Get the free Gifting Business Interests: Will the Parent's Tax ...

Show details

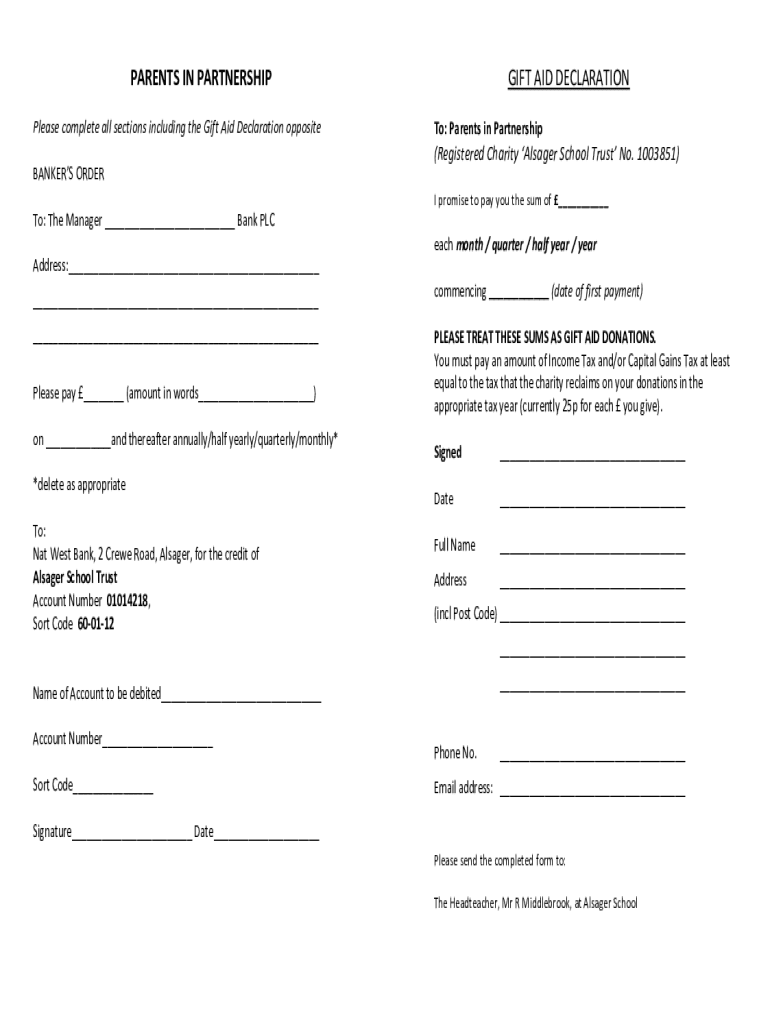

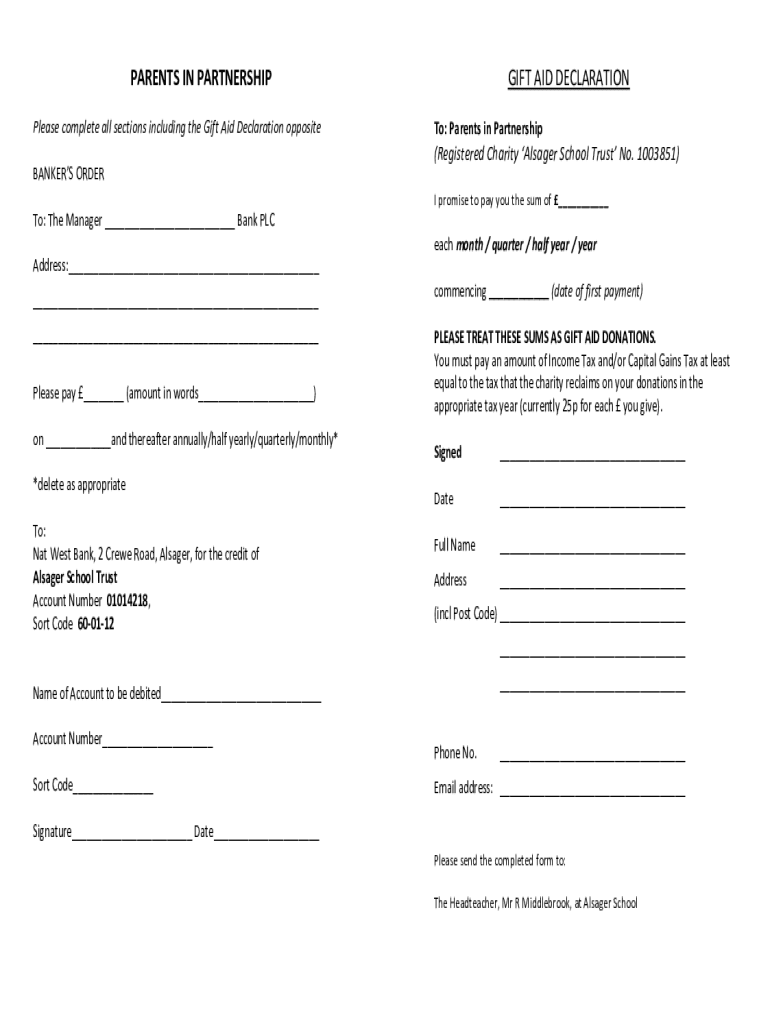

PARENTS IN PARTNERSHIP Please complete all sections including the Gift Aid Declaration opposite BANKERS ORDERING AID DECLARATION To: Parents in Partnership(Registered Charity Alsager School Trust

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifting business interests will

Edit your gifting business interests will form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifting business interests will form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifting business interests will online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gifting business interests will. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifting business interests will

How to fill out gifting business interests will

01

To fill out a gifting business interests will, follow these steps:

02

Start by gathering all necessary documents and information related to your business interests, including ownership records, financial statements, and any existing agreements or contracts.

03

Determine the value of your business interests by consulting with a professional appraiser or using other accepted valuation methods.

04

Consult with an attorney who specializes in estate planning to ensure that your gifting business interests will aligns with applicable laws and regulations.

05

Clearly state your intention to gift your business interests in your will, including the specific details of what you are gifting and to whom.

06

Consider including any restrictions or conditions on the gifted business interests, such as limitations on transferring or selling the interests.

07

Specify an executor or trustee who will be responsible for administering your gifting business interests will and ensure they have the necessary authority to do so.

08

Review and finalize your gifting business interests will with your attorney, making any necessary revisions or additions.

09

Sign your gifting business interests will in the presence of witnesses, as required by applicable laws.

10

Store your gifting business interests will in a safe and secure location, such as a lawyer's office or a trusted bank vault.

11

Regularly review and update your gifting business interests will as needed, especially if there are any significant changes to your business or personal circumstances.

Who needs gifting business interests will?

01

Various individuals and entities may require a gifting business interests will, including:

02

- Business owners who wish to pass on their business interests to specific individuals or organizations upon their death.

03

- Family members or loved ones who have been involved in the business and are designated as beneficiaries of the gifted interests.

04

- Investors or partners who have a vested interest in the business and need a clear understanding of how their interests will be handled in the event of the owner's death.

05

- Attorneys or estate planners who assist clients in creating comprehensive estate plans that encompass gifting business interests.

06

- Financial institutions or lenders who may require a gifting business interests will as part of loan or investment agreements.

07

- Potential buyers or acquirers of the business who want assurance that the owner's interests can be transferred in a smooth and legally-compliant manner in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gifting business interests will to be eSigned by others?

When you're ready to share your gifting business interests will, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my gifting business interests will in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your gifting business interests will directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit gifting business interests will on an Android device?

You can make any changes to PDF files, such as gifting business interests will, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is gifting business interests will?

Gifting business interests will involves transferring ownership of a business or shares in a business to another individual or entity.

Who is required to file gifting business interests will?

The individual or entity gifting the business interests is required to file the gifting business interests will.

How to fill out gifting business interests will?

To fill out a gifting business interests will, you must provide information about the business being gifted, the recipient of the gift, and any relevant financial details.

What is the purpose of gifting business interests will?

The purpose of gifting business interests will is to legally transfer ownership of a business or shares in a business to another party.

What information must be reported on gifting business interests will?

Information such as the value of the business interests being gifted, any relevant financial details, and the relationship between the gifter and the recipient must be reported on gifting business interests will.

Fill out your gifting business interests will online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifting Business Interests Will is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.