Get the free Charitable Gift Transfer Letter of Authorization

Show details

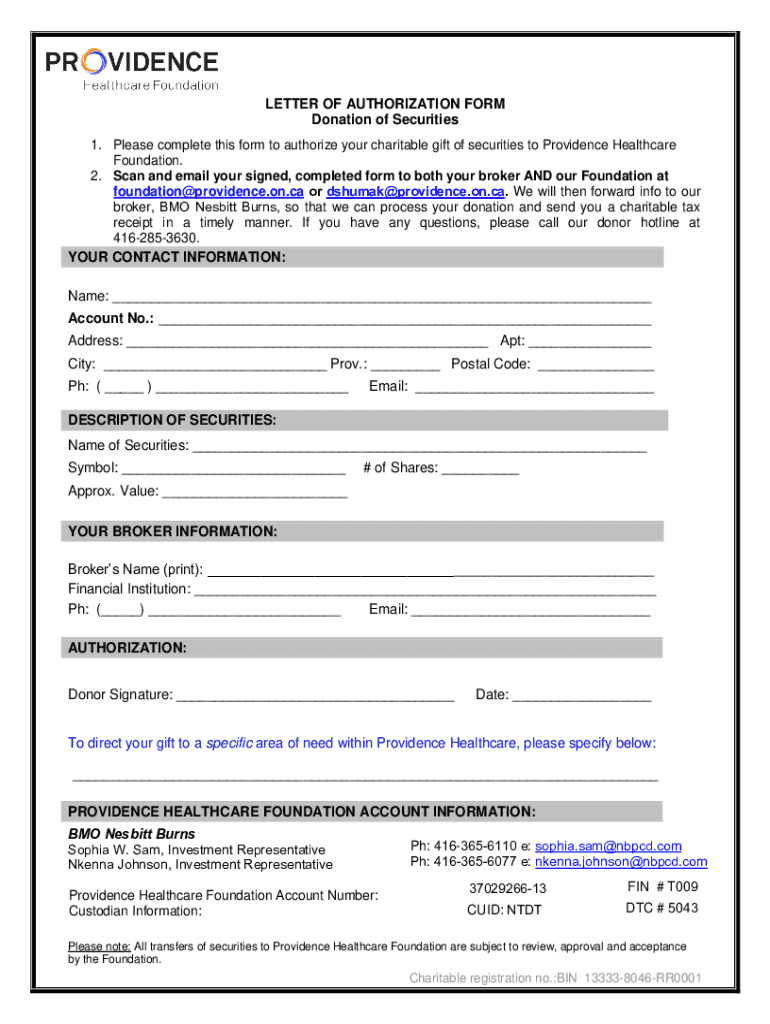

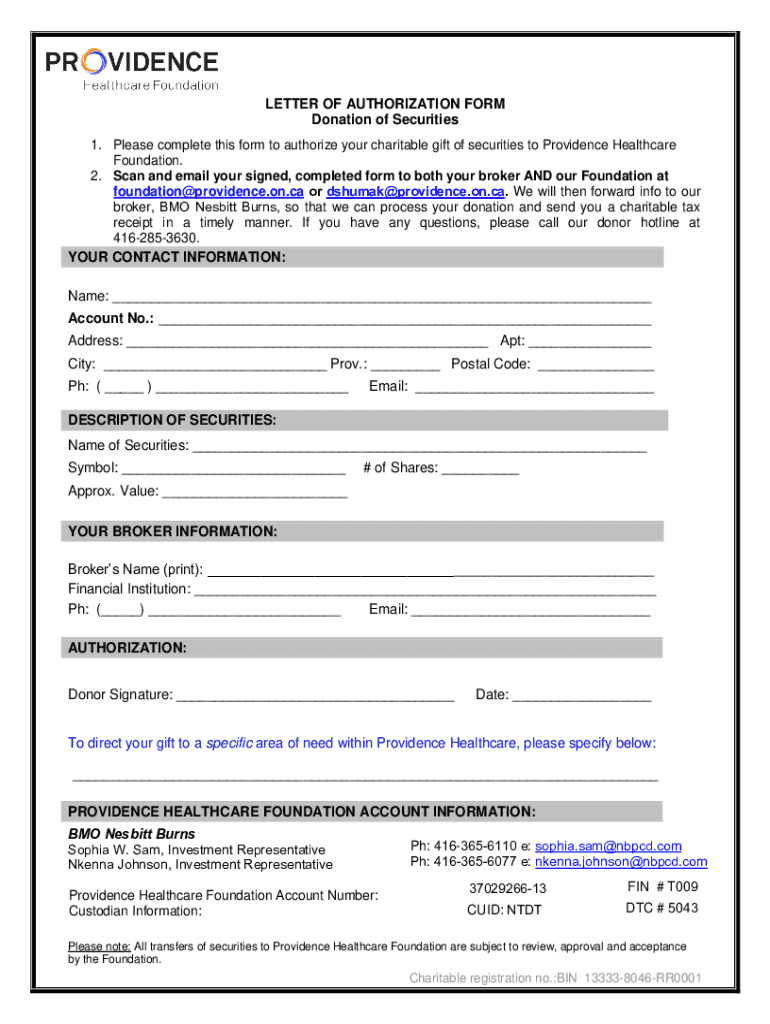

LETTER OF AUTHORIZATION FORM

Donation of Securities

1. Please complete this form to authorize your charitable gift of securities to Providence Healthcare

Foundation.

2. Scan and email your signed,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable gift transfer letter

Edit your charitable gift transfer letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable gift transfer letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable gift transfer letter online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charitable gift transfer letter. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable gift transfer letter

How to fill out charitable gift transfer letter

01

Step 1: Start by addressing the letter. Include your name, address, and contact information at the top of the letter.

02

Step 2: Write a brief introduction explaining your intention to make a charitable gift transfer. State the purpose of the letter and the organization or charity you wish to transfer the gift to.

03

Step 3: Include details about the gift you wish to transfer. Specify the type of gift (cash, stocks, property, etc.), the estimated value, and any specific instructions regarding the use of the gift.

04

Step 4: Provide your contact information and alternative contact person details. This can be helpful in case the recipient needs to reach out to you for further clarification or verification.

05

Step 5: Close the letter with a polite and sincere thank you. Express your gratitude for the recipient's time and consideration in accepting your charitable gift transfer.

06

Step 6: Sign the letter and include any necessary supporting documents or forms required by the organization or charity for processing the gift transfer.

Who needs charitable gift transfer letter?

01

Individuals who wish to make a charitable donation

02

Organizations or charities that accept donations

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit charitable gift transfer letter online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your charitable gift transfer letter to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out charitable gift transfer letter using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign charitable gift transfer letter and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit charitable gift transfer letter on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share charitable gift transfer letter from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is charitable gift transfer letter?

A charitable gift transfer letter is a document that outlines the specifics of a donation made to a charitable organization, detailing the donor's intent, the assets donated, and the recipient organization.

Who is required to file charitable gift transfer letter?

Individuals or entities that make significant charitable contributions, usually exceeding a certain threshold, are required to file a charitable gift transfer letter for tax reporting purposes.

How to fill out charitable gift transfer letter?

To fill out a charitable gift transfer letter, you need to include your personal information, details about the charitable organization, the nature and value of the gift, and any relevant tax identification numbers.

What is the purpose of charitable gift transfer letter?

The purpose of a charitable gift transfer letter is to provide documentation of donations for tax purposes, ensuring that both the donor and the recipient organization can accurately report the gift.

What information must be reported on charitable gift transfer letter?

The information that must be reported includes the donor's name and address, the charity's name and address, a description of the gift, the fair market value of the gift, and the date of the transfer.

Fill out your charitable gift transfer letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Gift Transfer Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.