Get the free Critical Illness Insurance Policies, Critical Illness ... - Mutual of Omaha

Show details

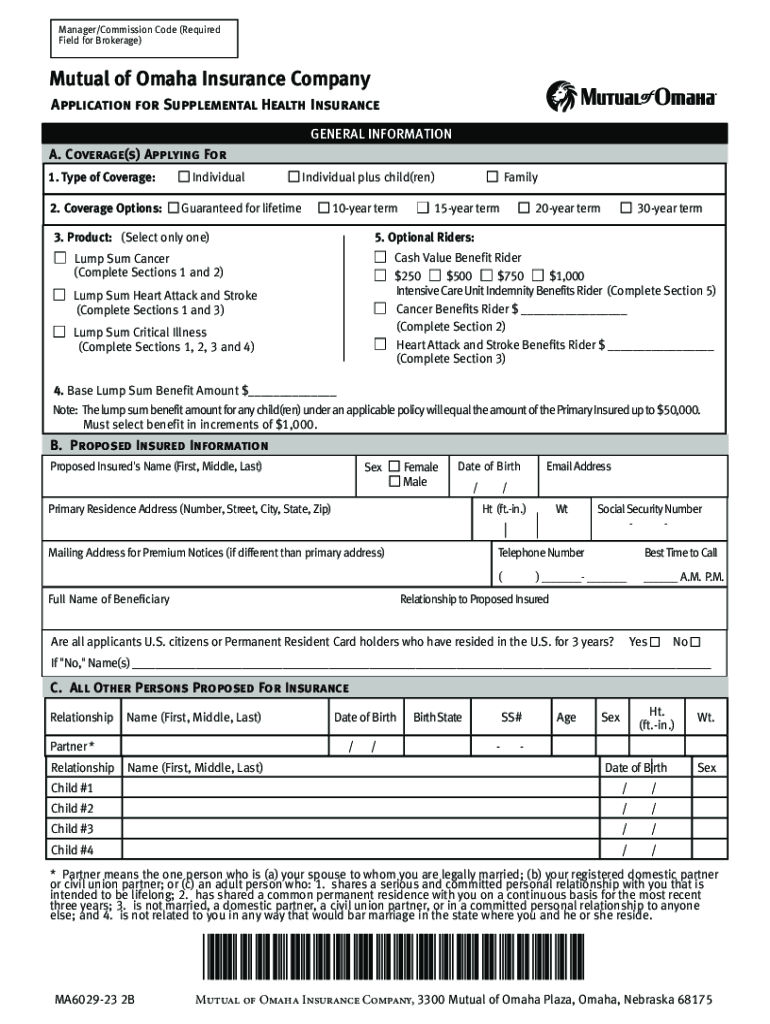

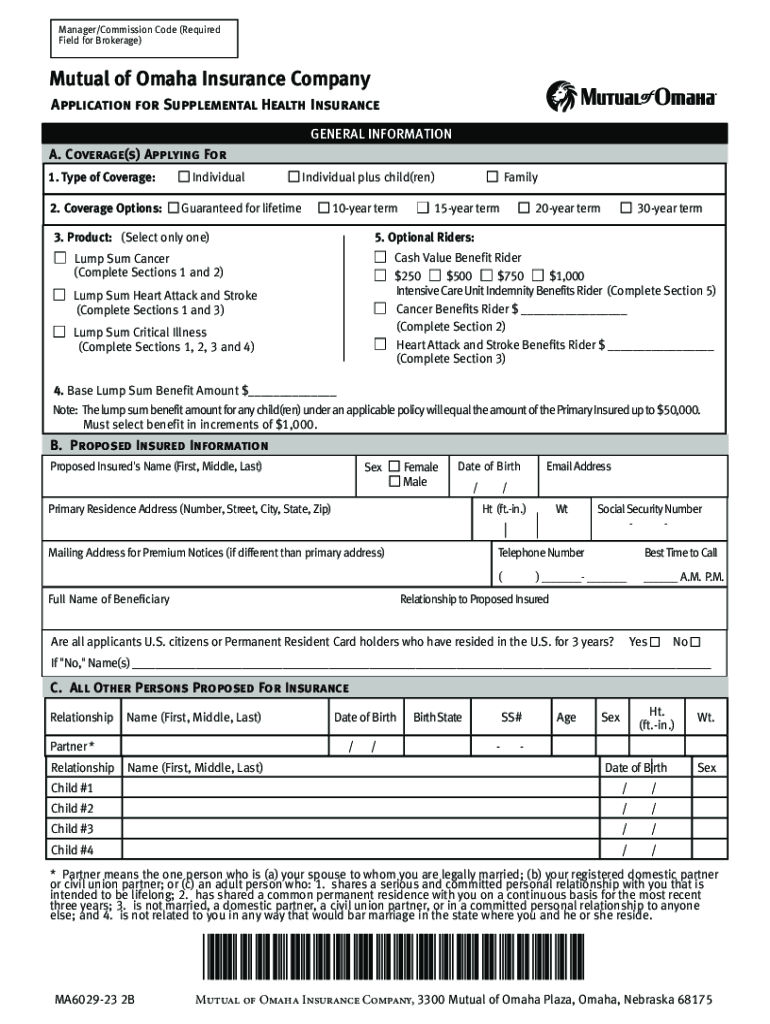

Mutual of Omaha Insurance Company 3300 Mutual of Omaha Plaza, Omaha, NE 68175LUMP SUM PORTFOLIOCRITICAL ADVANTAGE ($$10,000100,000) CANCER HEART ATTACK & STROKE CRITICAL ILLNESSApplication for Supplemental

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign critical illness insurance policies

Edit your critical illness insurance policies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your critical illness insurance policies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing critical illness insurance policies online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit critical illness insurance policies. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out critical illness insurance policies

How to fill out critical illness insurance policies

01

Understand the critical illness insurance policy: Familiarize yourself with the terms and conditions of the policy, including the covered illnesses, waiting periods, and payout amounts.

02

Assess your needs: Determine the coverage amount you require based on your financial responsibilities, such as mortgage payments, medical bills, and everyday expenses.

03

Compare insurance providers: Research and compare different insurance companies to find the best policy that suits your needs and offers competitive premiums.

04

Fill out the application form: Provide accurate information about your personal details, medical history, pre-existing conditions, and any medications or treatments you are currently undergoing.

05

Provide supporting documents: Attach any necessary documents, such as medical reports, lab results, or diagnostic imaging reports, to support your application.

06

Review the policy before signing: Carefully read through the policy terms, conditions, and exclusions to ensure you understand everything and to avoid any surprises in the future.

07

Seek professional advice if needed: If you have any doubts or concerns, consult with an insurance agent or financial advisor who specializes in critical illness insurance to guide you through the process.

08

Submit the application: Once you have completed the form and gathered all the required documents, submit your application to the insurance company.

09

Pay the premiums: Set up a payment method to cover the monthly or annual premiums to keep your critical illness insurance policy active and in force.

10

Maintain updated information: Update the insurance company with any changes in your health or personal circumstances to ensure accurate coverage.

Who needs critical illness insurance policies?

01

Individuals without sufficient savings: Critical illness insurance is beneficial for people who might struggle financially if they were to become critically ill and unable to work.

02

Breadwinners and caregivers: If you are responsible for supporting a family or dependents, having critical illness insurance can provide financial security in case you are unable to work due to illness.

03

Self-employed individuals: For self-employed people who do not have employer-provided benefits, critical illness insurance can protect from the impact of medical expenses and loss of income.

04

Individuals with a history of critical illnesses: Those who have experienced critical illnesses in the past or have a family history of such illnesses may find critical illness insurance beneficial as it provides coverage specific to those conditions.

05

Anyone concerned about healthcare costs: With the rising costs of medical treatments, having critical illness insurance can alleviate the burden of expensive medical bills and provide access to necessary healthcare services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute critical illness insurance policies online?

Completing and signing critical illness insurance policies online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit critical illness insurance policies on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing critical illness insurance policies right away.

How do I complete critical illness insurance policies on an Android device?

Use the pdfFiller Android app to finish your critical illness insurance policies and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is critical illness insurance policies?

Critical illness insurance policies are insurance policies that provide a lump sum payment upon diagnosis of a covered critical illness.

Who is required to file critical illness insurance policies?

Individuals who have purchased critical illness insurance policies are required to file them when making a claim.

How to fill out critical illness insurance policies?

Critical illness insurance policies can be filled out by providing personal information, medical history, and any other required documentation.

What is the purpose of critical illness insurance policies?

The purpose of critical illness insurance policies is to provide financial support to individuals upon diagnosis of a covered critical illness.

What information must be reported on critical illness insurance policies?

Critical illness insurance policies must include information about the policyholder, the covered critical illnesses, and the terms of the policy.

Fill out your critical illness insurance policies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Critical Illness Insurance Policies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.