Get the free Promissory Note Application - Central District - lcccentral

Show details

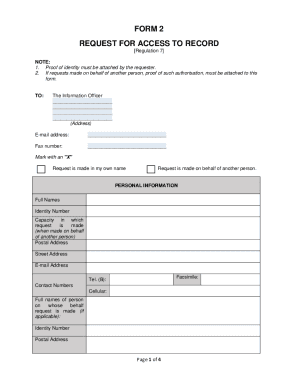

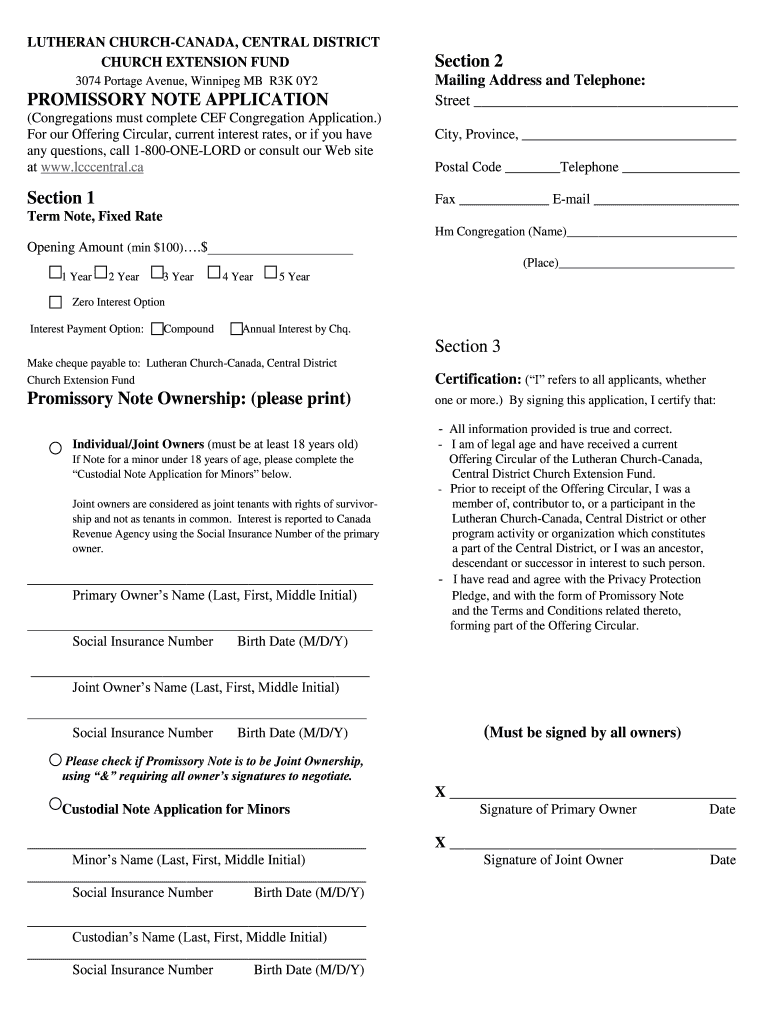

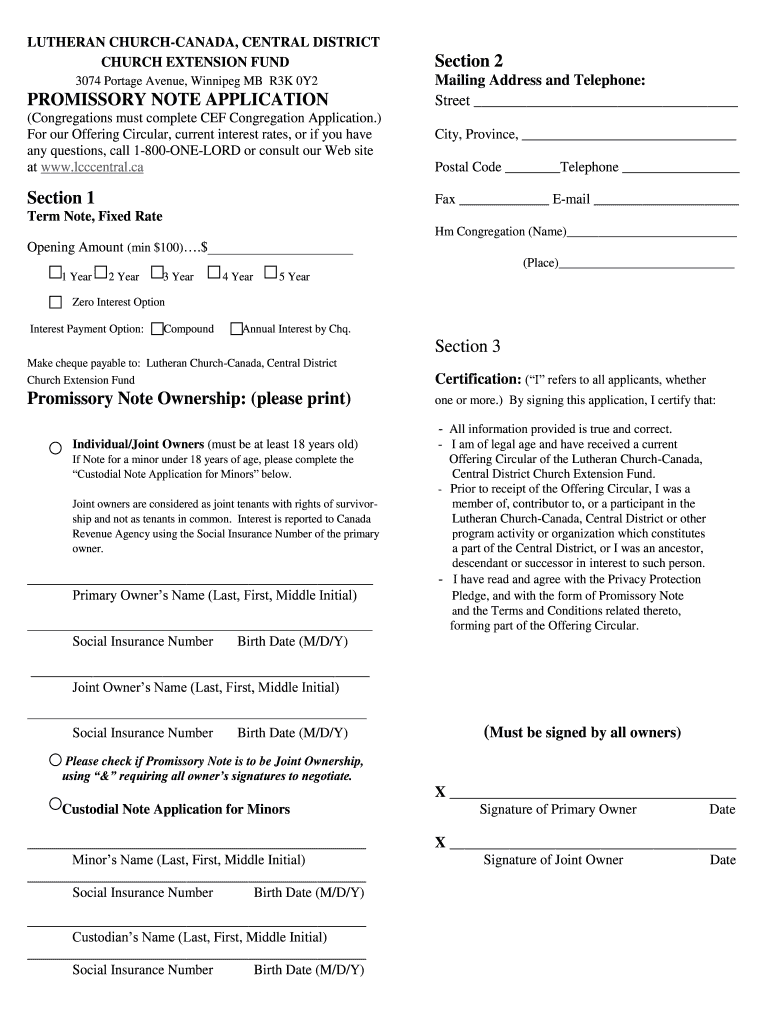

LUTHERAN CHURCH-CANADA, CENTRAL DISTRICT CHURCH EXTENSION FUND 3074 Portage Avenue, Winnipeg MB R3K 0Y2 PROMISSORY NOTE APPLICATION (Congregations must complete CEF Congregation Application.) For

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note application

Edit your promissory note application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit promissory note application online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit promissory note application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory note application

How to fill out a promissory note application:

01

Start by gathering all the necessary information: You will need the names and contact information of both the lender and borrower, the principal amount to be borrowed, the interest rate, repayment terms, and any additional terms or conditions.

02

Clearly identify the parties involved: Begin by stating the full legal names and addresses of both the lender and borrower. This is important for legal purposes and to ensure clarity in the agreement.

03

State the loan amount and interest rate: Specify the principal amount to be borrowed and the agreed-upon interest rate. This will determine the total amount to be repaid.

04

Outline the repayment terms: Indicate the duration of the loan and the repayment schedule. This could include monthly installments, quarterly payments, or a lump sum payment at the end of the term.

05

Include any additional terms or conditions: If there are any particular conditions or requirements for the loan, such as collateral or late payment penalties, make sure to include them in the application.

06

Sign and date: Both the lender and borrower should sign and date the promissory note application to show their agreement to the terms and conditions outlined.

Who needs a promissory note application:

01

Individual borrowers: If you are borrowing money from an individual, such as a friend or family member, it is important to have a promissory note application to clearly document the terms of the loan.

02

Small business owners: When borrowing money for business purposes, having a promissory note application helps protect both parties and ensures clear communication about the loan terms.

03

Lenders: Even as a lender, having a promissory note application is crucial to outline the terms of the loan and have a legally binding document in case of any disputes or issues that may arise.

In summary, filling out a promissory note application requires gathering all the necessary information, clearly identifying the parties involved, stating the loan amount and interest rate, outlining the repayment terms, including any additional conditions, and signing and dating the document. Both individual borrowers and small business owners may require a promissory note application, as well as lenders themselves.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify promissory note application without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your promissory note application into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send promissory note application for eSignature?

Once your promissory note application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute promissory note application online?

pdfFiller has made it simple to fill out and eSign promissory note application. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is promissory note application?

A promissory note application is a legal document in which a borrower promises to repay a loan according to specified terms.

Who is required to file promissory note application?

The borrower is required to file a promissory note application.

How to fill out promissory note application?

To fill out a promissory note application, the borrower must provide their personal information, loan amount, repayment terms, and signature.

What is the purpose of promissory note application?

The purpose of a promissory note application is to outline the terms and conditions of a loan agreement and provide legal recourse in case of default.

What information must be reported on promissory note application?

The promissory note application must include the borrower's name, loan amount, interest rate, repayment schedule, and any collateral or guarantors.

Fill out your promissory note application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.