Get the free Paycheck Protection Program - SBA

Show details

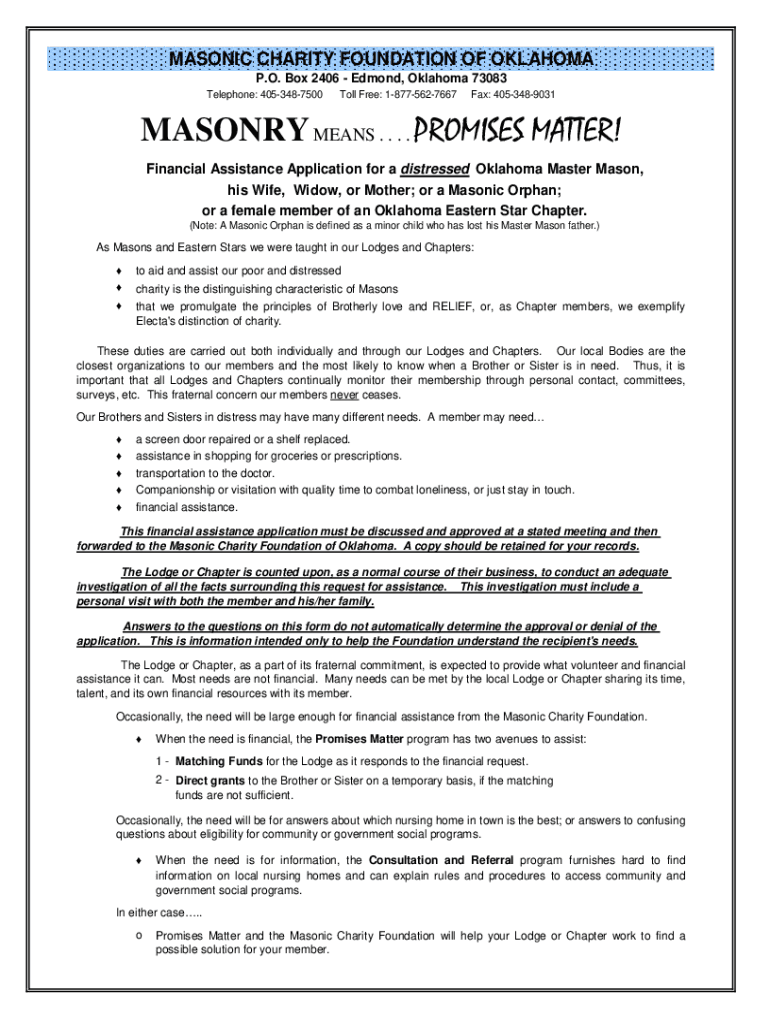

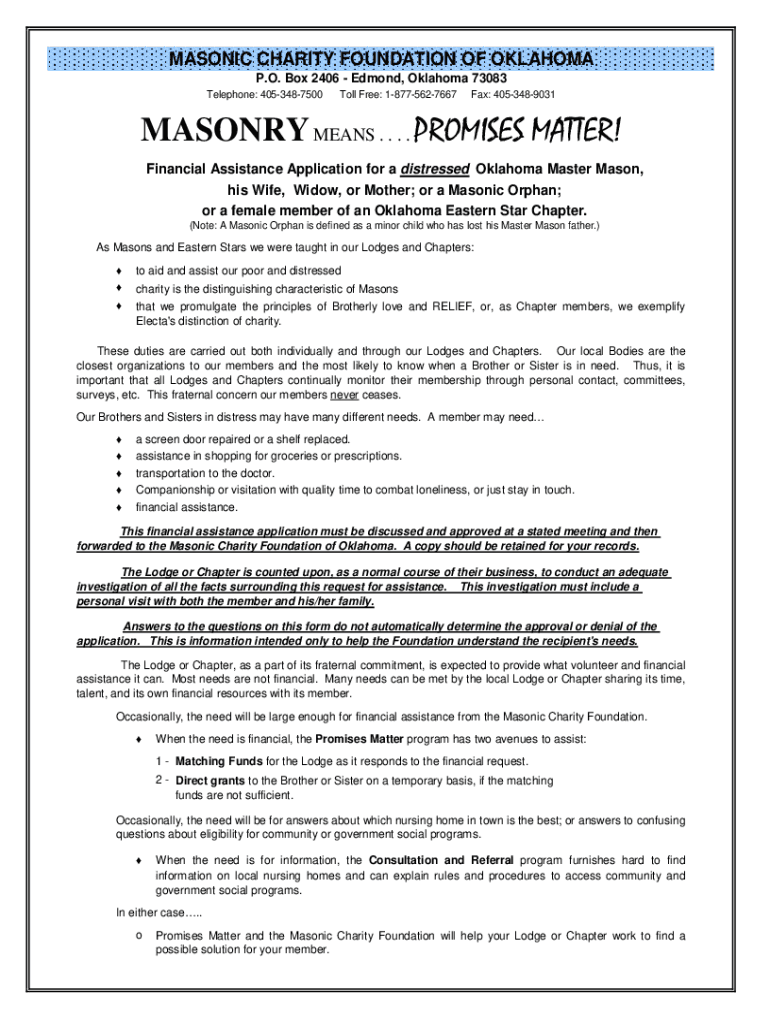

MASONIC CHARITY FOUNDATION OF OKLAHOMA P.O. Box 2406 Edmond, Oklahoma 73083 Telephone: 4053487500Toll Free: 18775627667Fax: 4053489031MASONRY MEANS. . . . PROMISES MATTER! Financial Assistance Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paycheck protection program

Edit your paycheck protection program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paycheck protection program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing paycheck protection program online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit paycheck protection program. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paycheck protection program

How to fill out paycheck protection program

01

Here is a step-by-step guide on how to fill out the Paycheck Protection Program:

02

Gather all required documents and information, such as payroll records, tax filings, and financial statements.

03

Visit the official website of the Small Business Administration (SBA) or find a trusted lender participating in the program.

04

Download the application form for the Paycheck Protection Program (PPP).

05

Carefully review the instructions and eligibility requirements before starting to fill out the form.

06

Fill out the necessary information in the application, including business details, number of employees, payroll costs, and loan amount requested.

07

Provide supporting documents to verify the payroll costs, such as payroll tax filings, Form 941, or bank statements.

08

Ensure all information is accurate and complete before submitting the application.

09

Submit the application through the designated submission platform, either online or directly to the lender.

10

Wait for the lender's review and decision on your application. Maintain regular communication with the lender for any additional information or documentation needed.

11

If approved, carefully review the terms and conditions of the loan agreement before accepting the funds.

12

Properly utilize the loan proceeds for eligible expenses, such as payroll costs, rent, utilities, and interest on mortgages.

13

Keep track of all expenses and maintain proper documentation for future audits or loan forgiveness processes.

14

Comply with all reporting requirements and deadlines as specified by the SBA and the loan agreement.

15

If applicable, apply for loan forgiveness by submitting the necessary documentation and forms as per the PPP guidelines.

16

Monitor any updates or changes in the program regulations and stay informed about any potential updates or extensions to the program.

17

Remember, it is always recommended to consult with a financial or legal professional for personalized guidance and assistance throughout the application process.

Who needs paycheck protection program?

01

The Paycheck Protection Program (PPP) is designed to assist small businesses affected by the COVID-19 pandemic. It is primarily aimed at businesses with fewer than 500 employees, including self-employed individuals, independent contractors, and sole proprietors.

02

Specifically, those who might benefit from the program include:

03

- Small business owners who have faced financial hardships due to the pandemic

04

- Businesses that had to close temporarily or reduce their operations

05

- Employers who need financial assistance to retain their employees and cover payroll costs

06

- Self-employed individuals and freelancers who have experienced a decline in income

07

- Nonprofit organizations

08

- Veterans organizations

09

- Tribal businesses

10

However, it is important to review the specific eligibility criteria and guidelines provided by the Small Business Administration (SBA) or your local financial institution. Consulting with a financial advisor or an SBA-approved lender can help determine if the Paycheck Protection Program is suitable for your business or individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit paycheck protection program from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your paycheck protection program into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for the paycheck protection program in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your paycheck protection program in seconds.

Can I edit paycheck protection program on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share paycheck protection program from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is paycheck protection program?

The Paycheck Protection Program (PPP) is a loan program designed to provide a direct incentive for small businesses to keep their workers on payroll.

Who is required to file paycheck protection program?

Small businesses, non-profit organizations, sole proprietorships, independent contractors, and self-employed individuals are required to file for the Paycheck Protection Program.

How to fill out paycheck protection program?

To fill out the Paycheck Protection Program, applicants need to provide information about their business, payroll costs, number of employees, and other relevant financial data.

What is the purpose of paycheck protection program?

The purpose of the Paycheck Protection Program is to help businesses retain their employees and cover essential expenses during the COVID-19 pandemic.

What information must be reported on paycheck protection program?

Applicants must report information about their business, payroll costs, number of employees, and other financial details on the Paycheck Protection Program application.

Fill out your paycheck protection program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paycheck Protection Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.