Get the free From Farming Profit or Loss - IRS

Show details

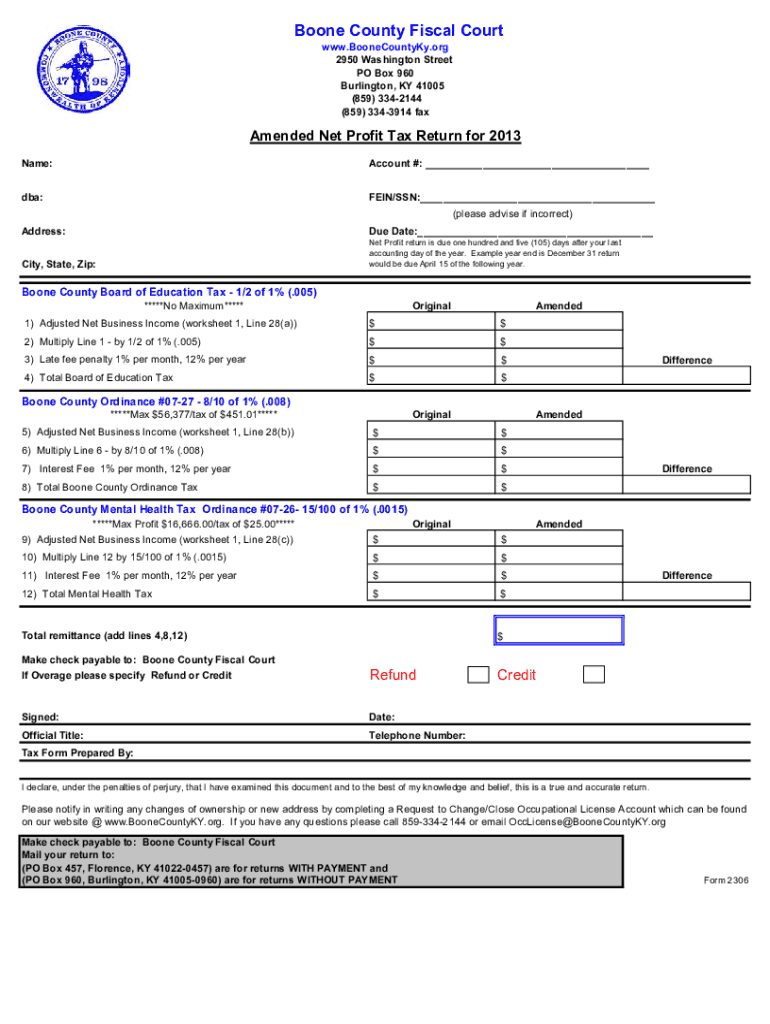

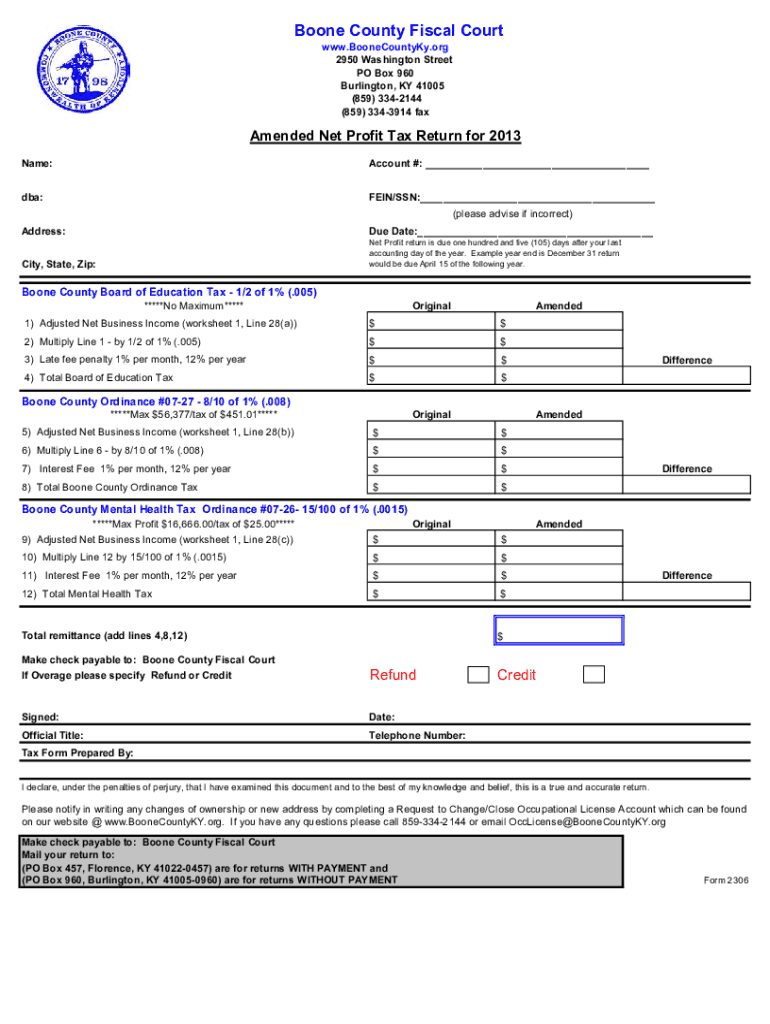

Boone County Fiscal Court www.BooneCountyKy.org 2950 Washington Street PO Box 960 Burlington, KY 41005 (859) 3342144 (859) 3343914 amended Net Profit Tax Return for 2013 Name:Account #: DBA:VEIN/SSN:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign from farming profit or

Edit your from farming profit or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your from farming profit or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing from farming profit or online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit from farming profit or. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out from farming profit or

How to fill out from farming profit or

01

Here is a step-by-step guide on how to fill out a farming profit form:

02

Start by gathering all the necessary financial information related to your farming activities, such as income and expenses.

03

Identify the specific form or template that is required for reporting farming profit in your jurisdiction. This may vary depending on your country or region.

04

Carefully read and understand the instructions provided with the form to ensure accurate completion.

05

Begin filling out the form by entering your personal information, such as name, address, and contact details. Make sure to provide accurate and up-to-date information.

06

Proceed to enter the financial details of your farming activities. This may include income from the sale of agricultural products, livestock, or other farming-related sources. Also, include any expenses such as seed purchases, equipment costs, labor expenses, and maintenance fees.

07

Double-check all the entered information for accuracy and completeness. Review any calculations or formulas provided on the form to ensure correct results.

08

Attach any supporting documents that may be required, such as receipts, invoices, or bank statements. Make sure to comply with any documentation guidelines specified.

09

Once you have completed filling out the form, review it again to ensure all the required fields are properly completed and nothing is missing.

10

Sign and date the form as specified. Follow any additional instructions provided for submitting the form, such as mailing it to a specific address, submitting it online, or hand-delivering it to a designated office.

11

Keep a copy of the filled-out form and any attachments for your records.

12

Remember to consult with a tax professional or agricultural expert if you have any specific questions or need further guidance on accurately filling out the farming profit form.

Who needs from farming profit or?

01

Farming profit forms are typically required by individuals or entities engaged in farming or agricultural activities for various purposes:

02

- Farmers: Individuals who operate farms as their primary source of income need to fill out farming profit forms to accurately report their financial activities for taxation or compliance purposes.

03

- Agricultural Businesses: Companies involved in agricultural production, livestock farming, or crop cultivation also need to fill out farming profit forms to report their financial performance and comply with legal requirements.

04

- Government Agencies: Government agencies responsible for overseeing agricultural activities might require farmers or agricultural businesses to submit farming profit forms to ensure compliance with agricultural policies, taxation, or eligibility for subsidies or grants.

05

- Financial Institutions: Banks or lenders providing agricultural loans or financing may request farming profit forms to assess the creditworthiness of borrowers and make informed decisions regarding loan approvals or terms.

06

It is important to note that the specific requirements for filling out farming profit forms may vary depending on the jurisdiction and purpose. It is advisable to consult with relevant authorities or seek professional assistance to ensure accurate and compliant completion of such forms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete from farming profit or online?

Completing and signing from farming profit or online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit from farming profit or online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your from farming profit or to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit from farming profit or on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing from farming profit or right away.

What is from farming profit or?

From farming profit is the income generated from agricultural activities such as crop cultivation, livestock rearing, and other farming operations.

Who is required to file from farming profit or?

Individuals and businesses involved in agricultural activities are required to file from farming profit.

How to fill out from farming profit or?

From farming profit can be filled out by providing details of income, expenses, and any deductions related to farming activities.

What is the purpose of from farming profit or?

The purpose of from farming profit is to accurately report the financial performance of farming activities for tax and regulatory purposes.

What information must be reported on from farming profit or?

Information such as income from sales of agricultural products, expenses related to farming operations, and deductions for equipment and supplies must be reported on from farming profit.

Fill out your from farming profit or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

From Farming Profit Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.