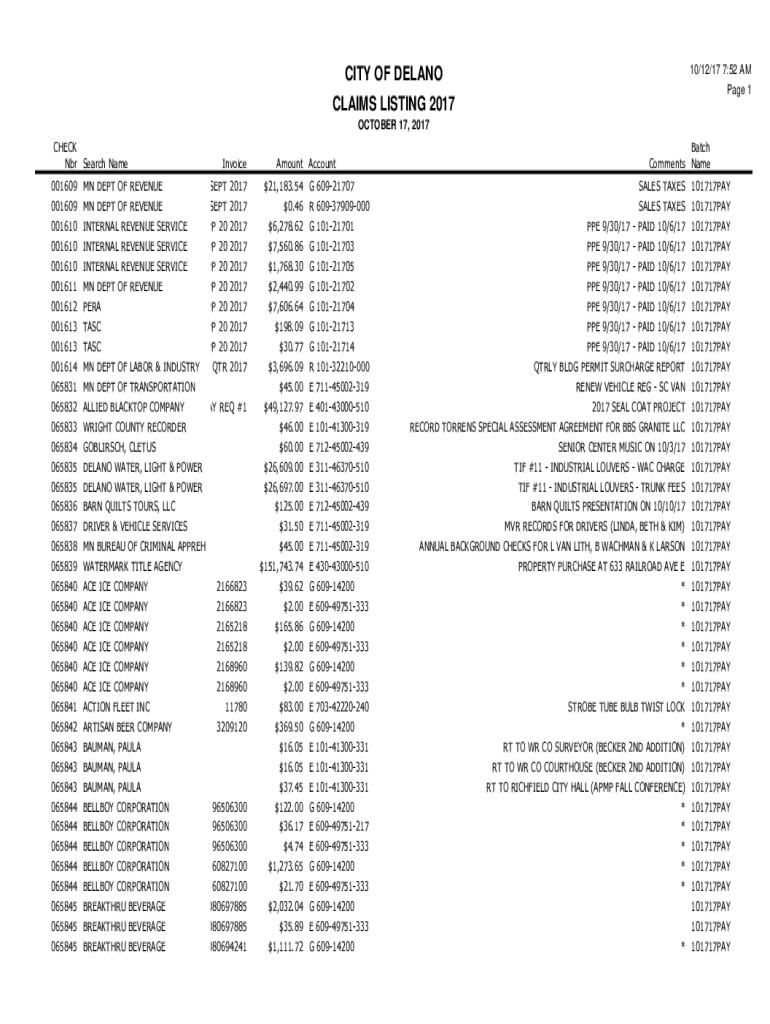

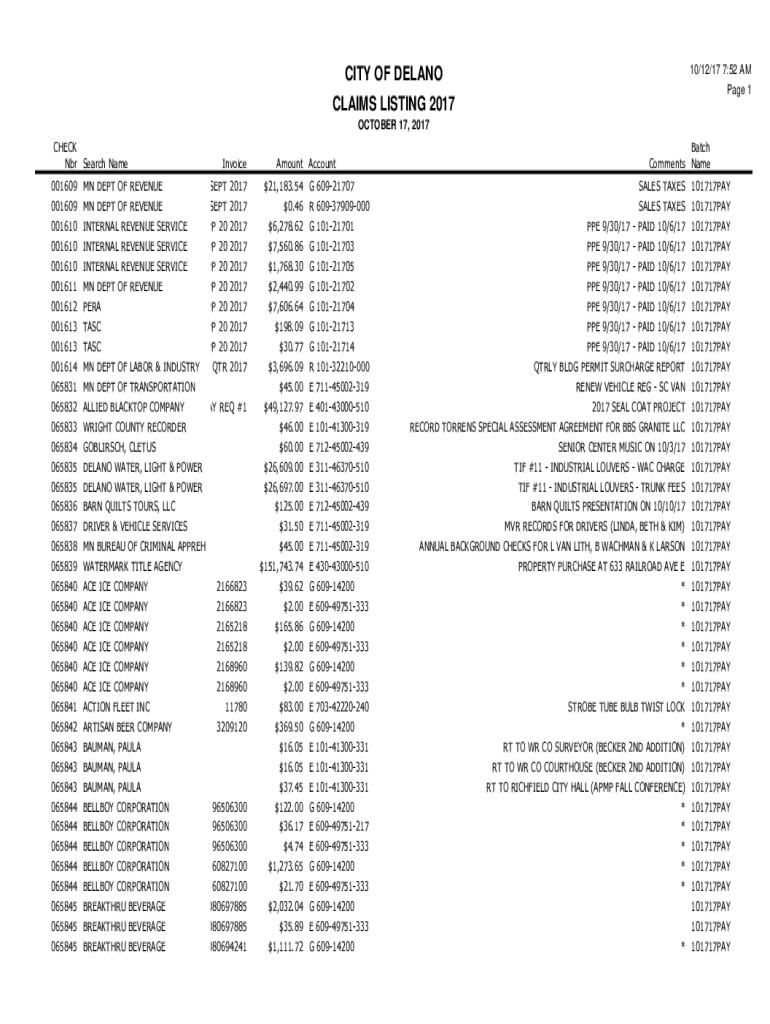

10/12/17 7:52 AM

Page 1CITY OF DELANO

CLAIMS LISTING 2017

OCTOBER 17, 2017,

CHECK

NBR Search Name

001609

001609

001610

001610

001610

001611

001612

001613

001613

001614

065831

065832

065833

065834

065835

065835

065836

065837

065838

065839

065840

065840

065840

065840

065840

065840

065841

065842

065843

065843

065843

065844

065844

065844

065844

065844

065845

065845

065845InvoiceMN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax calculator

Edit your property tax calculator form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax calculator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax calculator online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax calculator. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax calculator

How to fill out property tax calculator

01

To fill out a property tax calculator, follow these steps:

02

Gather all necessary information: This includes the assessed value of the property, the tax rate, and any applicable deductions or exemptions.

03

Determine the assessed value: If you don't already know the assessed value, you can find this information on your property tax bill or by contacting your local tax assessor's office.

04

Calculate the taxable amount: Subtract any applicable deductions or exemptions from the assessed value to determine the taxable amount.

05

Apply the tax rate: Multiply the taxable amount by the tax rate to calculate the property tax.

06

Review the results: Double-check your calculations to ensure accuracy.

07

Repeat the process if necessary: If you have multiple properties or need to calculate property taxes for different scenarios, repeat the steps above for each property or scenario.

08

Remember to consult with a tax professional or refer to your local tax laws for more specific guidance and to ensure you are filling out the property tax calculator correctly.

Who needs property tax calculator?

01

Anyone who owns a property and is responsible for paying property taxes can benefit from using a property tax calculator.

02

This tool is especially useful for:

03

- Homeowners: Homeowners who want to estimate their annual property tax liability before receiving their tax bill.

04

- Real estate investors: Investors who own multiple properties and need to calculate property taxes for each property.

05

- Potential buyers: Buyers who are considering purchasing a property and want to estimate their potential property tax expenses as part of their overall financial planning.

06

- Tax professionals: Tax professionals who assist clients with property tax planning and need an accurate and efficient way to calculate property tax liability.

07

In summary, anyone who wants to estimate property taxes or needs to calculate property tax liability for any reason can benefit from using a property tax calculator.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out property tax calculator using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign property tax calculator and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete property tax calculator on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your property tax calculator, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete property tax calculator on an Android device?

Use the pdfFiller mobile app and complete your property tax calculator and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is property tax calculator?

Property tax calculator is a tool used to estimate the amount of property tax a homeowner will owe based on the assessed value of their property.

Who is required to file property tax calculator?

Property owners are required to file property tax calculator in order to determine their property tax liability.

How to fill out property tax calculator?

To fill out a property tax calculator, you need to input information about the assessed value of your property, any exemptions you may qualify for, and the tax rate in your area.

What is the purpose of property tax calculator?

The purpose of a property tax calculator is to help property owners estimate how much they will owe in property taxes and plan their finances accordingly.

What information must be reported on property tax calculator?

On a property tax calculator, you must report the assessed value of your property, any exemptions you qualify for, and the tax rate in your area.

Fill out your property tax calculator online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Calculator is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.