MS 89-105-20-3-1-000 2020-2025 free printable template

Show details

Form 891052031000 (Rev. 09/20)Mississippi06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ms withholding tax return form

Edit your mississippi 891052031000 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mississippi 891052031000 doc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mississippi withholding tax return online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mississippi withholding tax return. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mississippi withholding tax return

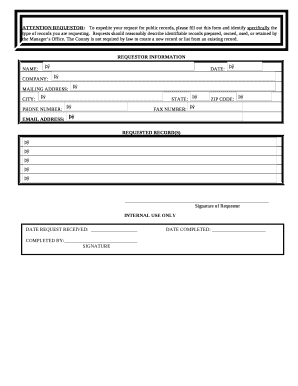

How to fill out MS 89-105-20-3-1-000

01

Gather all necessary personal and financial information needed for the form.

02

Start filling out the form by entering your personal details in the required fields.

03

Proceed to fill in the financial information accurately, ensuring all figures are correct.

04

Review any specific instructions for each section of the form to ensure compliance.

05

Double-check all entered information for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed form according to the designated submission guidelines.

Who needs MS 89-105-20-3-1-000?

01

Individuals applying for a specific service related to MS 89-105-20-3-1-000.

02

Organizations or entities that must comply with regulations requiring this form.

03

Government agencies involved in processing applications that require this form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mississippi withholding tax return to be eSigned by others?

When you're ready to share your mississippi withholding tax return, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete mississippi withholding tax return online?

pdfFiller has made it simple to fill out and eSign mississippi withholding tax return. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the mississippi withholding tax return form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign mississippi withholding tax return and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MS 89-105-20-3-1-000?

MS 89-105-20-3-1-000 is a specific form used for reporting designated financial information in compliance with regulatory requirements.

Who is required to file MS 89-105-20-3-1-000?

Entities or individuals who meet certain criteria set by the regulatory authority and are subject to the financial reporting standards are required to file MS 89-105-20-3-1-000.

How to fill out MS 89-105-20-3-1-000?

To fill out MS 89-105-20-3-1-000, follow the instructions provided in the accompanying guidelines, ensuring all sections are completed accurately and all required information is included.

What is the purpose of MS 89-105-20-3-1-000?

The purpose of MS 89-105-20-3-1-000 is to facilitate the collection of financial data for analysis and compliance monitoring by regulatory authorities.

What information must be reported on MS 89-105-20-3-1-000?

The information that must be reported on MS 89-105-20-3-1-000 typically includes financial statements, disclosures, and other relevant data as specified by the filing guidelines.

Fill out your mississippi withholding tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mississippi Withholding Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.