CA FTB 592-A 2021 free printable template

Show details

TAXABLE YEAR2021CALIFORNIA Repayment Voucher for Foreign Partner or Member Withholding592AThe withholding agent completes and files this form. For calendar year 2021 or fiscal year beginning (mm/dd/YYY)Payment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 592-A

Edit your CA FTB 592-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 592-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 592-A online

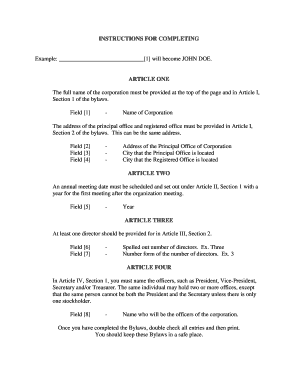

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA FTB 592-A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 592-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 592-A

How to fill out CA FTB 592-A

01

Obtain a copy of form CA FTB 592-A from the California Franchise Tax Board website or a local office.

02

Fill in the payer's information, including name, address, and taxpayer identification number.

03

Complete the recipient's details such as name, address, and taxpayer identification number.

04

Report the total amount of payments made to the recipient during the tax year.

05

Enter any applicable withholding amounts that were reported on the form.

06

Sign and date the form, certifying the accuracy of the information provided.

07

Submit the completed form to the California Franchise Tax Board by the required deadline.

Who needs CA FTB 592-A?

01

Individuals or entities that make payments to nonresidents for services or rents.

02

Payees who received payments subject to California withholding.

03

Tax professionals preparing returns for clients who have made such payments.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 592-A?

2021 Form 592-A Payment Voucher for Foreign Partner or Member Withholding. Page 1. TAXABLE YEAR. 2021 Payment Voucher for Foreign Partner or Member Withholding.

Who fills out Form 592?

A pass-through entity should use Form 592 if: It is reporting withholding from payments made to domestic nonresident independent contractors or domestic nonresident recipients of rents, endorsement income, or royalties.

What is Form 592 used for?

A pass-through entity should use Form 592 if: It is reporting withholding from payments made to domestic nonresident independent contractors or domestic nonresident recipients of rents, endorsement income, or royalties.

What is Form 592 and 593?

The real estate withholding amount for California generate when withholding information are entered in the California Form 592-B/Form 593.

What is Form 592 in California 2019?

Use Form 592-F to pass the withholding to your foreign (non U.S.) partners or members. If you are an estate or trust, you must pass through the withholding to your beneficiaries if the related income was distributed. Use Form 592 to pass through the withholding to your beneficiaries.

What is a 592a?

This is the most basic and most widely used type of tapered roller bearing. It consists of two main separable parts: the cone (inner ring) assembly and the cup (outer ring). It is typically mounted in opposing pairs on a shaft.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the CA FTB 592-A in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your CA FTB 592-A right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the CA FTB 592-A form on my smartphone?

Use the pdfFiller mobile app to fill out and sign CA FTB 592-A. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit CA FTB 592-A on an iOS device?

You certainly can. You can quickly edit, distribute, and sign CA FTB 592-A on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is CA FTB 592-A?

CA FTB 592-A is a form used in California for reporting nonresident withholding tax for payments made to nonresidents.

Who is required to file CA FTB 592-A?

Payors who make payments subject to withholding to nonresidents are required to file CA FTB 592-A.

How to fill out CA FTB 592-A?

To fill out CA FTB 592-A, you must provide information about the payor, payee, payment details, and the amount withheld, along with signatures where required.

What is the purpose of CA FTB 592-A?

The purpose of CA FTB 592-A is to report and remit any California state income tax withheld from payments made to nonresident individuals or entities.

What information must be reported on CA FTB 592-A?

The form requires reporting the payor's name, address, and taxpayer identification number, the payee's information, the type and amount of payment, and the amount withheld.

Fill out your CA FTB 592-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 592-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.