Get the free Personal Inventory and

Show details

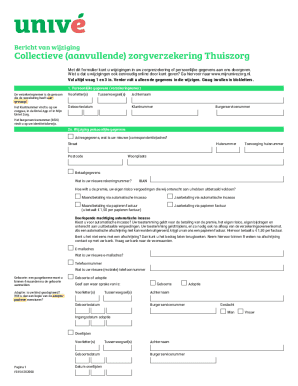

Personal Inventory and Executor Information Name: Social Insurance Number:Pension Number:Health Benefits Number: Safe deposit box Location of Box: Registered under Names: Location of Key: Advised

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal inventory and

Edit your personal inventory and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal inventory and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal inventory and online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal inventory and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal inventory and

How to Fill Out Personal Inventory:

01

Start by gathering all the necessary documents, such as bank statements, investment records, property deeds, and insurance policies.

02

Create a detailed list of your assets, including real estate properties, vehicles, jewelry, collectibles, and financial accounts.

03

Record the current values of your assets, either by determining their market worth or getting appraisals, if necessary.

04

Make a list of your liabilities, including outstanding mortgage balances, loans, credit card debts, and any other financial obligations.

05

Calculate your net worth by subtracting your liabilities from your assets.

06

Compile information about your income sources, such as salary, business earnings, rental income, alimony, or any other form of regular income.

07

Document your monthly expenses, including bills, utilities, groceries, transportation costs, entertainment expenses, and any other recurring payments.

08

Analyze your income and expenses to determine your cash flow and understand your financial situation.

09

Consider including details about your insurance coverage, including life insurance, health insurance, auto insurance, and property insurance.

10

Finally, review and update your personal inventory regularly to reflect any changes in your financial situation.

Who Needs Personal Inventory:

01

Individuals and families who want to have a comprehensive understanding of their financial situation.

02

People who are planning for retirement and need to assess their current assets, liabilities, and income sources.

03

Those who are undergoing major life changes, such as getting married, having children, or starting a new business, and need to evaluate their financial status.

04

Homeowners who want to accurately assess the value of their property and its contents for insurance purposes.

05

Those who wish to create an estate plan and need a clear overview of their assets and liabilities to ensure a smooth transfer of wealth.

06

Individuals who want to track their progress in achieving their financial goals and make informed financial decisions.

07

People who want to be prepared for unexpected events, such as natural disasters or accidents, by having a comprehensive inventory of their belongings and financial information.

08

Business owners who need to assess their company's assets, liabilities, and financial performance.

09

Executors or beneficiaries of an estate who need to complete probate or make financial decisions based on the deceased's assets and liabilities.

10

Anyone who wants to gain better control over their finances and improve their financial well-being.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit personal inventory and from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your personal inventory and into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send personal inventory and to be eSigned by others?

When your personal inventory and is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the personal inventory and electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is personal inventory?

Personal inventory is a detailed list of a person's assets and liabilities at a specific point in time.

Who is required to file personal inventory?

Personal inventory is typically required to be filed by individuals who are appointed as executors or administrators of an estate.

How to fill out personal inventory?

Personal inventory can be filled out by listing all assets and liabilities owned by the individual, including real estate, investments, bank accounts, debts, and other possessions.

What is the purpose of personal inventory?

The purpose of personal inventory is to provide an accurate record of a person's financial situation at the time of their death, for the purpose of estate administration.

What information must be reported on personal inventory?

Information that must be reported on personal inventory includes details of all assets, their values, and any liabilities or debts that the individual may owe.

Fill out your personal inventory and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Inventory And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.