Get the free Personal Financial Statement - Irvine Company Office

Show details

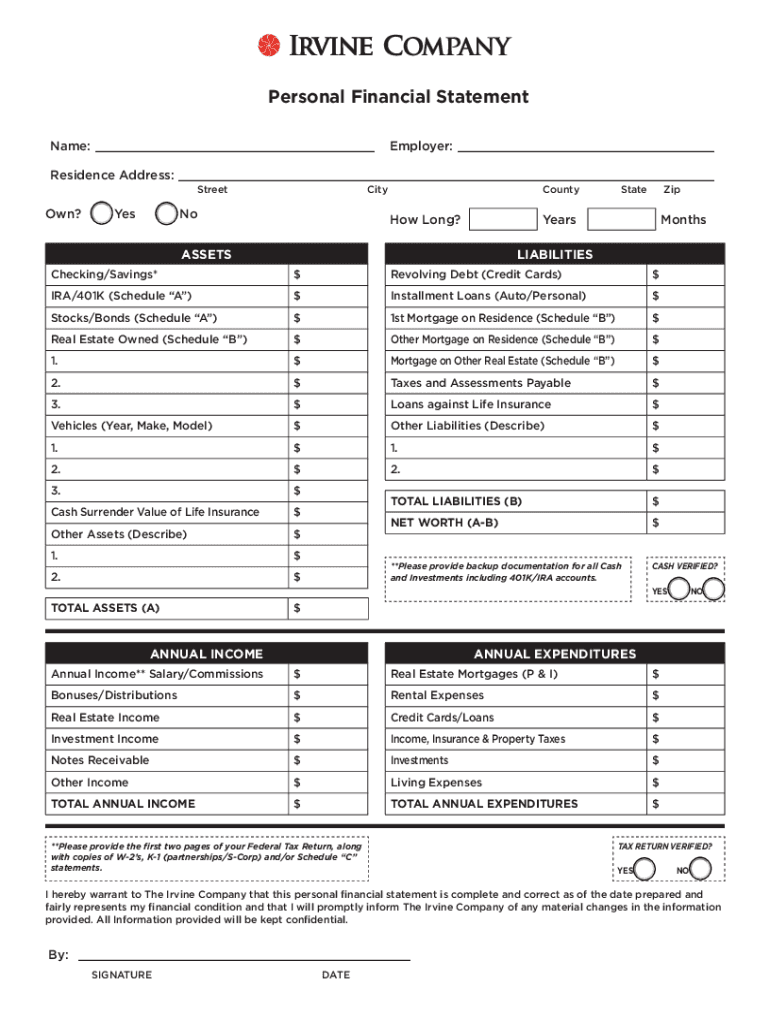

Personal Financial Statement Name: Employer: Residence Address: StreetCityOwn? YesNoCountyHow Long? StateZipYearsASSETSMonthsLIABILITIESChecking/Savings×revolving Debt (Credit Cards)$IRA/401K (Schedule

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal financial statement online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal financial statement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out personal financial statement

01

To fill out a personal financial statement, follow these steps:

02

Gather all your financial documents, such as bank statements, investment statements, tax returns, and pay stubs.

03

Create a list of your assets, including cash, savings, investments, real estate, vehicles, and any valuable possessions.

04

Determine the value of each asset based on current market prices or appraisals.

05

Calculate your liabilities by listing all your debts, such as credit card balances, loans, mortgages, and outstanding bills.

06

Provide detailed information about each liability, including the balance owed, interest rate, and monthly payment.

07

Subtract your total liabilities from your total assets to calculate your net worth.

08

Fill out the sections for income and expenses, including your sources of income, monthly expenses, and any additional financial information.

09

Review the completed personal financial statement for accuracy and make any necessary corrections or updates.

10

Sign and date the statement to certify its accuracy.

11

Keep a copy of the personal financial statement for your records.

Who needs personal financial statement?

01

Anyone who wants to gain a clear understanding of their financial situation needs a personal financial statement.

02

Some specific groups who may need a personal financial statement include:

03

- Individuals applying for a loan or mortgage: Lenders often require a personal financial statement to assess an individual's ability to repay the loan.

04

- Entrepreneurs and business owners: A personal financial statement is useful for managing personal and business finances, especially when seeking funding or investors.

05

- Individuals going through a divorce or legal proceedings: A personal financial statement helps provide an accurate overview of an individual's assets and liabilities during asset division or settlement discussions.

06

- Estate planners: Personal financial statements assist in estate planning by determining the value of assets and liabilities to plan for inheritances, taxes, and asset distribution.

07

- Financial advisors and planners: These professionals use personal financial statements to provide comprehensive financial advice and recommendations.

08

- Individuals aiming for financial growth and stability: Regularly updating a personal financial statement allows individuals to track their progress, set financial goals, and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my personal financial statement in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your personal financial statement as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out personal financial statement using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign personal financial statement and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete personal financial statement on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your personal financial statement. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is personal financial statement?

A personal financial statement is a document that provides an individual's financial information, including assets, liabilities, income, and expenses.

Who is required to file personal financial statement?

Public officials and high-ranking government employees are often required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, one must gather information on all assets, liabilities, income, and expenses, and then accurately record these details in the designated sections of the statement form.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide transparency about an individual's financial situation and to identify any potential conflicts of interest.

What information must be reported on personal financial statement?

Information such as real estate holdings, investment accounts, debts, sources of income, and major expenses must be reported on a personal financial statement.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.