Get the free Contributions of more than $100:* - web pdc wa

Show details

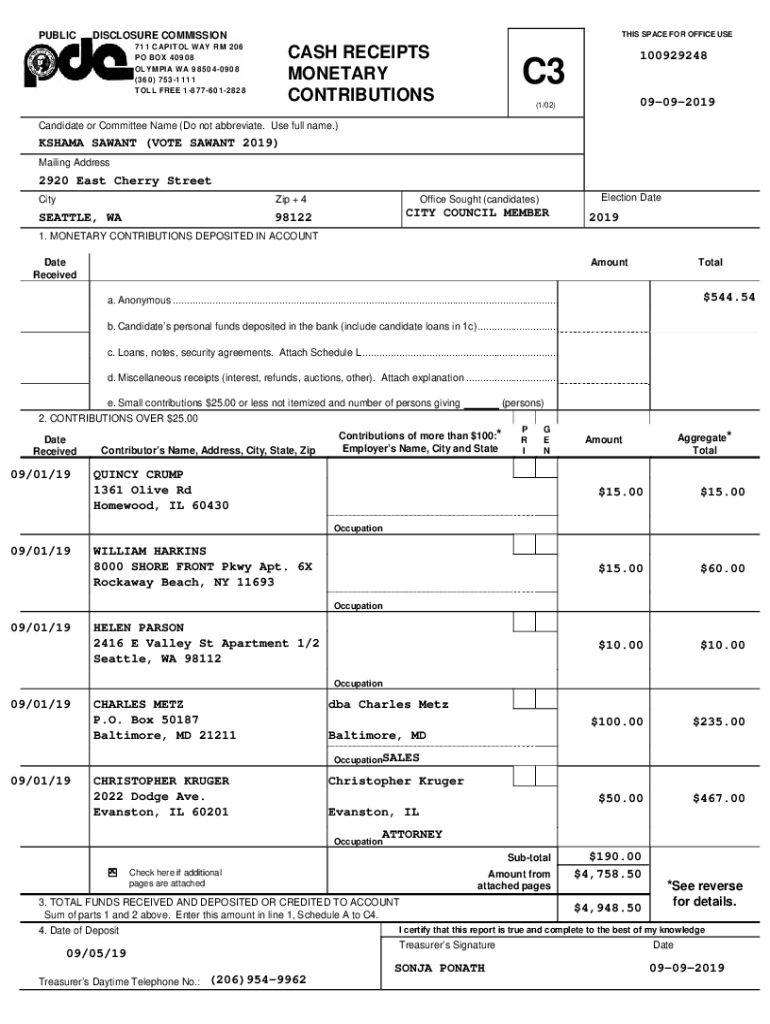

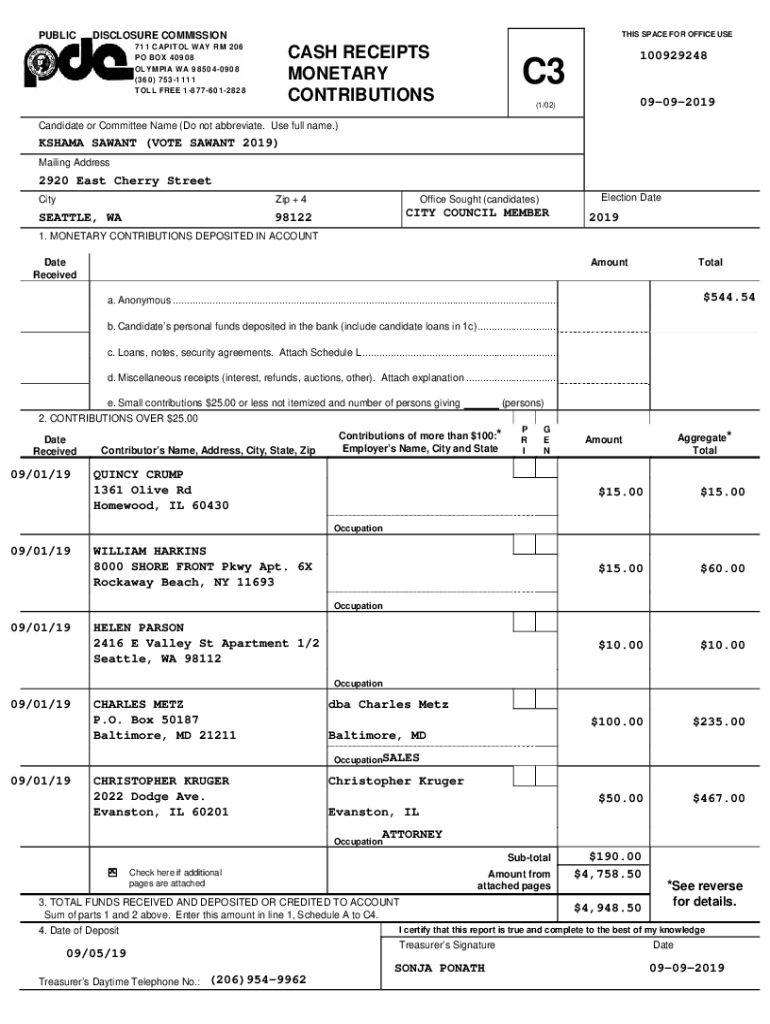

PUBLISHES SPACE FOR OFFICE DISCLOSURE COMMISSION

711 CAPITOL WAY RM 206

PO BOX 40908

OLYMPIA WA 985040908

(360) 7531111

TOLL FREE 18776012828C3CASH RECEIPTS

MONETARY

CONTRIBUTIONS10092924809092019(1/02)Candidate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contributions of more than

Edit your contributions of more than form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contributions of more than form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contributions of more than online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit contributions of more than. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contributions of more than

How to fill out contributions of more than

01

To fill out contributions of more than, follow these steps:

02

Start by gathering all the necessary information. This includes the amount of contributions you want to make as well as the recipient's details.

03

Next, check the requirements and guidelines set by the organization or platform where you will be making the contributions.

04

Fill out the necessary forms or online fields with the relevant information. Provide accurate details to ensure the contributions are credited correctly.

05

Review the information provided before submitting the contributions. Double-check the amount, recipient's details, and any other relevant information.

06

Once you are satisfied with the accuracy of the information, submit the contributions.

07

Keep a copy or record of the contribution for your own reference and future tracking purposes.

08

Monitor and verify that the contributions have been successfully received by the intended recipient.

09

If there are any issues or discrepancies, contact the organization or platform's customer support for assistance.

10

Consider setting up automatic contributions or recurring payments, if available, to simplify the process for future contributions.

Who needs contributions of more than?

01

Contributions of more than are typically needed by individuals or organizations who are looking to donate a significant amount of funds or resources.

02

This can include philanthropists, charities, non-profit organizations, businesses, or individuals who wish to make a substantial impact through their contributions.

03

People who are passionate about supporting causes or initiatives that require larger financial assistance may also seek to make contributions of more than.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contributions of more than for eSignature?

To distribute your contributions of more than, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my contributions of more than in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your contributions of more than right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out contributions of more than using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign contributions of more than. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is contributions of more than?

Contributions of more than refer to donations or monetary gifts that exceed a certain threshold.

Who is required to file contributions of more than?

Individuals or organizations who receive contributions of more than a certain amount are required to file.

How to fill out contributions of more than?

Contributions of more than can be filled out by providing details of the donor, amount of contribution, purpose of contribution, and any other required information.

What is the purpose of contributions of more than?

The purpose of contributions of more than is to track and report large donations or gifts that may have an impact on financial transactions or tax obligations.

What information must be reported on contributions of more than?

Information such as the name of the donor, amount of contribution, date of contribution, and purpose of contribution must be reported on contributions of more than.

Fill out your contributions of more than online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contributions Of More Than is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.