KS DoR KS-1520 2015 free printable template

Show details

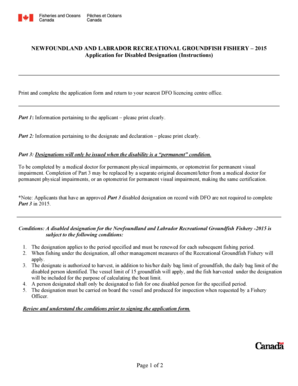

Seller s name and address For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at www. Pub KS-1520 Rev. 1/15 TABLE OF CONTENTS RETAILER RESPONSIBILITIES.. USING EXEMPTION CERTIFICATES. 14 The Cardinal Rule What is an Exemption Certificate Accepting Exemption Certificates Blanket Exemption Certificates Record Keeping ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DoR KS-1520

Edit your KS DoR KS-1520 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DoR KS-1520 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS DoR KS-1520 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KS DoR KS-1520. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR KS-1520 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DoR KS-1520

How to fill out KS DoR KS-1520

01

Gather all necessary personal information, including your name, address, and contact information.

02

Review the instructions provided on the KS DoR KS-1520 form to understand each section's requirements.

03

Fill out section 1 by providing your legal name as it appears on your identification.

04

In section 2, enter your current residence address, ensuring accuracy.

05

Complete section 3 by including any additional details that may be requested, such as date of birth or Social Security number if applicable.

06

Double-check all entered information for errors and completeness.

07

Sign and date the form at the designated area, affirming that the information is correct.

08

Submit the completed form as instructed, either through mail or online, depending on the submission guidelines.

Who needs KS DoR KS-1520?

01

Individuals who are required to provide information related to their residency status in Kansas.

02

Residents applying for certain benefits, licenses, or permits through the Kansas Department of Revenue.

03

Anyone who needs to document their residency for tax purposes in Kansas.

Fill

form

: Try Risk Free

People Also Ask about

Do Kansas sales tax exemption certificates expire?

Any exemption certificate issued to a tax exempt entity contains an expiration date. Expired exemption certificates are not valid for claiming exemptions from sales tax when making purchases from retailers.

How do I get a tax exemption in Kansas?

You will need to: Sign-in or register with the Kansas Department of Revenue Customer Service Center. Select one of the below exemption certificate types. Complete and submit an exemption certificate application.

Does a exemption certificate expire?

Resale certificates in Iowa are valid for up to three years from the original issue.

What is the personal exemption in Kansas?

Kansas taxpayers can claim a personal exemption of $2,250 for themselves, their spouse, and each of their dependents. ( Sec. 79-32,121(a), K.S.A.) The state allows an additional exemption allowance of $2,250 for taxpayers who have a filing status of head of household, effective for tax years beginning before 2023.

How do I file for tax-exempt status in Kansas?

You will need to: Sign-in or register with the Kansas Department of Revenue Customer Service Center. Select one of the below exemption certificate types. Complete and submit an exemption certificate application.

What is exempt from the Kansas Department of Revenue?

WHAT PURCHASES ARE EXEMPT? Only goods or merchandise intended for resale (inventory) are exempt. Tools, equipment, fixtures, supplies, and other items purchased for business or personal use are TAXABLE since the buyer is the final consumer of the property.

How do I get a sales tax permit in Kansas?

To register for and pay your business taxes, you will need to set up an account with the Kansas Department of Revenue Customer Service Center. You can do so by clicking the "Customer Service Center" link at the top of the website and following the directions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out KS DoR KS-1520 using my mobile device?

Use the pdfFiller mobile app to fill out and sign KS DoR KS-1520 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit KS DoR KS-1520 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like KS DoR KS-1520. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out KS DoR KS-1520 on an Android device?

On Android, use the pdfFiller mobile app to finish your KS DoR KS-1520. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is KS DoR KS-1520?

KS DoR KS-1520 is a form used in Kansas for reporting certain tax information and compliance data to the Kansas Department of Revenue.

Who is required to file KS DoR KS-1520?

Any entity or individual that is subject to Kansas tax laws and regulations may be required to file KS DoR KS-1520, depending on their specific tax obligations.

How to fill out KS DoR KS-1520?

To fill out KS DoR KS-1520, taxpayers should enter their identification details, report required financial information accurately, and ensure they follow any specific instructions provided by the Kansas Department of Revenue.

What is the purpose of KS DoR KS-1520?

The purpose of KS DoR KS-1520 is to facilitate the accurate reporting of tax-related information to ensure compliance with state tax laws and to aid in the assessment and collection of taxes.

What information must be reported on KS DoR KS-1520?

The information that must be reported on KS DoR KS-1520 typically includes tax identification numbers, income details, deductions, credits, and any other relevant financial data as required by the form's instructions.

Fill out your KS DoR KS-1520 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DoR KS-1520 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.