Get the free Bankruptcy and Restructuring Professionals Resources ...

Show details

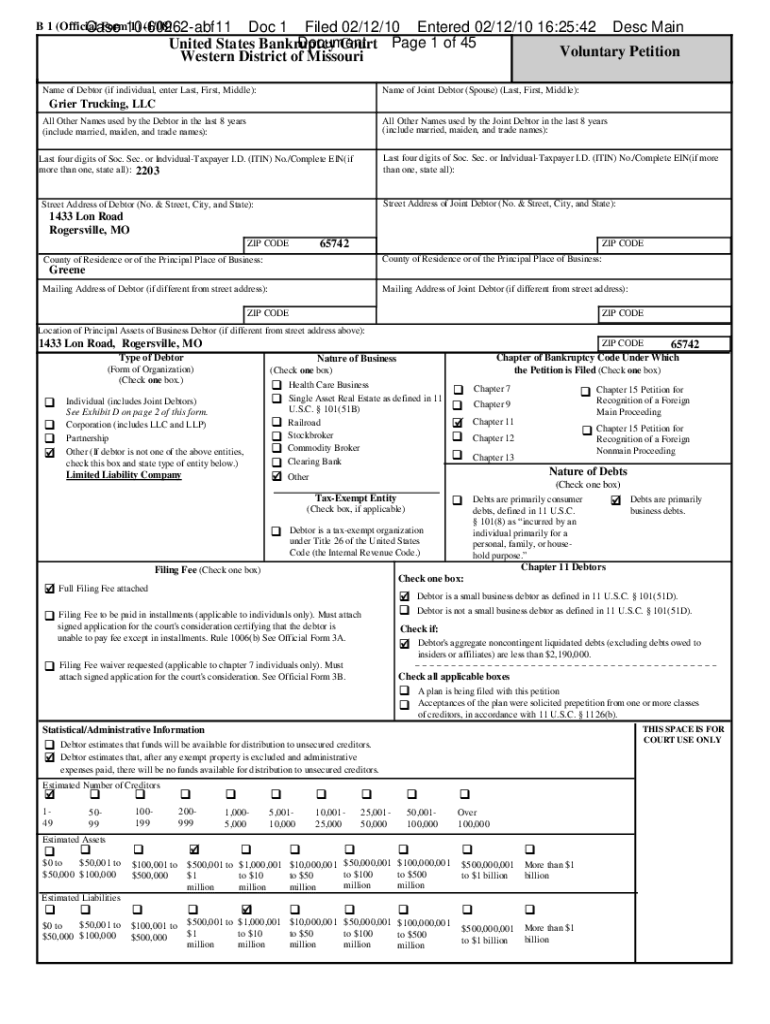

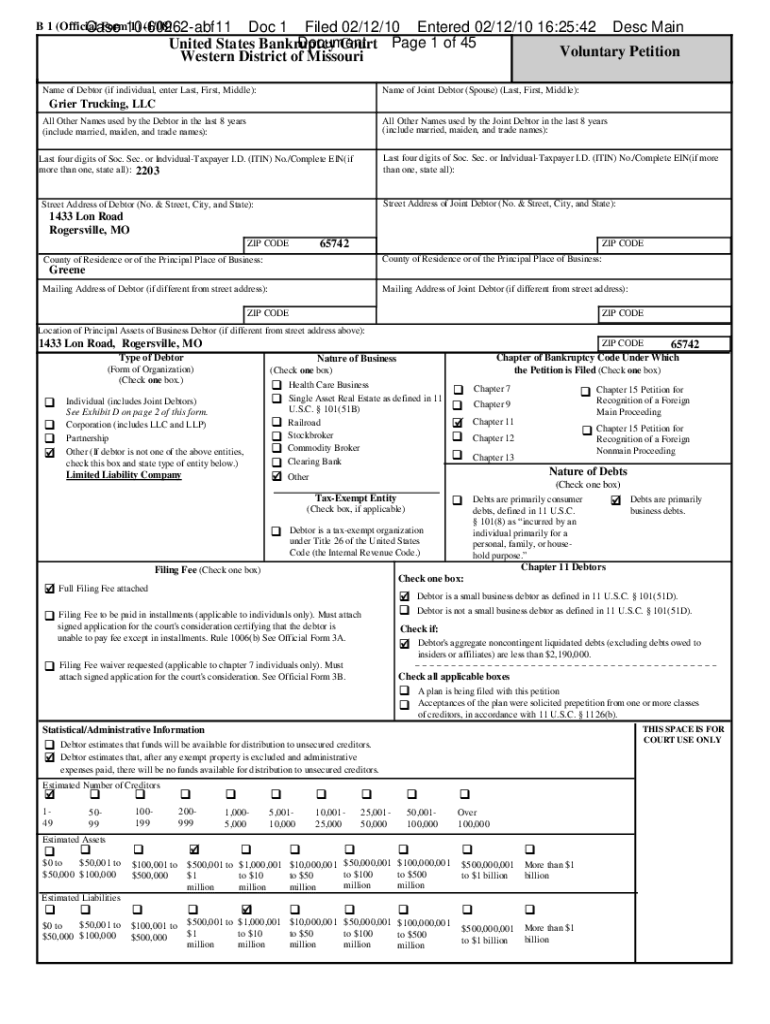

B 1 (Official Form1060262abf11 1) (1/08) Cased 1 Filed 02/12/10 Entered 02/12/10 16:25:42 Disc Main Document United States Bankruptcy Court Page 1 of 45 Voluntary Petition Western Districts of Missourians

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bankruptcy and restructuring professionals

Edit your bankruptcy and restructuring professionals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy and restructuring professionals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bankruptcy and restructuring professionals online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bankruptcy and restructuring professionals. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bankruptcy and restructuring professionals

How to fill out bankruptcy and restructuring professionals

01

Understand the bankruptcy and restructuring process: Familiarize yourself with the laws and regulations governing bankruptcy and restructuring procedures. This will ensure you have a clear understanding of what is required.

02

Gather necessary financial information: Collect all relevant financial statements, documents, and records. This includes information about your assets, liabilities, income, and expenses.

03

Determine your objectives: Evaluate your financial situation and determine your goals for the bankruptcy or restructuring process. This could be to liquidate assets, renegotiate debts, or develop a repayment plan.

04

Seek professional assistance: Engage the services of bankruptcy and restructuring professionals such as attorneys, accountants, and financial advisors. They will provide expertise, guidance, and help you navigate the complex legal and financial aspects of the process.

05

Prepare and file necessary documents: Work with your professionals to prepare and file all required legal documents. This may include petitions, schedules, financial statements, and other relevant paperwork.

06

Attend meetings and hearings: Participate in meetings with creditors, attend court hearings, and cooperate with the appointed trustee or administrator. It is important to be responsive and adhere to all court-mandated deadlines and requirements.

07

Implement the agreed-upon plan: Once your bankruptcy or restructuring plan is approved, take the necessary steps to execute it. This may involve making payments, liquidating assets, restructuring debts, or implementing other agreed-upon strategies.

08

Maintain compliance: Throughout the process, continue to adhere to all legal and regulatory requirements. This includes making timely payments, fulfilling reporting obligations, and complying with any court orders or agreements.

09

Seek post-bankruptcy/restructuring guidance: After completing the bankruptcy or restructuring process, seek professional guidance on how to rebuild your financial health and prevent similar situations in the future. This may include working with financial counselors or advisors.

10

Review and reassess regularly: Periodically review and reassess your financial situation to ensure you remain on track and make any necessary adjustments. Stay proactive in managing your finances to avoid future financial distress.

Who needs bankruptcy and restructuring professionals?

01

Individuals facing overwhelming debt: Individuals who have accumulated significant debt and are unable to meet their financial obligations may need the assistance of bankruptcy and restructuring professionals.

02

Companies in financial distress: Businesses experiencing financial difficulties, such as declining revenue, high debt levels, or cash flow problems, may require the expertise of bankruptcy and restructuring professionals to navigate the process.

03

Creditors seeking recovery: Creditors who are owed money by individuals or businesses facing financial challenges may hire bankruptcy and restructuring professionals to help them recover their debts.

04

Investors and lenders: Investors and lenders who have provided funds to distressed companies may engage bankruptcy and restructuring professionals to protect their interests and maximize their returns.

05

Legal professionals: Attorneys specializing in bankruptcy law or corporate law may require the assistance of bankruptcy and restructuring professionals to support their clients' cases and provide expert opinions.

06

Financial institutions: Banks, lending institutions, and other financial organizations may utilize the services of bankruptcy and restructuring professionals to manage their exposure to distressed assets and improve their financial position.

07

Government agencies: Regulatory bodies and government agencies responsible for overseeing bankruptcy and restructuring proceedings may employ bankruptcy and restructuring professionals to ensure compliance and protect the interests of all stakeholders.

08

Insurance companies: Insurers with policies covering bankruptcy-related risks may engage bankruptcy and restructuring professionals to assess claims, verify information, and manage the resolution process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bankruptcy and restructuring professionals for eSignature?

bankruptcy and restructuring professionals is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute bankruptcy and restructuring professionals online?

Easy online bankruptcy and restructuring professionals completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my bankruptcy and restructuring professionals in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your bankruptcy and restructuring professionals right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is bankruptcy and restructuring professionals?

Bankruptcy and restructuring professionals are experts who assist individuals or businesses in financial distress to navigate bankruptcy proceedings, restructure debts, and develop plans for financial recovery.

Who is required to file bankruptcy and restructuring professionals?

Individuals or businesses facing financial difficulties and seeking bankruptcy protection or debt restructuring are required to hire bankruptcy and restructuring professionals.

How to fill out bankruptcy and restructuring professionals?

To fill out bankruptcy and restructuring professionals, individuals or businesses need to provide detailed financial information, asset and liability statements, and other relevant documentation to the professionals.

What is the purpose of bankruptcy and restructuring professionals?

The purpose of bankruptcy and restructuring professionals is to help individuals or businesses in financial distress to navigate legal proceedings, restructure debts, and develop plans for financial recovery.

What information must be reported on bankruptcy and restructuring professionals?

The information required to be reported on bankruptcy and restructuring professionals includes detailed financial statements, asset and liability information, income statements, and other relevant financial data.

Fill out your bankruptcy and restructuring professionals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy And Restructuring Professionals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.