Get the free SSA / IRS Reporter - ssa

Show details

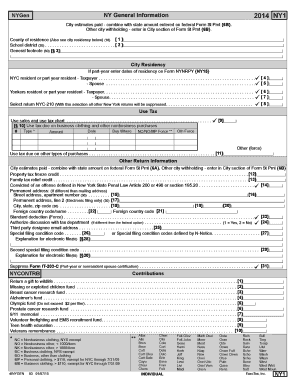

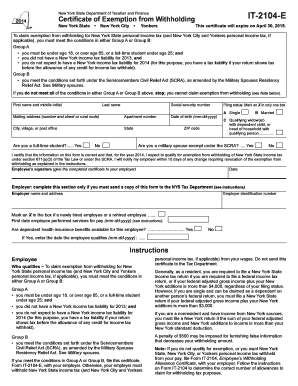

Reporter SSA / IRS Social Security Administration Internal Revenue Service Inside this Issue. Form 8955-SSA Page 2 Simple Cafeteria Plans for Small Employers Correct Paperwork for Hiring a New Employee Page 3 APA s National Payroll Week Web Site APA Seminar/Webinar Preparing for Year-End and 2011 The Taxpayer Advocate Service Your Voice at the IRS Page 4 Tax Help and Guidance for Oil Spill Victims HIRE Act Questions and Answers for Employers Fall 2010 A Newsletter for Employers IRS Reaches...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ssa irs reporter

Edit your ssa irs reporter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssa irs reporter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ssa irs reporter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ssa irs reporter. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ssa irs reporter

How to fill out SSA / IRS Reporter

01

Gather all relevant financial documents such as income statements and tax records.

02

Access the SSA / IRS Reporter form, either online or in printed format.

03

Fill in your personal identification information, including your Social Security Number and contact details.

04

Report your income accurately in the designated sections, ensuring all figures are correct.

05

Include any applicable deductions or credits that you may qualify for based on your financial situation.

06

Double-check all entries for accuracy and completeness before submission.

07

Submit the completed SSA / IRS Reporter to the appropriate agency as instructed on the form.

Who needs SSA / IRS Reporter?

01

Individuals who receive Social Security benefits and need to report their income.

02

Self-employed individuals who must report their earnings for tax purposes.

03

Taxpayers who qualify for certain deductions or credits related to their income.

04

Anyone who has received a notification from SSA or IRS requesting income reporting.

Fill

form

: Try Risk Free

People Also Ask about

Does IRS communicate with SSA?

The IRS may therefore share information with SSA about Social Security and Medicare tax liability if necessary to establish the taxpayer's liability.

How often does the IRS report to SSA?

SSA collects wage data from two main sources: Forms 941, processed by IRS, provide wage data by employer by calendar quarter. IRS sends the processed data to SSA four times per year. W-2s, processed by SSA, provide individuals' wage information by calendar year.

How long does SSA take to process W2?

How long does it take for the IRS/SSA to process my 1099/W-2 returns? 24-48 hours is the typical turnaround time for form acceptance. However, during the deadline season, the time frame could range from 48 hours to 96 hours due to the extreme volume of filings being processed.

Can IRS go after Social Security benefits?

All taxpayers with outstanding tax debts are subject to a levy on assets and income sources, including Social Security benefits. There are two ways the IRS may levy upon your Social Security benefits – via the automated Federal Payment Levy Program (FPLP) or by a manual (non-FPLP) levy.

How often does Social Security check your income?

Each year, we review the records of all Social Security beneficiaries who have wages reported for the previous year. If your latest year of earnings is one of your highest years of earnings, we recalculate your benefit and pay you any increase you are due.

Does SSA talk to IRS?

The IRS/SSA Reconciliation Process compares the employer's earnings report data processed by SSA with the employer's tax report data processed by IRS. Earnings report data and tax report data, are submitted to SSA and IRS by employers, their representatives, third parties, and agents.

Does the IRS and SSA share information?

Each year employers and the Internal Revenue Service ( IRS ) send information to the Social Security Administration ( SSA ) on the earnings of the U.S. working population.

How often does the IRS report to Social Security?

Each year employers and the Internal Revenue Service ( IRS ) send information to the Social Security Administration ( SSA ) on the earnings of the U.S. working population.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SSA / IRS Reporter?

The SSA / IRS Reporter is a form used to report employee wages and taxes withheld to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

Who is required to file SSA / IRS Reporter?

Employers who have employees and are required to report wages and withholdings for Social Security and Medicare taxes must file the SSA / IRS Reporter.

How to fill out SSA / IRS Reporter?

To fill out the SSA / IRS Reporter, employers need to enter information such as employee details, wages paid, and taxes withheld. It involves completing the designated sections of the form accurately and submitting it by the appropriate deadlines.

What is the purpose of SSA / IRS Reporter?

The purpose of the SSA / IRS Reporter is to ensure accurate reporting of wages and taxes to facilitate the correct calculation of Social Security benefits and compliance with federal tax obligations.

What information must be reported on SSA / IRS Reporter?

The SSA / IRS Reporter must include information such as employee name, Social Security number, total wages earned, and the amount of federal income tax withheld, as well as Social Security and Medicare tax withholdings.

Fill out your ssa irs reporter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ssa Irs Reporter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.