Get the free Down Payment & Closing Cost Assistance Request for Service - homehq

Show details

This document outlines the application process for the Down Payment and Closing Cost Assistance Program by Home HeadQuarters, detailing requirements such as education courses, necessary documents,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign down payment closing cost

Edit your down payment closing cost form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your down payment closing cost form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit down payment closing cost online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit down payment closing cost. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out down payment closing cost

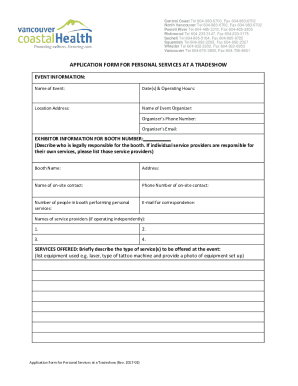

How to fill out Down Payment & Closing Cost Assistance Request for Service

01

Gather necessary documents, such as proof of income and bank statements.

02

Obtain the Down Payment & Closing Cost Assistance Request form from the relevant housing authority or website.

03

Fill out the form with accurate personal information, including your name, address, and contact details.

04

Specify the requested amount for down payment and closing costs.

05

Attach the required supporting documents as outlined in the instructions.

06

Review the completed form for any errors or missing information.

07

Submit the form via the specified method (online, by mail, or in person) before the deadline.

Who needs Down Payment & Closing Cost Assistance Request for Service?

01

First-time homebuyers looking for financial assistance.

02

Individuals or families with low to moderate income.

03

Those unable to afford the up-front costs of purchasing a home.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum credit score for Chenoa DPA?

CBC Mortgage Agency adheres to industry standards when determining the credit score to apply for Chenoa Fund™ down payment assistance. The minimum acceptable credit score is 600.

Is it worth getting down payment assistance?

Whether down payment assistance is worth it depends on your situation. If saving for a down payment seems unreachable, these programs may be a game-changer for you. However, you'll need to weigh the potential long-term costs of higher monthly payments or interest rates.

What is the minimum FICO score for DPA?

Pathway To Purchase DPA While you don't need to be a first-time homebuyer, there are several requirements to meet: Maximum purchase price for a home is set at $371,936. The first mortgage loan must be 95% or less of the home's value. A minimum FICO score of 640 is required.

Can you really get an FHA loan with a 500 credit score?

Applicants who have a minimum credit score of less than 500 are not eligible for FHA mortgages. Those with credit scores of 500 or better are eligible for 100% FHA loan financing with no down payment required when using the FHA 203(h), Mortgage Insurance for Disaster Victims.

What credit score is needed for DPA?

Down payment assistance is any grant or loan that helps homebuyers put more cash down up front. It may come from a government agency, private lender or other organization. These programs typically have eligibility requirements, such as a minimum credit score or a maximum purchase price.

What credit score is needed for a down payment?

Most lenders want to see at least a 620 FICO score for a conventional mortgage. You can get a FHA loan with a score as low as 500, however, if you can put 10% down.

What is the $35000 down payment assistance program in Florida?

The Pathway DPA program stands out from other California down payment assistance options for several reasons: Lower Credit Score Requirements: Most programs require a 640+ credit score, but Pathway DPA allows buyers with scores as low as 580 to qualify.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Down Payment & Closing Cost Assistance Request for Service?

The Down Payment & Closing Cost Assistance Request for Service is a application process designed to help eligible homebuyers secure financial assistance for the down payment and closing costs associated with purchasing a home.

Who is required to file Down Payment & Closing Cost Assistance Request for Service?

Individuals or families seeking financial assistance for their home purchase who meet specific eligibility criteria set by the assistance program are required to file this request.

How to fill out Down Payment & Closing Cost Assistance Request for Service?

To fill out the request, applicants need to provide their personal information, financial details, the property address, and any additional documentation required by the assistance program.

What is the purpose of Down Payment & Closing Cost Assistance Request for Service?

The purpose of the request is to facilitate access to financial aid that helps homebuyers cover initial costs, making homeownership more attainable by reducing the financial burden at the time of purchase.

What information must be reported on Down Payment & Closing Cost Assistance Request for Service?

The request must report personal identification details, income information, asset information, the intended property details, and any other relevant financial data necessary to assess eligibility for assistance.

Fill out your down payment closing cost online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Down Payment Closing Cost is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.