Get the free Payment Due Upon Receipt - Invoice Payment Term Made Clear

Show details

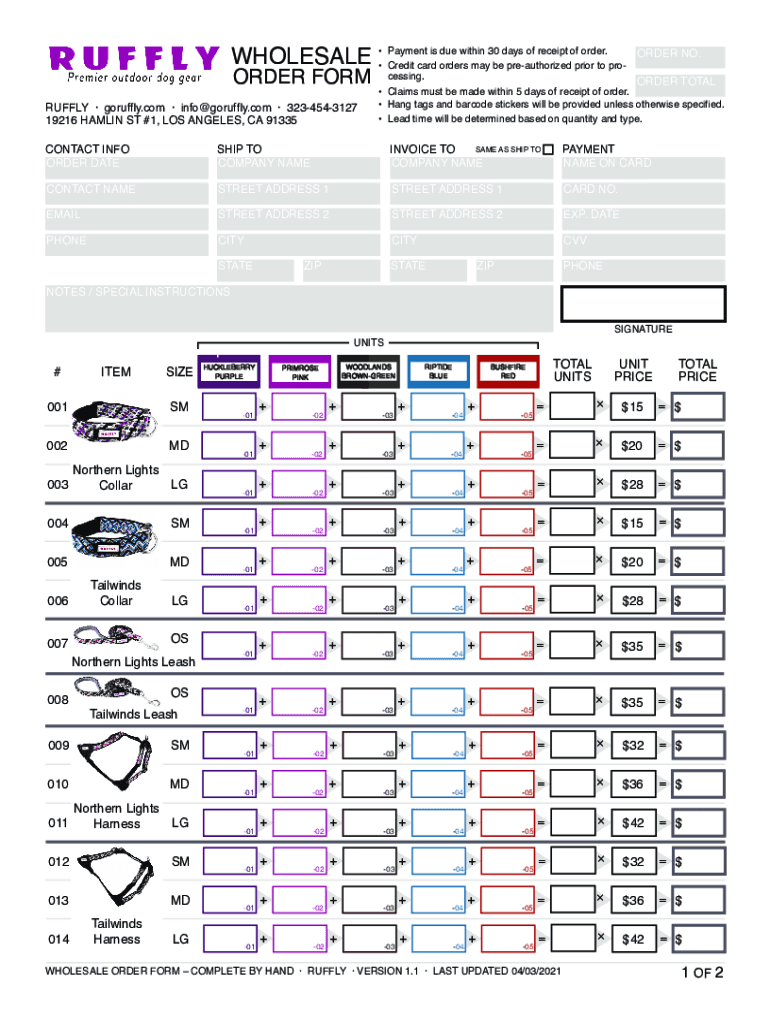

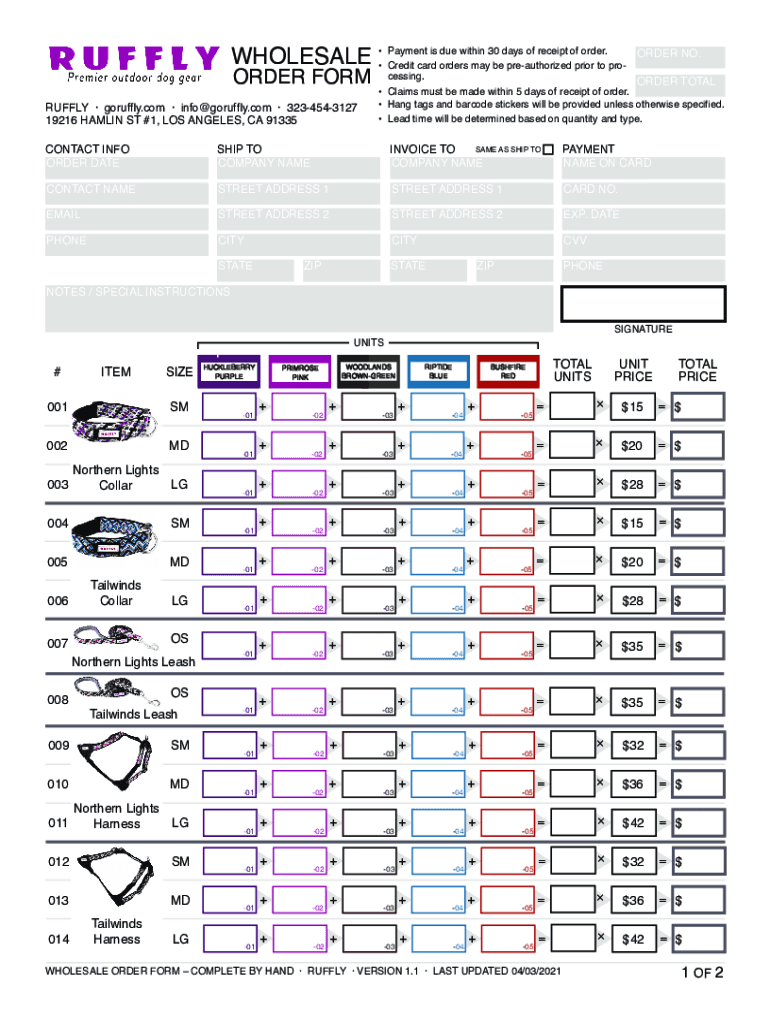

Is due within 30 days of receipt of order. WHOLESALE Payment Credit card orders may be preauthorized prior to preorder FORMRUFFLY goruffly.com info goruffly.com 3234543127 19216 HAMLIN ST #1, LOS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment due upon receipt

Edit your payment due upon receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment due upon receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment due upon receipt online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payment due upon receipt. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment due upon receipt

How to fill out payment due upon receipt

01

To fill out payment due upon receipt, follow these steps:

02

Start by writing the date at the top of the payment due upon receipt form.

03

Provide your business name, address, and contact information on the form.

04

Enter the recipient's name and address who will be responsible for making the payment.

05

Specify the payment amount that is due upon receipt.

06

Clearly state the payment terms, such as the accepted forms of payment and any late fees or penalties for non-payment.

07

Include any additional information or instructions if necessary, such as a reference number or invoice details.

08

Sign and date the form to confirm its validity.

09

Make a copy of the completed payment due upon receipt form for your records.

10

Provide the form to the recipient, either in person, by mail, or electronically, depending on your preferred method of delivery.

Who needs payment due upon receipt?

01

Payment due upon receipt is commonly used by businesses or individuals who want immediate payment for their goods or services.

02

Some specific examples of who needs payment due upon receipt are:

03

- Small businesses that rely on cash flow to sustain their operations

04

- Freelancers or independent contractors who provide services on a project basis

05

- Online sellers who want to ensure timely payment before shipping the goods

06

- Service providers who offer one-time services or consultations

07

- Vendors or suppliers who want to establish clear payment expectations

08

- Individuals who are selling high-value items and want to protect their interests

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the payment due upon receipt electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your payment due upon receipt.

How do I edit payment due upon receipt on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute payment due upon receipt from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete payment due upon receipt on an Android device?

On an Android device, use the pdfFiller mobile app to finish your payment due upon receipt. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is payment due upon receipt?

Payment due upon receipt is a payment term where the amount is to be paid immediately when the goods or services are received.

Who is required to file payment due upon receipt?

Any entity or individual who is providing goods or services and specifying payment due upon receipt to the recipient.

How to fill out payment due upon receipt?

To fill out payment due upon receipt, the seller should include the payment terms on the invoice or payment agreement given to the buyer.

What is the purpose of payment due upon receipt?

The purpose of payment due upon receipt is to ensure timely payment for goods or services provided.

What information must be reported on payment due upon receipt?

The payment due date, invoice number, description of goods or services, and payment amount must be reported on payment due upon receipt.

Fill out your payment due upon receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Due Upon Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.