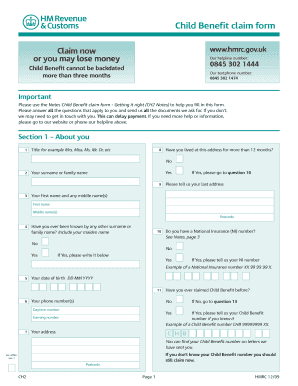

UK HMRC CH2 2021 free printable template

Show details

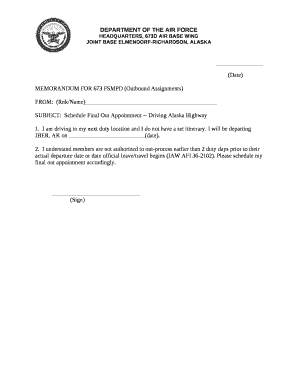

Child Benefit claim form Fill in this form if you or your partner are responsible for a child, even if you decide not to get Child Benefit payments should fill in this form either you or your partner

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign child benefit form online

Edit your child benefit form online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your child benefit form online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit child benefit form online online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit child benefit form online. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC CH2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out child benefit form online

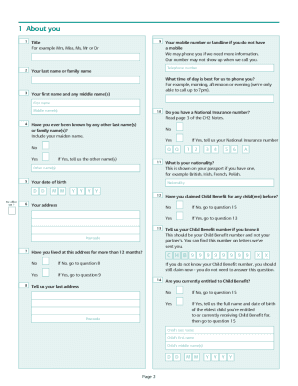

How to fill out UK HMRC CH2

01

Obtain the UK HMRC CH2 form from the HMRC website or local tax office.

02

Fill in your personal details, including your name, address, and National Insurance number.

03

Provide details of your employment status and income.

04

Indicate any applicable tax reliefs or allowances you wish to claim.

05

Carefully review the completed form for accuracy.

06

Sign and date the form to validate it.

07

Submit the form to the appropriate HMRC office, either by post or online.

Who needs UK HMRC CH2?

01

Individuals who need to claim tax relief on expenses related to their employment.

02

Those who have incurred costs for work-related expenses not reimbursed by their employer.

03

Employees who are self-assessing their income for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim Child Benefit?

You can claim Child Benefit if: you're 'responsible for the child' the child is under 16 years old - or 16 to 20 years old and still in education or training.

How do I get CH2 form?

Form CH2 is the child benefit claim form. There are 3 main ways to obtain a claim form: In the bounty pack that is given to new mothers in hospital. From the child benefit helpline (0300 200 3100;NGT text relay if you cannot hear or speak on the phone: dial 18001 then 0300 200 3100 ; and overseas +441612103086)

Is it better for mom or dad to claim baby?

If you are married, in most cases it is more beneficial to file jointly and claim your children as dependents. If you are not married or if you decide to file as Married filing separately. it is usually more beneficial for the parent with the higher income to claim the children.

How far back can I claim Child Benefit?

Your Child Benefit will be backdated to when the child was born - up to a maximum of 3 months - so you won't miss out on payments.

How much is child benefit in Canada per month?

Based on CCB payments in 2021, you could receive a maximum of: $6,833 per year ($569.41 per month) for each eligible child under the age of 6. $5,765 per year ($480.41 per month) for each eligible child aged 6 to 17.

Which parent should claim child on taxes if not married?

Only one parent can claim the children as dependents on their taxes if the parents are unmarried. Either unmarried parent is entitled to the exemption, so long as they support the child. Typically, the best way to decide which parent should claim the child is to determine which parent has the higher income.

Where can I get a CH2 form?

Form CH2 is the child benefit claim form. There are 3 main ways to obtain a claim form: In the bounty pack that is given to new mothers in hospital. From the child benefit helpline (0300 200 3100;NGT text relay if you cannot hear or speak on the phone: dial 18001 then 0300 200 3100 ; and overseas +441612103086)

What are CH2 notes?

Use these notes to help you fill in the Child Benefit claim form. We have a range of services for disabled people. These include guidance in Braille, audio and large print (most of our forms are also available in large print).

What benefits do you get when have a child?

What can I claim when I have a child? Child Benefit. Universal Credit. Child Tax Credit. Income Support. Housing Benefit. Council Tax Reduction. Sure Start Maternity Grant. Healthy Start Scheme.

Can I claim child benefit?

Only one person can get Child Benefit for a child. You normally qualify for Child Benefit if you're responsible for a child under 16 (or under 20 if they stay in approved education or training) and you live in the UK.

Which parent is best to claim child benefit?

Either of you can claim Child Benefit. If one of you isn't working, it's best for them to make the claim. This is because they'll get National Insurance contributions which will improve their state pension amount.

How do I get a Child Benefit form UK?

If you cannot find the information online you can phone the Child Benefit helpline on 0300 200 3100 or use Relay UK (if you cannot hear or speak on the phone) dial 18001 then 0300 200 3100. 1 Do you have a National Insurance number? Read page 3 of the CH2 Notes.

Which parent should claim child on taxes to get more money?

It's up to you. Since he qualifies as a qualifying child for each of you, either parent may claim the child as a dependent. If you can't decide, the dependency claim goes to whichever of you reports the higher Adjusted Gross Income on your separate tax return.

What happens if 2 parents claim the same child?

If you do not file a joint return with your child's other parent, then only one of you can claim the child as a dependent. When both parents claim the child, the IRS will usually allow the claim for the parent that the child lived with the most during the year.

How far back can you claim child benefit?

Your Child Benefit will be backdated to when the child was born - up to a maximum of 3 months - so you won't miss out on payments.

What are the benefits of having a child in Canada?

Canada Child Benefits include the Canada Child Tax Benefit (CCTB), the Universal Child Care Benefit (UCCB), the GST/HST credit, and any related provincial/territorial programs that the CRA administers. To access health-care services, your provincial or territorial government issues a health card for your baby.

How much is the Canada Child Benefit 2022?

For the 2022–23 benefit year, families most in need can receive up to $6,997 per child under the age of six and $5,903 per child aged six through 17. The Canada Child Benefit was introduced in 2016 and is a key component of the Government of Canada's Affordability Plan.

What benefits can you get if you have children?

What can I claim when I have a child? Child Benefit. Universal Credit. Child Tax Credit. Income Support. Housing Benefit. Council Tax Reduction. Sure Start Maternity Grant. Healthy Start Scheme.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in child benefit form online without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit child benefit form online and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit child benefit form online on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign child benefit form online right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete child benefit form online on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your child benefit form online. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is UK HMRC CH2?

UK HMRC CH2 is a form used by individuals and businesses to report changes to their circumstances that may affect their tax obligations.

Who is required to file UK HMRC CH2?

Individuals and businesses who need to report a change in their tax circumstances to HMRC are required to file UK HMRC CH2.

How to fill out UK HMRC CH2?

To fill out UK HMRC CH2, provide accurate information regarding your personal details, the changes being reported, and any relevant financial information, ensuring to follow the instructions outlined by HMRC.

What is the purpose of UK HMRC CH2?

The purpose of UK HMRC CH2 is to ensure that HMRC is updated with any significant changes that could impact an individual's or business's tax status, allowing for accurate tax assessments.

What information must be reported on UK HMRC CH2?

Information that must be reported on UK HMRC CH2 includes personal identification details, the specific changes in circumstances, and any financial information related to these changes.

Fill out your child benefit form online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Benefit Form Online is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.